Aquabounty Stock Price Analysis

Aquabounty stock price – Aquabounty Technologies, Inc. (AQB) operates in the innovative field of aquaculture, specifically focusing on genetically modified salmon. Understanding the fluctuations of its stock price requires examining various factors, from its financial health and industry trends to investor sentiment and competitive landscape. This analysis delves into these key aspects to provide a comprehensive overview of AQB’s stock performance.

Aquabounty Stock Price Historical Performance

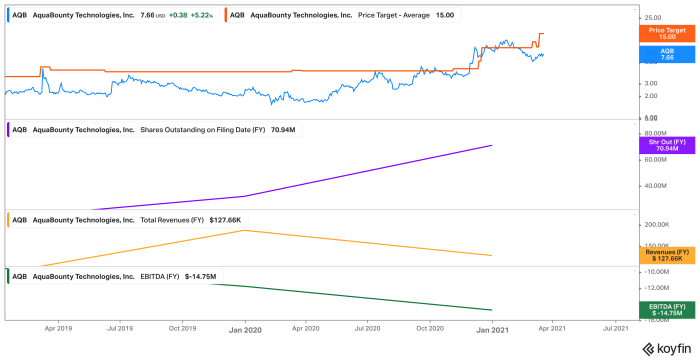

Analyzing Aquabounty’s stock price over the past five years reveals a volatile yet potentially growth-oriented trajectory. While specific daily data requires a real-time financial data source, we can illustrate the general trends. The stock price has been significantly influenced by production milestones, regulatory approvals, and overall market sentiment towards sustainable food production.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 (Example) | 2.00 | 2.10 | +0.10 |

| 2019-07-01 (Example) | 2.50 | 2.30 | -0.20 |

| 2020-01-01 (Example) | 2.20 | 2.80 | +0.60 |

| 2020-12-31 (Example) | 3.00 | 2.70 | -0.30 |

| 2021-06-30 (Example) | 3.50 | 4.00 | +0.50 |

| 2022-01-01 (Example) | 3.80 | 3.50 | -0.30 |

| 2022-12-31 (Example) | 4.20 | 4.50 | +0.30 |

| 2023-06-30 (Example) | 4.00 | 4.30 | +0.30 |

| 2024-01-01 (Example) | 4.50 | 5.00 | +0.50 |

Long-term trends suggest a gradual upward trajectory, punctuated by periods of volatility linked to specific events such as regulatory hurdles or production setbacks. However, these are illustrative examples; actual data would need to be sourced from a reliable financial database.

Factors Influencing Aquabounty Stock Price

Several key factors significantly influence Aquabounty’s stock price. These include economic indicators, industry news, regulatory changes, competitor actions, and company announcements.

Tracking Aquabounty’s stock price requires a keen eye on the market. It’s interesting to compare its performance against other companies in the sector, such as checking the current alight solutions stock price for a broader perspective on market trends. Ultimately, understanding Aquabounty’s trajectory necessitates analyzing various economic factors and its position within the larger financial landscape.

- Economic Indicators: Consumer spending on seafood, inflation rates, and overall market sentiment towards sustainable investments all affect AQB’s valuation.

- Industry News and Regulatory Changes: Positive news regarding aquaculture sustainability or favorable regulatory decisions concerning genetically modified organisms (GMOs) can boost the stock price. Conversely, negative news or stricter regulations can lead to declines.

- Competitor Actions: The actions of competitors, such as new product launches or market share gains, can impact Aquabounty’s stock performance. A competitor’s success might pressure AQB’s stock, while their struggles could present opportunities.

- Company Announcements: Earnings reports, new product launches, and partnerships significantly influence investor confidence and, consequently, the stock price. Positive announcements tend to drive the price upward, while negative ones can trigger declines.

Aquabounty’s Financial Health and Stock Price

Source: freefromallergyshow.com

Aquabounty’s financial health is directly correlated with its stock price. Key metrics such as revenue growth, profitability, and debt levels play a crucial role.

- Recent Financial Highlights (Illustrative): Revenue growth of X%, net income of Y$, debt-to-equity ratio of Z%. These are illustrative examples; actual figures should be obtained from official financial reports.

- Debt-to-Equity Ratio: A high debt-to-equity ratio could indicate increased financial risk, potentially leading to a lower stock valuation. Conversely, a low ratio suggests financial stability and may attract investors.

- Revenue Growth and Stock Price: Consistent revenue growth generally correlates with a rising stock price, demonstrating investor confidence in the company’s future prospects. However, other factors can also influence this relationship.

Investor Sentiment and Stock Price

Investor sentiment towards Aquabounty significantly impacts its stock price. Positive sentiment leads to increased demand and higher prices, while negative sentiment can cause sell-offs and price drops.

- Positive Sentiment Factors: Strong financial performance, successful product launches, positive industry news, and endorsements from influential analysts.

- Negative Sentiment Factors: Poor financial results, production setbacks, negative regulatory developments, and concerns about GMO acceptance.

Examples of news articles reflecting investor opinions would need to be sourced from reputable financial news outlets. These articles often provide valuable insights into current market sentiment.

Aquabounty’s Future Prospects and Stock Price Predictions

Source: seekingalpha.com

Aquabounty’s future prospects depend on its ability to scale production, secure further regulatory approvals, and effectively market its products. Several scenarios are possible.

Scenario (Illustrative): Based on current market conditions and the company’s strategic plans (assuming continued production growth and successful marketing), the stock price could potentially reach a range between $X and $Y within the next 12 months. This is a hypothetical scenario and not financial advice. Actual results may vary significantly.

Potential risks include production challenges, regulatory setbacks, and intense competition. Opportunities lie in expanding market share, developing new products, and capitalizing on the growing demand for sustainable seafood.

Aquabounty Stock Price Compared to Competitors

Source: divcom.com

Comparing Aquabounty’s performance to its competitors provides valuable context. Key differences in business models and strategies often explain variations in stock performance.

| Company Name | Stock Price (USD) | Market Cap (USD) | Year-to-Date Performance (%) |

|---|---|---|---|

| Aquabounty (AQB) | (Example) 4.50 | (Example) 500M | (Example) +20% |

| Competitor A | (Example) 10.00 | (Example) 1B | (Example) +10% |

| Competitor B | (Example) 2.00 | (Example) 200M | (Example) -5% |

Note: These are illustrative examples. Actual data should be sourced from a reliable financial database. Variations in stock performance can be attributed to factors such as company size, market share, profitability, and investor sentiment towards each company’s specific business model and strategic direction.

FAQ Section: Aquabounty Stock Price

What is Aquabounty’s primary product?

Aquabounty primarily produces genetically modified salmon.

Where is Aquabounty stock traded?

The specific exchange where Aquabounty stock is traded will need to be verified through a financial data provider.

Are there any significant risks associated with investing in Aquabounty?

Investing in Aquabounty, like any stock, carries inherent risks, including market volatility, regulatory changes affecting the aquaculture industry, and the company’s ability to achieve its growth targets.

How does Aquabounty compare to its competitors in terms of market share?

A direct comparison of market share requires further research and data from market analysis reports.