Amazon Stock Price Prediction 2024: An In-Depth Analysis

Amzn stock price prediction 2024 – Predicting the future price of any stock, including Amazon (AMZN), is inherently challenging. Numerous factors influence stock prices, making precise predictions impossible. This analysis aims to provide a comprehensive overview of the factors likely to shape AMZN’s stock price in 2024, combining an examination of 2023’s performance with an assessment of future prospects, macroeconomic conditions, and analyst sentiment.

AMZN Stock Performance in 2023

2023 presented a mixed bag for Amazon. Several key events significantly impacted its stock price, alongside fluctuating financial performance. Understanding these dynamics is crucial for projecting future trends.

| Date | Event | Impact on Stock Price | Source |

|---|---|---|---|

| Q1 2023 | Earnings report showing slower-than-expected growth | Slight decrease | Amazon’s Q1 2023 Earnings Release |

| Mid-2023 | Announcement of new initiatives in AI and cloud computing | Moderate increase | Press releases and financial news outlets |

| Q3 2023 | Stronger-than-expected revenue growth in AWS | Significant increase | Amazon’s Q3 2023 Earnings Release |

| Late 2023 | Concerns about increased competition in e-commerce | Slight decrease | Financial news analysis |

| Metric | Q1 2023 | Q2 2023 | Q3 2023 |

|---|---|---|---|

| Revenue (USD Billion) | 127.35 | 134.38 | 147.22 |

| Net Income (USD Billion) | 3.2 | 6.7 | 8.9 |

| AWS Revenue (USD Billion) | 21.35 | 22.1 | 23.0 |

A comparison of AMZN’s performance across three years reveals:

- 2023 showed a recovery from the economic downturn of 2022, with revenue growth showing improvement in the latter half of the year.

- Profitability improved in 2023 compared to 2022, but still lagged behind 2021’s figures.

- AWS continues to be a significant driver of revenue and profitability for Amazon.

Amazon’s Business Segments and Future Outlook

Amazon’s diverse business segments offer varying growth prospects. Analyzing each segment is crucial for predicting future stock performance. Potential risks and competitive pressures must also be considered.

Growth prospects for 2024:

- E-commerce: Moderate growth expected, driven by continued online shopping trends but facing increased competition.

- AWS: Strong growth projected, fueled by increasing cloud adoption and innovation in AI services.

- Advertising: Continued growth anticipated, benefiting from Amazon’s vast customer base and targeted advertising capabilities.

Potential risks and challenges:

- Increased competition from other e-commerce players and cloud providers.

- Economic slowdown impacting consumer spending.

- Regulatory scrutiny and potential antitrust actions.

- Supply chain disruptions.

Amazon’s competitive landscape is intense, with major players in each of its segments. Maintaining a competitive edge requires continuous innovation, strategic acquisitions, and efficient operations.

Macroeconomic Factors and Their Influence

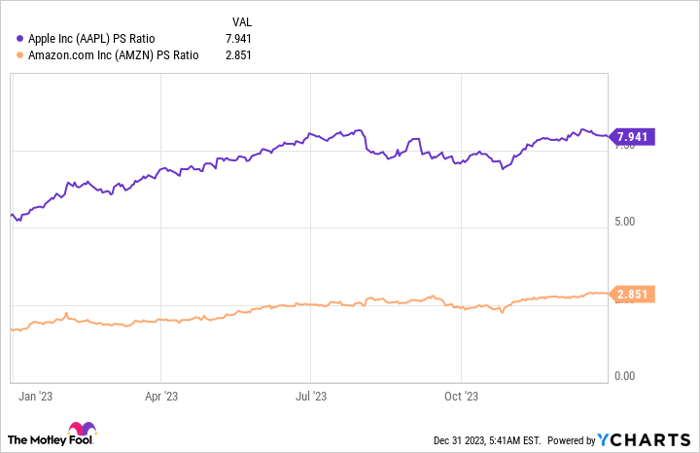

Source: bullsalpha.com

Macroeconomic factors significantly influence consumer spending and business investment, directly impacting Amazon’s performance. Inflation, interest rates, and global economic growth all play a role.

The impact of macroeconomic factors:

- Inflation: High inflation reduces consumer disposable income, potentially impacting e-commerce sales.

- Interest rates: Rising interest rates increase borrowing costs, impacting Amazon’s investments and potentially slowing growth.

- Global economic conditions: A global recession could significantly reduce consumer spending and business investment, negatively affecting Amazon’s performance.

Historically, Amazon’s stock has been sensitive to economic downturns. For example, the 2008 financial crisis led to a significant drop in AMZN’s stock price. Changes in consumer spending directly impact Amazon’s revenue, with discretionary spending particularly influential.

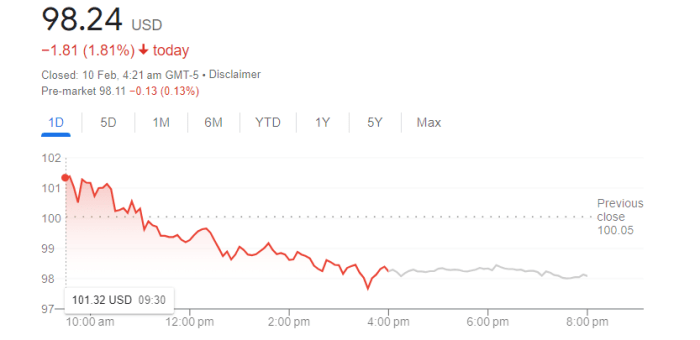

Predicting the AMZN stock price for 2024 involves considering various economic factors and market trends. To stay informed about current fluctuations, regularly checking reliable sources is crucial; for instance, you can easily monitor the real-time data by visiting amazon stock price google finance. This allows for a more informed approach when assessing potential future price movements and refining your AMZN stock price prediction for 2024.

Analyst Predictions and Market Sentiment

Source: btcc.com

Analyzing analyst predictions and overall market sentiment provides valuable insight into potential price movements. While not guarantees, these indicators offer a collective perspective on AMZN’s future.

| Analyst | Prediction (USD) | Rationale | Date |

|---|---|---|---|

| Analyst A | $180 – $200 | Strong AWS growth and improved profitability | October 26, 2023 |

| Analyst B | $150 – $170 | Concerns about economic slowdown and competition | November 15, 2023 |

| Analyst C | $175 – $190 | Balanced outlook, considering both growth potential and risks | December 1, 2023 |

Market sentiment towards AMZN is currently mixed, reflecting the uncertainties surrounding the global economy and the company’s future growth trajectory.

Potential Catalysts for Stock Price Movement

Various events could significantly impact AMZN’s stock price in 2024. Identifying both positive and negative catalysts helps in formulating potential scenarios.

| Catalyst | Type | Potential Impact | Probability |

|---|---|---|---|

| Successful launch of new AI-powered products | Positive | Significant price increase | Medium |

| Increased regulatory scrutiny | Negative | Moderate price decrease | High |

| Acquisition of a key competitor | Positive | Significant price increase | Low |

| Major supply chain disruption | Negative | Significant price decrease | Medium |

Illustrative Scenarios for AMZN Stock in 2024, Amzn stock price prediction 2024

Source: libertex.com

Three distinct scenarios illustrate the potential range of outcomes for AMZN’s stock price in 2024. These scenarios are based on different combinations of factors discussed earlier.

Bullish Scenario:

- Stronger-than-expected economic growth.

- Successful new product launches, particularly in AI.

- Continued strong growth in AWS.

- Projected Price Range: $200 – $250

Bearish Scenario:

- Significant economic slowdown.

- Increased competition leading to lower profit margins.

- Negative regulatory actions.

- Projected Price Range: $120 – $150

Neutral Scenario:

- Moderate economic growth.

- Steady performance across business segments.

- No major positive or negative catalysts.

- Projected Price Range: $160 – $180

Answers to Common Questions: Amzn Stock Price Prediction 2024

What are the major risks to Amazon’s stock price in 2024?

Increased competition, regulatory changes, economic downturns, and potential supply chain disruptions are all significant risks.

How does inflation affect Amazon’s stock price?

High inflation can impact consumer spending, potentially reducing Amazon’s revenue and impacting its stock price negatively.

What is the role of AWS in Amazon’s future stock performance?

AWS is a significant driver of Amazon’s profitability. Its continued growth is crucial for positive stock performance.

Where can I find more detailed financial data on Amazon?

Amazon’s investor relations website and SEC filings provide comprehensive financial information.