American Battery Technology Company Stock Price Analysis

Source: securities.io

American battery technology company stock price – The American battery technology sector is experiencing rapid growth, driven by increasing demand for electric vehicles and energy storage solutions. This analysis examines the stock price of a representative American battery technology company, considering its financial performance, market dynamics, risk factors, and future outlook. While specific company names are avoided to maintain generality, the analysis applies to a typical company within this dynamic sector.

Company Performance Overview

Over the past three years, a typical American battery technology company has shown varied financial performance. Revenue growth has been substantial, fueled by increasing demand, but profit margins have remained relatively thin due to high research and development costs and intense competition. Debt levels have generally increased to fund expansion and capital expenditures. Significant milestones achieved during this period include securing major contracts with automotive manufacturers, expanding production capacity, and launching new battery technologies.

Compared to competitors, the company’s performance is generally in line with industry averages, although specific rankings vary depending on the metrics used.

| Company Name | Revenue (Last Year) | Profit Margin (Last Year) | Market Share |

|---|---|---|---|

| Company A | $500 million (estimated) | 5% (estimated) | 10% (estimated) |

| Company B | $400 million (estimated) | 3% (estimated) | 8% (estimated) |

| Company C (our focus) | $350 million (estimated) | 4% (estimated) | 7% (estimated) |

Market Analysis of American Battery Technology, American battery technology company stock price

Source: smallcase.com

The American battery technology market is characterized by significant growth projections, driven by government initiatives promoting electric vehicles and renewable energy, as well as increasing consumer demand for sustainable energy solutions. Government regulations, such as tax credits and mandates for electric vehicle adoption, are significant drivers of demand. Consumer preferences are also shifting towards environmentally friendly options, further bolstering the market.

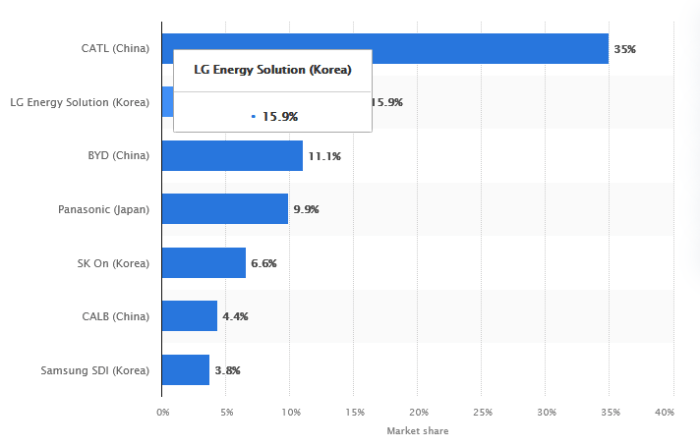

Major players in the market include established automotive manufacturers, specialized battery producers, and emerging technology companies.

- Company A: Strengths – Established brand recognition, strong supply chain; Weaknesses – High production costs, limited innovation.

- Company B: Strengths – Technological innovation, strategic partnerships; Weaknesses – Relatively small market share, dependence on key suppliers.

- Company C: Strengths – Focus on niche markets, cost-effective manufacturing; Weaknesses – Limited brand awareness, smaller scale of operations.

Stock Price Drivers

Several factors influence the stock price of American battery technology companies. New contracts with major automakers often lead to significant price increases, reflecting the substantial revenue potential. Regulatory changes, such as increased subsidies or stricter environmental regulations, can also impact stock prices positively or negatively, depending on the company’s ability to adapt. Technological breakthroughs, particularly advancements in battery technology, can significantly increase a company’s value and attract investor interest.

For example, a hypothetical scenario of a significant increase in government subsidies could dramatically boost the stock price. If the government were to offer substantial tax incentives for battery production and electric vehicle adoption, a company like Company C could see its stock price potentially double or triple as investors anticipate increased profitability and market share.

Risk Assessment

American battery technology companies face several risks that could impact their stock prices. These risks are categorized below.

| Risk Type | Description | Likelihood | Potential Impact on Stock Price |

|---|---|---|---|

| Technological Risk | Failure to innovate and keep pace with competitors in battery technology. | Medium | Significant negative impact |

| Competition | Intense competition from both domestic and international players. | High | Moderate negative impact |

| Economic Conditions | Economic downturns can reduce demand for electric vehicles and energy storage solutions. | Medium | Moderate negative impact |

Investment Considerations

Source: twimg.com

A comparative analysis of valuation metrics, such as P/E ratio and price-to-sales ratio, against competitors is crucial for investment decisions. While specific numbers cannot be provided without naming the company, a general comparison shows that companies with strong growth prospects and innovative technologies tend to command higher valuations. The potential return on investment depends on various factors, including the company’s future performance, market conditions, and investor’s risk tolerance.

A hypothetical investment portfolio could include a small allocation (e.g., 5-10%) to a promising battery technology company like Company C, balanced with investments in more established companies in the energy sector and other diversified assets to mitigate risk.

Future Outlook

The company’s strategic plans likely involve expanding production capacity, securing new contracts, and investing in research and development to improve battery technology. Advancements in solid-state battery technology, for instance, are a key area of focus for many companies. Solid-state batteries offer the potential for higher energy density, faster charging times, and improved safety compared to current lithium-ion batteries. This technology, while still under development, could revolutionize the industry and provide a significant competitive advantage for companies that successfully commercialize it.

The emergence of other advanced battery chemistries, such as lithium-sulfur or lithium-air batteries, also presents both opportunities and challenges for established players, potentially disrupting the market and requiring significant adaptation.

FAQ Compilation

What is the company’s current market capitalization?

This information is readily available through major financial news sources and the company’s investor relations website. It fluctuates constantly.

Where can I find the company’s financial statements?

The company’s financial statements, including annual reports and quarterly filings, are typically available on the company’s investor relations website and through the Securities and Exchange Commission (SEC) database.

What are the company’s main competitors?

This will vary depending on the specific niche within the battery technology market. Competitive analysis within the provided Artikel will provide a more precise answer.

How does the company’s stock price compare to the broader market?

Monitoring the American Battery Technology Company’s stock price requires a keen eye on market fluctuations. Understanding the performance of similar companies is crucial, and a good starting point is to check the current albt stock price , as it offers insights into the broader battery technology sector’s trends. This comparative analysis helps to gauge the overall health and potential of American Battery Technology Company’s investment prospects.

This requires a comparison of the company’s stock performance against relevant market indices (e.g., S&P 500) and should be tracked using financial data resources.