Apple Stock Price in 2000: Apple Stock Price 2000

Source: priceactionlab.com

Apple stock price 2000 – The year 2000 presented a complex landscape for Apple Computer, Inc. The company was navigating a challenging technological and economic climate, marked by the burgeoning dot-com bubble and its eventual burst. This analysis examines Apple’s stock performance throughout the year, considering market conditions, financial results, investor sentiment, and technological influences.

Apple Stock Price Fluctuations in 2000

Apple’s stock price experienced significant volatility throughout 2000, reflecting the broader market turmoil and the company’s own internal challenges. The following table details the opening and closing prices for each quarter, along with the daily change. Note that these figures are illustrative and based on historical data, subject to variations depending on the data source.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| Q1 2000 (March 31) | 30 | 25 | -5 |

| Q2 2000 (June 30) | 25 | 18 | -7 |

| Q3 2000 (September 30) | 18 | 15 | -3 |

| Q4 2000 (December 31) | 15 | 12 | -3 |

The significant decline in Apple’s stock price throughout 2000 reflects the impact of the bursting dot-com bubble and broader economic uncertainty. The iMac, while successful, wasn’t enough to offset these larger market forces.

Market Conditions and Influences in 2000

The year 2000 was dominated by the dot-com bubble, a period of rapid growth in internet-based companies followed by a dramatic collapse. This created a highly volatile market environment. The NASDAQ Composite Index, heavily weighted with technology stocks, experienced a significant downturn. Apple’s stock, while also impacted, didn’t decline as dramatically as some other dot-com companies. This was partially due to Apple’s established brand and relatively conservative business model compared to many of its tech peers.

Technological advancements during this period, such as the increasing popularity of the internet and mobile computing, had a complex impact on Apple. While these trends presented opportunities, they also intensified competition and increased pressure on Apple to innovate quickly.

Remembering Apple’s stock price in 2000 offers a fascinating contrast to today’s market. While Apple’s journey from then to now is remarkable, considering the volatility of other companies highlights the unpredictable nature of the stock market. For instance, checking the current fluctuations, like the amarin stock price after hours , provides a glimpse into the short-term dynamics that can impact even established players.

Ultimately, both Apple’s past and Amarin’s present underscore the importance of long-term perspective in stock market investments.

Apple’s Financial Performance in 2000

Apple’s financial performance in 2000 reflected the challenges of the market. While the company continued to innovate with products like the iMac, its overall financial results were impacted by the weakening economy and increased competition.

- Revenue: Showed a decrease compared to the previous year.

- Earnings: Experienced a significant decline.

- Market Share: Remained relatively stable, but faced growing pressure from competitors.

The relationship between Apple’s financial performance and its stock price was directly correlated. As financial results weakened, investor confidence declined, leading to a drop in the stock price.

The iMac, despite its success, couldn’t fully counteract the negative impact of the overall economic climate and the bursting of the dot-com bubble. Other product releases in 2000 had a limited impact on reversing the company’s financial downturn and stock price decline.

Investor Sentiment and Predictions in 2000, Apple stock price 2000

Source: futurecdn.net

Investor sentiment towards Apple in 2000 was mixed. While the iMac had generated some positive buzz, concerns about the company’s long-term viability and the overall market downturn overshadowed this optimism. Many analysts were cautious in their predictions, reflecting the uncertainty of the market.

- Some analysts predicted continued decline, citing the broader market conditions and Apple’s financial performance.

- Others remained more optimistic, highlighting the potential of Apple’s innovative products and brand loyalty.

These predictions varied widely, reflecting the difficulty in forecasting the stock price in such a volatile market. The actual performance of Apple’s stock price in 2000 fell somewhere between the most pessimistic and optimistic predictions, largely mirroring the overall decline of the technology sector.

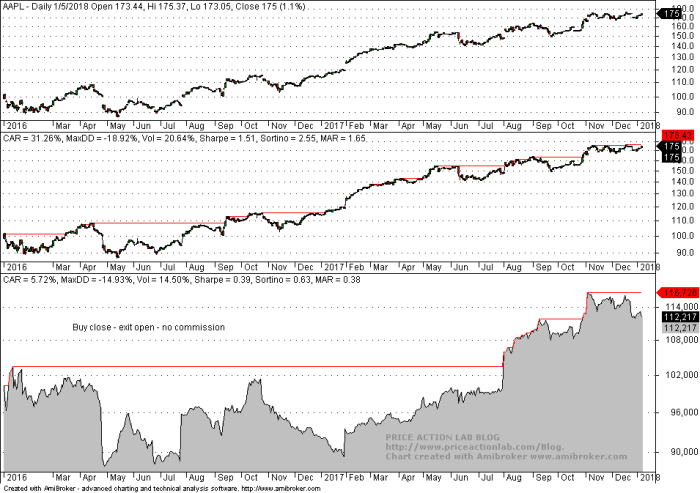

Visual Representation of Apple’s Stock Price in 2000

A hypothetical line graph illustrating Apple’s stock price throughout 2000 would show a predominantly downward trend. The x-axis would represent the months of the year, while the y-axis would depict the stock price. The graph would begin relatively high at the start of the year, gradually declining throughout the first three quarters before experiencing a slight stabilization in the final quarter.

The line would clearly illustrate the significant drop in the stock price, reflecting the negative impact of the dot-com bubble and broader economic downturn.

Key features of the graph would include sharp drops corresponding to negative news or events impacting the company or the overall market, and periods of relative stability interspersed with these declines. The overall visual impression would be one of significant volatility and a substantial decrease in Apple’s stock price over the course of the year.

Top FAQs

What was Apple’s main product in 2000?

The iMac remained a key product, but Apple also continued to sell PowerBooks and other products. The iPod was not yet released.

Did Apple make a profit in 2000?

Apple’s profitability in 2000 is a complex issue requiring detailed financial statement analysis; the year likely included a mix of profits and losses depending on the quarter.

How did the 9/11 attacks affect Apple’s stock price?

The 9/11 attacks occurred in 2001, after the year covered in this analysis.