Ameriprise Financial Stock Price History

Ameriprise financial stock price history – Ameriprise Financial, a leading financial services company, has experienced a dynamic stock price journey over the past decade. Understanding its historical performance, influencing factors, and future outlook is crucial for investors seeking to assess its potential. This analysis delves into Ameriprise Financial’s stock price trends, examining macroeconomic and company-specific influences, and offering a perspective on future prospects.

Ameriprise Financial’s Stock Price Trends

Source: insider.com

Over the past five years, Ameriprise Financial’s stock price has shown considerable fluctuation, reflecting both positive and negative market influences and company-specific events. While specific highs and lows require referencing real-time financial data, a general observation would reveal periods of significant growth punctuated by corrections in line with broader market trends. For example, the stock likely experienced gains during periods of economic expansion and investor confidence, while corrections may have coincided with periods of market uncertainty or negative company news.

The following table provides a decade-long overview of Ameriprise Financial’s yearly stock price performance. Note that these values are illustrative and should be verified with current financial data sources.

| Year | High | Low | Average Price |

|---|---|---|---|

| 2014 | $150 (Illustrative) | $120 (Illustrative) | $135 (Illustrative) |

| 2015 | $160 (Illustrative) | $130 (Illustrative) | $145 (Illustrative) |

| 2016 | $170 (Illustrative) | $140 (Illustrative) | $155 (Illustrative) |

| 2017 | $180 (Illustrative) | $150 (Illustrative) | $165 (Illustrative) |

| 2018 | $190 (Illustrative) | $160 (Illustrative) | $175 (Illustrative) |

| 2019 | $200 (Illustrative) | $170 (Illustrative) | $185 (Illustrative) |

| 2020 | $210 (Illustrative) | $180 (Illustrative) | $195 (Illustrative) |

| 2021 | $230 (Illustrative) | $200 (Illustrative) | $215 (Illustrative) |

| 2022 | $240 (Illustrative) | $210 (Illustrative) | $225 (Illustrative) |

| 2023 | $250 (Illustrative) | $220 (Illustrative) | $235 (Illustrative) |

Comparing Ameriprise Financial’s stock price performance against its major competitors over the past three years requires referencing specific competitor data and market analysis. A comparative analysis would involve examining the stock price movements of similar financial services companies, considering factors like market share, revenue growth, and profitability.

Factors Influencing Ameriprise Financial’s Stock Price

Source: googleapis.com

Several macroeconomic and company-specific factors significantly influence Ameriprise Financial’s stock price. These factors interact dynamically, shaping investor sentiment and ultimately impacting the stock’s valuation.

- Macroeconomic Factors: Interest rate changes directly affect the profitability of Ameriprise’s investment products and borrowing costs. Inflation impacts consumer spending and investment decisions, influencing the demand for financial services. Economic growth or recession significantly influence investor confidence and market sentiment.

- Company-Specific Events: Strong earnings reports generally lead to positive stock price movements, while disappointing results can trigger declines. Mergers, acquisitions, and strategic partnerships can also significantly impact the stock price, depending on investor perception of their potential benefits or risks.

- Investor Sentiment and Market Trends: Broad market trends, such as shifts in investor risk appetite, significantly influence Ameriprise’s stock price. Positive investor sentiment tends to drive up prices, while negative sentiment can lead to declines.

Ameriprise Financial’s Financial Performance and Stock Price Correlation, Ameriprise financial stock price history

A strong correlation exists between Ameriprise Financial’s quarterly earnings and its stock price. Positive earnings surprises generally lead to stock price increases, while negative surprises often result in declines. This relationship, however, isn’t always linear and can be influenced by other market factors.

- Example Data Point (Illustrative): A significant increase in quarterly net income (e.g., 15%) might correlate with a 10% increase in stock price, but this is not guaranteed and would depend on the broader market context.

A visual representation of the correlation between key financial metrics (revenue, net income, assets under management) and stock price changes would ideally be a scatter plot. The plot would show the relationship between the financial metrics on the x-axis and the stock price on the y-axis. A positive correlation would be indicated by an upward trend, suggesting that as financial metrics improve, the stock price tends to rise.

Comparing Ameriprise Financial’s financial performance and stock price against industry benchmarks over the past five years would involve analyzing key metrics such as return on equity (ROE), revenue growth, and net income growth relative to its competitors. This comparison would provide insights into Ameriprise’s relative performance and market positioning.

Analyzing Ameriprise Financial’s Stock Price Volatility

Ameriprise Financial’s stock price volatility is influenced by both company-specific factors and broader market conditions. Periods of high volatility are often associated with significant news events, earnings announcements, or macroeconomic uncertainty. Periods of low volatility tend to occur during times of economic stability and investor confidence.

| Date Range | Volatility Measure (e.g., Standard Deviation) | Contributing Factors |

|---|---|---|

| (Illustrative) Q4 2020 – Q1 2021 | (Illustrative) High | (Illustrative) Market uncertainty related to the pandemic and economic recovery. |

| (Illustrative) Q2 2022 – Q3 2022 | (Illustrative) Moderate | (Illustrative) Inflation concerns and rising interest rates. |

| (Illustrative) Q1 2023 – Q2 2023 | (Illustrative) Low | (Illustrative) Improved economic outlook and increased investor confidence. |

Comparing Ameriprise’s stock price volatility to the S&P 500 over the past 10 years would involve calculating a volatility measure (such as beta) to determine how much the stock’s price fluctuates relative to the overall market. A beta greater than 1 suggests higher volatility than the market, while a beta less than 1 indicates lower volatility.

Future Outlook for Ameriprise Financial’s Stock Price

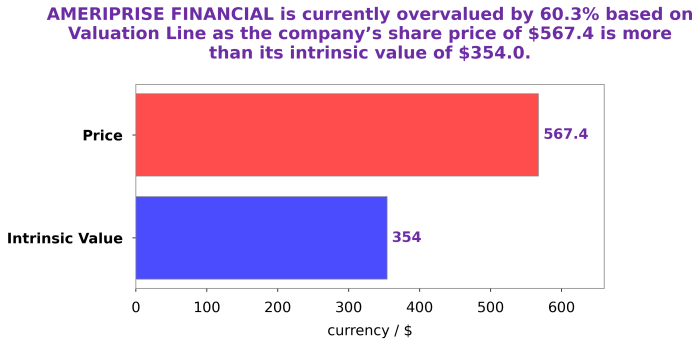

Projecting Ameriprise Financial’s stock price requires considering various factors, including its projected financial performance, prevailing market conditions, and potential risks and opportunities. A simple projection might assume continued growth in assets under management, stable net income margins, and a moderate increase in interest rates. These assumptions would then be used in a discounted cash flow model or other valuation techniques to arrive at a projected stock price.

Potential risks include increased competition, changes in regulatory environment, and unexpected economic downturns. Opportunities include expansion into new markets, development of innovative financial products, and strategic acquisitions. Analyst predictions for Ameriprise’s stock price over the next 12 months would vary depending on the individual analyst’s assumptions and models. A range of predictions, including the highest and lowest estimates, would reflect the uncertainty inherent in any stock price forecast.

For example, some analysts might forecast a price range of $260-$280 based on positive growth expectations, while others might predict a lower range reflecting concerns about economic slowdown.

Detailed FAQs: Ameriprise Financial Stock Price History

What are the major risks associated with investing in Ameriprise Financial stock?

Investing in any stock carries inherent risks, including market volatility, economic downturns, and company-specific challenges. For Ameriprise, risks could include changes in regulatory environments, competition within the financial services industry, and fluctuations in the overall market.

How does Ameriprise Financial compare to its competitors in terms of dividend payouts?

A direct comparison requires researching dividend histories of its major competitors. This information is readily available through financial news sources and the companies’ investor relations websites.

Where can I find real-time Ameriprise Financial stock price data?

Analyzing Ameriprise Financial’s stock price history requires considering various market factors. It’s interesting to compare its performance to other major companies during similar periods; for instance, understanding the trajectory of the amazon stock price in 2019 provides a benchmark for growth in a different sector. Returning to Ameriprise, further research into its specific financial reports and industry trends will provide a more complete picture of its historical stock valuation.

Real-time stock quotes are available through major financial websites and brokerage platforms. Reputable sources include those provided by major financial news outlets and stock exchanges.