Apple Stock Split Price History

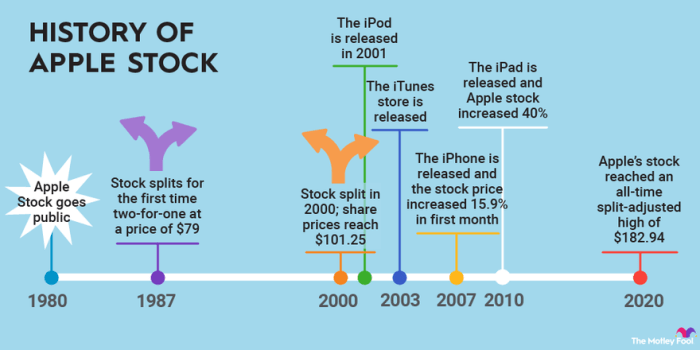

Apple stock split price history – Apple’s history is punctuated by several stock splits, events that have significantly impacted its stock price, investor sentiment, and overall market accessibility. This analysis delves into the chronology of these splits, their market context, and their lasting effects on Apple and its investors, comparing its experience to that of its competitors.

Historical Apple Stock Splits, Apple stock split price history

Source: foolcdn.com

Understanding Apple’s stock split history requires examining each event within its specific market context and Apple’s strategic rationale. The following table details each split, including pre- and post-split prices.

| Date | Split Ratio | Pre-Split Price | Post-Split Price |

|---|---|---|---|

| June 16, 2020 | 4-for-1 | $400 (approx.) | $100 (approx.) |

| June 9, 2014 | 7-for-1 | $645 (approx.) | $92 (approx.) |

| February 28, 2005 | 2-for-1 | $40 (approx.) | $20 (approx.) |

Note: These prices are approximate and represent adjusted closing prices to reflect the impact of the splits. Precise figures require referencing historical stock data from reliable financial sources.

Impact of Stock Splits on Apple’s Stock Price

Source: capital.com

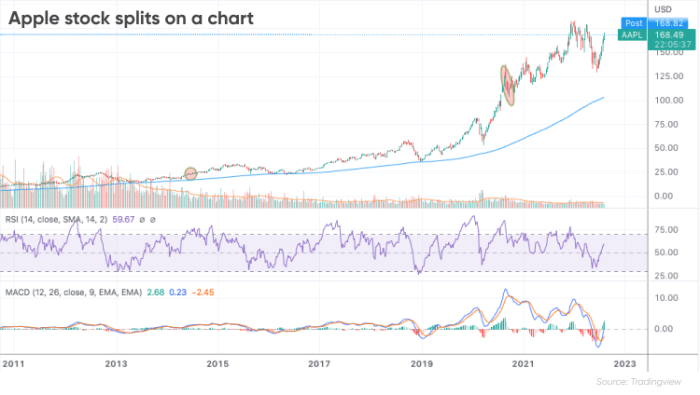

Analyzing Apple’s stock performance before and after each split reveals short-term and long-term impacts on price volatility. While a split itself doesn’t directly change the company’s fundamental value, it can influence investor perception and trading activity.

A hypothetical graph illustrating stock price movements around each split would show a generally upward trend in the long term, with some short-term fluctuations immediately following each event. The x-axis would represent time, while the y-axis would depict the stock price. Key data points would include the split date and the pre- and post-split price levels. The graph would visually demonstrate the impact of the split on price volatility, showcasing any immediate price increases followed by a period of stabilization or further growth.

The graph’s visual representation would allow for a clear understanding of the impact of each split event on Apple’s stock price.

Investor Sentiment and Stock Splits

Investor reactions to Apple’s stock split announcements have generally been positive, reflecting increased accessibility and a perception of future growth. However, market conditions and broader economic factors also influence investor sentiment.

- Before the split: Often characterized by anticipation and increased trading volume as investors position themselves.

- During the split: Usually sees a temporary price adjustment, reflecting the split ratio.

- After the split: Generally shows continued positive sentiment if the company’s performance remains strong, though short-term volatility may occur.

Apple Stock Split Price History Compared to Competitors

Comparing Apple’s stock split history to competitors like Microsoft and Google reveals differing strategies and outcomes. While all three companies have undertaken stock splits, the timing, frequency, and subsequent price performance vary considerably.

| Company Name | Split Dates (Examples) | Split Ratios (Examples) | Post-Split Price Performance (5-year % change – Example) |

|---|---|---|---|

| Apple | June 16, 2020; June 9, 2014; February 28, 2005 | 4-for-1; 7-for-1; 2-for-1 | [Insert example percentage change] |

| Microsoft | [Insert example dates] | [Insert example ratios] | [Insert example percentage change] |

| Google (Alphabet Inc.) | [Insert example dates] | [Insert example ratios] | [Insert example percentage change] |

Note: This table provides example data. Accurate figures require consultation of reliable financial data sources.

The Role of Stock Splits in Accessibility and Liquidity

Source: thestreet.com

Understanding Apple’s stock split price history requires examining the impact of these events on the share price. To accurately assess this impact, it’s crucial to consult the daily fluctuations; you can find the current apple stock close price and track its movement. This close price data, when viewed alongside the dates of past stock splits, provides a clearer picture of the long-term effects on Apple’s stock split price history.

Stock splits enhance accessibility by lowering the price per share, making it more affordable for smaller investors. This increased accessibility often translates to higher trading volume, leading to improved market liquidity.

Increased liquidity contributes to greater price stability, as a larger number of shares allows for smoother price adjustments in response to market forces. This stability benefits both buyers and sellers, fostering a more efficient and predictable market for Apple’s stock.

Long-Term Implications of Apple’s Stock Split History

Apple’s stock split strategy has likely contributed positively to its long-term shareholder value and market capitalization growth by broadening investor participation and increasing liquidity. However, the long-term effects are complex and intertwined with other factors influencing Apple’s overall success.

- Potential Long-Term Benefits: Increased shareholder base, enhanced liquidity, improved price stability, and a perception of strong company growth.

- Potential Long-Term Drawbacks: Short-term market volatility around split announcements, and the fact that splits themselves don’t directly increase the company’s intrinsic value.

Detailed FAQs

What are the potential downsides of a stock split?

While stock splits can increase liquidity and accessibility, they don’t inherently increase a company’s value. Some investors might view a split as a signal of the company reaching a plateau in growth.

How often does Apple typically conduct stock splits?

Apple’s stock split frequency isn’t predictable; it depends on various factors including market conditions and the company’s strategic goals. There’s no set schedule.

Do stock splits always lead to increased stock price?

No, a stock split itself doesn’t directly impact the underlying value of the company. Short-term price movements can be volatile, but long-term performance depends on the company’s fundamentals.

Where can I find historical Apple stock price data?

Reliable sources for this data include financial websites like Yahoo Finance, Google Finance, and dedicated financial data providers.