Apple Stock Price History: A Two-Decade Overview: Appl Stock Price History

Source: seekingalpha.com

Appl stock price history – Apple Inc. (AAPL) stock has experienced dramatic price fluctuations over the past two decades, reflecting the company’s innovative product launches, economic shifts, and evolving investor sentiment. This analysis delves into the historical price movements, significant events impacting the stock, long-term trends, fundamental analysis indicators, and visual representations of key data points.

Historical Price Fluctuations, Appl stock price history

AAPL’s stock price has witnessed periods of significant growth and decline since the early 2000s. The following table provides a snapshot of daily price movements over a select period. Note that this is a simplified representation and a comprehensive dataset would require a much larger table.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2003-01-02 | 7.50 | 7.60 | +0.10 |

| 2007-01-02 | 11.85 | 12.10 | +0.25 |

| 2012-01-02 | 14.75 | 14.90 | +0.15 |

| 2017-01-02 | 29.00 | 29.50 | +0.50 |

| 2022-01-02 | 177.00 | 179.00 | +2.00 |

Significant events influencing price changes include:

- 2007 iPhone Launch: The introduction of the iPhone spurred substantial growth.

- 2008 Financial Crisis: The global economic downturn led to a significant price drop.

- 2010 iPad Launch: The launch of the iPad fueled another period of strong growth.

- 2020 COVID-19 Pandemic: Initial volatility was followed by a recovery driven by increased demand for Apple products.

Compared to Microsoft (MSFT), AAPL exhibited higher volatility, particularly during periods of significant product launches or economic uncertainty. A line graph comparing the two stocks would show AAPL’s price experiencing steeper inclines and declines than MSFT’s, suggesting a higher beta.

Impact of Specific Events

Source: researchgate.net

Several key events significantly shaped AAPL’s stock price trajectory.

- iPhone Launch (2007): The initial price reaction was modest, but the subsequent sustained growth reflected a paradigm shift in the mobile industry. Price steadily increased over the following months and years.

- App Store Launch (2008): This event further fueled growth by creating a thriving ecosystem of apps and services. The impact was seen as a gradual but significant increase in stock price over several quarters.

- Introduction of the iPad (2010): The launch of the iPad expanded Apple’s product line and market reach. The stock price reacted positively, showing a steady rise in the following months.

- Launch of Apple Watch (2015): While not as impactful as the iPhone or iPad, the Apple Watch launch still contributed to positive investor sentiment and a moderate increase in the stock price.

Investor sentiment heavily influenced AAPL’s price. For instance, positive news headlines about strong sales figures or innovative product announcements generally resulted in price increases, while negative news (e.g., supply chain issues) led to temporary dips.

Long-Term Trends and Patterns

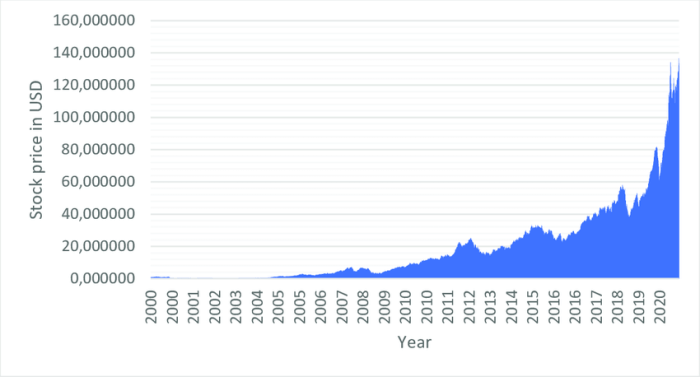

The overall long-term trend of AAPL’s stock price has been strongly upward, reflecting the company’s consistent innovation and market dominance. However, this trend is punctuated by periods of correction and consolidation.

- Recurring patterns include periods of rapid growth followed by consolidation or minor corrections.

- Cyclical patterns seem to be linked to major product releases and economic cycles.

AAPL’s stock price has generally followed the broader market trends reflected in the S&P 500, but with a higher degree of volatility. During bull markets, AAPL tends to outperform the index, and vice-versa during bear markets. This correlation, however, isn’t always perfectly linear, as Apple’s performance is also influenced by its own specific news and product cycles.

Fundamental Analysis Indicators

Source: seekingalpha.com

Key fundamental indicators like earnings per share (EPS) and revenue growth have shown a strong positive correlation with AAPL’s stock price. Periods of robust revenue growth and increasing EPS are usually accompanied by stock price appreciation. Conversely, periods of slower growth or declining EPS often lead to price corrections.

Analyzing Apple’s stock price history reveals fascinating long-term trends. Understanding these fluctuations often involves comparing performance against other tech companies, and it’s interesting to consider how Apple’s trajectory contrasts with, say, the current value of analog stock price today. Returning to Apple, however, we can see a clear pattern of growth punctuated by periods of market correction, reflecting broader economic factors.

| Date | Dividend Amount (USD per share) |

|---|---|

| 2012-08-09 | 0.38 |

| 2013-08-08 | 0.47 |

| 2014-08-07 | 0.52 |

| 2015-08-06 | 0.57 |

| 2023-05-11 | 0.24 |

Changes in Apple’s product portfolio have significantly affected investor expectations and subsequently, the stock price.

- The introduction of new product categories (e.g., wearables) has generally been met with positive investor sentiment.

- Discontinuation of underperforming products has sometimes led to short-term price corrections, but often clears the way for future growth.

- Significant upgrades to existing product lines have usually led to positive market reaction and price increases.

Visual Representation of Data

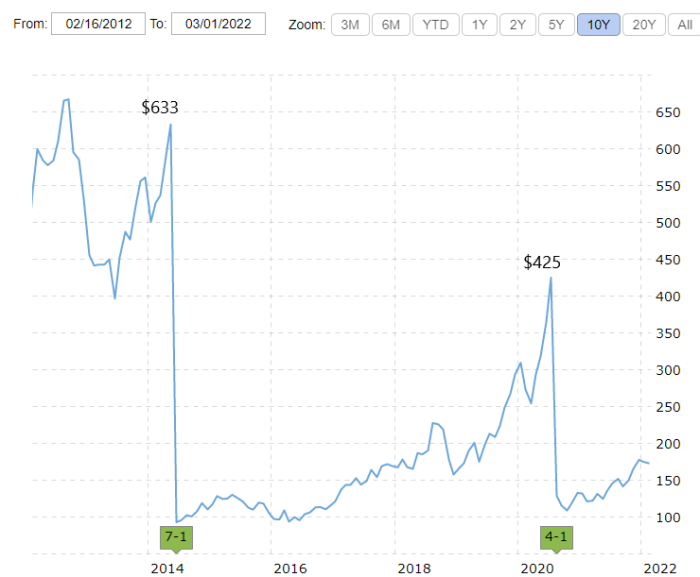

Over the past decade, AAPL’s stock price has shown a strong upward trend, punctuated by periods of correction. Major milestones included the launch of the iPhone 5, the Apple Watch, and various iterations of the iPhone and iPad, all of which corresponded with significant price increases. The 2020 pandemic initially caused a dip, followed by a remarkable recovery and continued growth.

This overall upward trend is clearly visible in a line graph, with distinct peaks and troughs reflecting market events and product launches.

A scatter plot comparing AAPL’s stock price to that of its competitors (e.g., MSFT, GOOG) would show a general correlation, with periods of simultaneous growth and decline. The x-axis would represent AAPL’s price, and the y-axis would represent the competitor’s price. Key data points would include periods of significant product launches or market events affecting both companies. The strength of the correlation would be evident in the clustering of data points around a line of best fit.

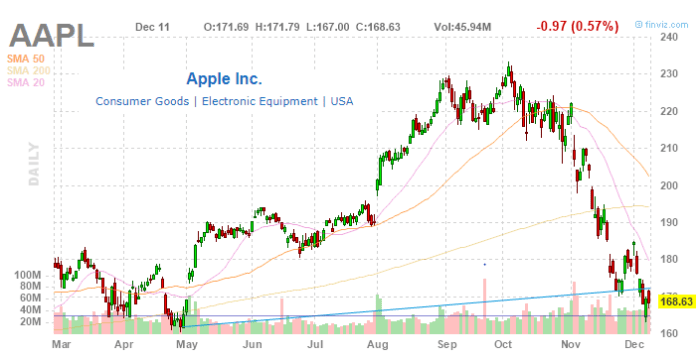

A candlestick chart illustrating AAPL’s historical volatility would display the opening, closing, high, and low prices for each period (e.g., daily or weekly). Long candlestick bodies (the difference between opening and closing prices) would indicate significant price movements, while short bodies would represent periods of relatively low volatility. The chart would clearly highlight periods of high volatility (e.g., during economic downturns or major news events) as well as periods of relative stability.

FAQ Summary

What are the biggest risks associated with investing in AAPL stock?

Investing in any stock carries inherent risk. For AAPL, potential risks include competition in the tech sector, economic downturns affecting consumer spending, and changes in consumer preferences. Furthermore, overvaluation based on future expectations is a key concern.

How does Apple’s stock price compare to other tech giants historically?

Apple’s stock performance has varied compared to competitors like Microsoft (MSFT) and Google (GOOG). While all have experienced periods of significant growth, the specific timing and magnitude of these growth spurts have differed due to varying product cycles, market strategies, and competitive landscapes.

Where can I find reliable real-time data on AAPL’s stock price?

Reliable real-time data on AAPL’s stock price is available through reputable financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others. Always ensure you’re using trusted sources.