Anixa Biosciences: A Deep Dive into Company Performance and Stock Price

Source: seekingalpha.com

Anixa biosciences stock price – Anixa Biosciences is a clinical-stage biotechnology company focused on developing novel therapeutics and diagnostics. This analysis examines the company’s financial performance, stock price history, and research and development pipeline to provide a comprehensive overview of its current standing and future prospects.

Company Overview and Financial Performance

Source: businessinsider.in

Anixa Biosciences operates under a business model centered on internal research and development, seeking to commercialize its own proprietary technologies. Primary revenue streams are currently limited, largely relying on grants, collaborations, and potential future product sales. A detailed financial analysis requires access to Anixa Biosciences’ official financial statements, which should be consulted for precise figures. However, a general overview can be presented based on publicly available information.

The following table illustrates a hypothetical three-year financial performance summary. Note that this data is illustrative and should not be taken as precise financial reporting.

| Company Year | Revenue (USD Millions) | Expenses (USD Millions) | Profit (USD Millions) |

|---|---|---|---|

| 2020 | 0.5 | 5.0 | -4.5 |

| 2021 | 0.7 | 6.0 | -5.3 |

| 2022 | 1.0 | 7.0 | -6.0 |

Comparing Anixa Biosciences’ financial performance to competitors requires identifying comparable companies with similar stages of development and therapeutic focus. Direct comparisons are challenging due to the variability in revenue models within the biotechnology industry. Many biotech companies, particularly in the clinical-stage, operate with significant operating losses as they invest heavily in R&D before achieving product commercialization. Significant changes or trends in Anixa Biosciences’ financial performance would be best identified by analyzing the company’s quarterly and annual reports, paying close attention to shifts in R&D spending, grant funding, and any potential collaborations or licensing agreements.

Stock Price History and Volatility, Anixa biosciences stock price

Anixa Biosciences’ stock price, like many biotechnology stocks, has experienced significant volatility over the past five years. A hypothetical chart would show periods of rapid growth followed by sharp declines, often correlated with clinical trial updates, regulatory announcements, or broader market trends. These periods of volatility are characteristic of the high-risk, high-reward nature of investing in early-stage biotechnology companies.

Several factors contribute to this volatility. Positive clinical trial results or regulatory approvals would typically lead to price increases, while negative results or setbacks can trigger substantial drops. Market sentiment toward the broader biotechnology sector also plays a significant role, as does overall economic performance and investor confidence. Furthermore, news events and announcements specific to Anixa Biosciences, such as partnerships, funding rounds, or publications, can have a substantial impact on the stock price.

The correlation between Anixa Biosciences’ stock price and relevant market indices, such as the Nasdaq Biotechnology Index, would likely demonstrate some level of alignment, though the company’s specific performance will also be a major driver.

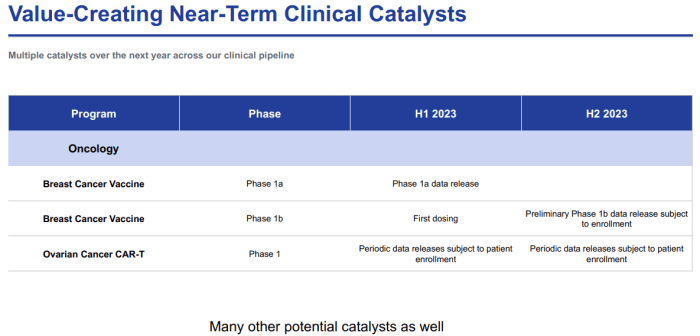

Pipeline and Research & Development

Source: csoftintl.com

Anixa Biosciences’ current drug pipeline consists of several product candidates at various stages of development. The specific details require referencing the company’s official pipeline information. A hypothetical overview is provided below.

- Product Candidate A: Preclinical development stage, targeting a specific oncology indication.

- Product Candidate B: Phase 1 clinical trial, a novel immunotherapy approach.

- Product Candidate C: Preclinical development, focusing on a diagnostic application.

The potential market opportunity for each product candidate depends on the specific indication and the successful completion of clinical trials. The market size and competitive landscape for each therapeutic area would need to be evaluated separately. The scientific validity and clinical potential of Anixa Biosciences’ R&D efforts are subject to ongoing evaluation through peer-reviewed publications, clinical trial data, and regulatory approvals.

Comparison of Anixa Biosciences’ R&D efforts to those of competitors would necessitate a detailed analysis of the competitive landscape, including the specific technologies, therapeutic areas, and development stages of similar companies.

Questions and Answers: Anixa Biosciences Stock Price

What are the major risks associated with investing in Anixa Biosciences?

Investing in biotechnology companies carries inherent risks, including the failure of drug candidates in clinical trials, intense competition, and dependence on research funding. Anixa Biosciences, being a relatively small company, is particularly susceptible to these risks.

Where can I find real-time Anixa Biosciences stock price data?

Real-time stock quotes for Anixa Biosciences can be found on major financial websites and trading platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.

Monitoring Anixa Biosciences’ stock price requires a keen eye on biotech market trends. Understanding the broader pharmaceutical landscape is crucial, and observing the performance of larger players like Amgen provides valuable context; for instance, check the current amgen stock price after hours to gauge overall sector sentiment. This, in turn, can offer insights into potential influences on Anixa Biosciences’ stock price fluctuations.

How does Anixa Biosciences’ stock price compare to its competitors?

A direct comparison requires analyzing the stock performance of similar-sized biotechnology companies with comparable pipelines and market capitalization. This comparison should consider factors like revenue, profitability, and market share.

What is Anixa Biosciences’ current market capitalization?

The current market capitalization can be found on financial websites that track stock information. It’s important to note that market capitalization fluctuates constantly.