Arbutus Biopharma Corporation: A Stock Price Deep Dive: Arbutus Stock Price

Source: seekingalpha.com

Arbutus stock price – Arbutus Biopharma Corporation is a publicly traded biotechnology company focused on developing therapies for Hepatitis B virus (HBV) infection. Understanding its stock price requires analyzing its business model, financial performance, research pipeline, and the broader market context.

Arbutus Biopharma Corporation Overview

Arbutus Biopharma Corporation is a clinical-stage biopharmaceutical company dedicated to discovering, developing, and commercializing a cure for chronic HBV infection. Its market capitalization fluctuates but generally sits within a range reflective of its stage of development and the potential of its pipeline. The company’s history includes significant milestones such as securing funding rounds, initiating clinical trials, and announcing partnerships.

Its current financial performance shows a company focused on R&D with revenue primarily derived from collaborations and grants, while operating expenses reflect its ongoing research efforts. Detailed financial figures are available in its quarterly and annual reports.

Factors Influencing Arbutus Stock Price

Several factors influence Arbutus’s stock price. Macroeconomic factors like interest rate changes and inflation impact investor sentiment towards riskier assets like biotech stocks. Industry trends, including advancements in HBV treatment and competitive pressures from other pharmaceutical companies, also play a crucial role. Company-specific news, such as clinical trial results, regulatory updates, and partnership announcements, can cause significant short-term volatility.

| Company Name | Stock Price (USD) | Market Cap (USD) | Recent News |

|---|---|---|---|

| Arbutus Biopharma | (Data varies; consult financial news sources) | (Data varies; consult financial news sources) | (Data varies; consult financial news sources) |

| Competitor 1 | (Data varies; consult financial news sources) | (Data varies; consult financial news sources) | (Data varies; consult financial news sources) |

| Competitor 2 | (Data varies; consult financial news sources) | (Data varies; consult financial news sources) | (Data varies; consult financial news sources) |

| Competitor 3 | (Data varies; consult financial news sources) | (Data varies; consult financial news sources) | (Data varies; consult financial news sources) |

Arbutus’s Research and Development Pipeline

Source: seekingalpha.com

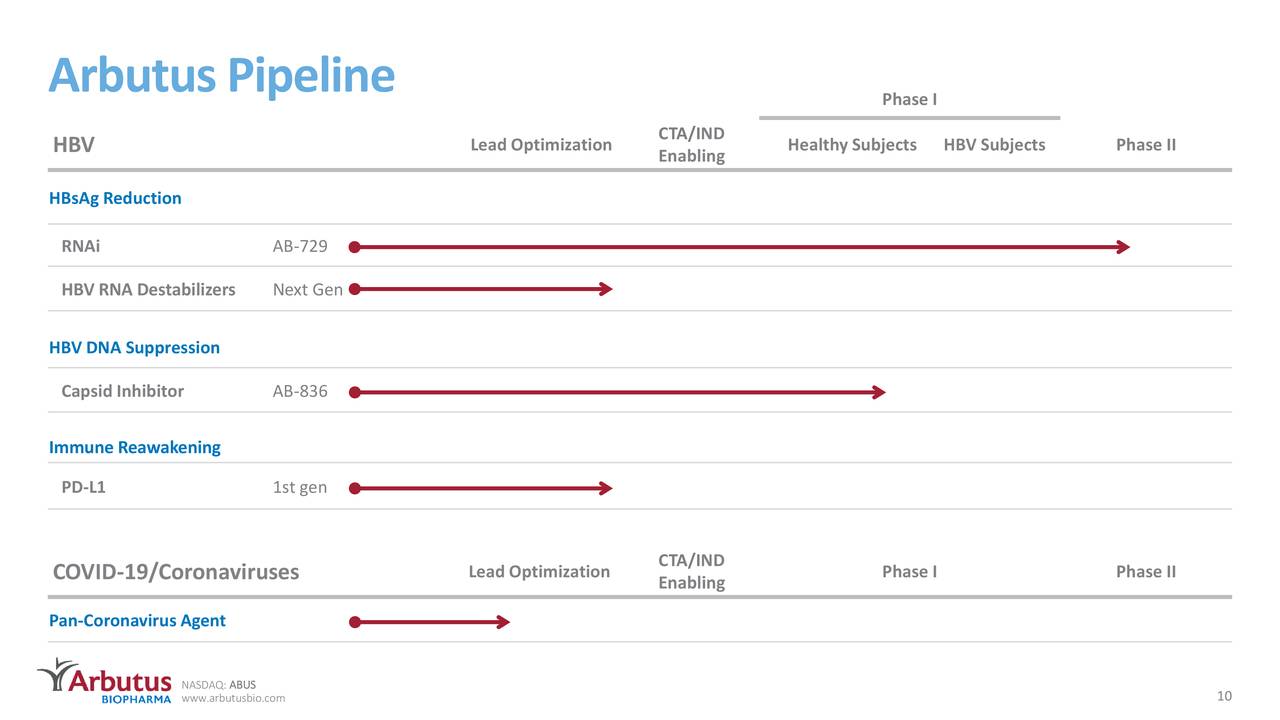

Arbutus’s pipeline consists of several HBV therapeutics at various stages of development. The success or failure of these projects significantly impacts the company’s valuation and stock price. Delays, unexpected results, or regulatory hurdles can lead to substantial price fluctuations.

- Project A: Phase (e.g., Phase 2 clinical trial), Projected Timeline (e.g., Completion in 2025)

- Project B: Phase (e.g., Pre-clinical development), Projected Timeline (e.g., Initiation of Phase 1 trials in 2024)

- Project C: Phase (e.g., Phase 1 clinical trial), Projected Timeline (e.g., Data readout expected in 2023)

Financial Performance and Analysis

Analyzing Arbutus’s financial statements—income statement, balance sheet, and cash flow statement—provides insights into its financial health and sustainability. Key financial ratios, compared over time and against industry benchmarks, reveal trends in profitability, liquidity, and efficiency. The company’s debt levels, if significant, can constrain future growth and increase financial risk. A visual representation (below) would illustrate revenue and earnings trends over the past five years.

Note: Actual figures would be obtained from Arbutus’s financial reports.

Illustrative Revenue and Earnings (Past Five Years): A line graph would show revenue and earnings trends over the past five years. Generally, a biotech company in the clinical stage would show increasing operating expenses related to R&D, potentially with limited revenue until product commercialization.

Tracking Arbutus’s stock price requires diligent monitoring of market trends. For comparative analysis, it’s helpful to observe the performance of other tech companies; a quick check of the amd stock price live can offer valuable insight into broader market sentiment, which in turn can inform predictions regarding Arbutus’s future trajectory. Ultimately, understanding the interplay between various tech stocks helps to better contextualize Arbutus’s performance.

Investor Sentiment and Analyst Ratings

Investor sentiment towards Arbutus Biopharma is often influenced by clinical trial results, regulatory updates, and overall market conditions. Analyst ratings and consensus price targets offer a summary of professional opinions on the stock’s future performance. Changes in analyst ratings can significantly impact the stock price, reflecting shifts in perceived risk and potential.

- Analyst A: Rating (e.g., Buy), Price Target (e.g., $15)

- Analyst B: Rating (e.g., Hold), Price Target (e.g., $12)

- Analyst C: Rating (e.g., Sell), Price Target (e.g., $8)

Risk Assessment and Potential Opportunities

Investing in Arbutus Biopharma involves significant risks. Clinical trial setbacks, intense competition in the HBV treatment market, and regulatory hurdles pose potential challenges. However, successful clinical trial outcomes, securing strategic partnerships, and regulatory approvals present substantial opportunities for growth and increased shareholder value. Comparing these risks and rewards to other biotech companies requires a detailed comparative analysis of their respective pipelines, financial positions, and market positions.

FAQ

What are the main risks associated with investing in Arbutus?

The primary risks include the inherent uncertainties of clinical trials (potential failures), competition from other biotech firms, and the volatility of the overall biotech market. Regulatory hurdles and funding challenges also pose significant risks.

How does Arbutus compare to its competitors in terms of market capitalization?

A direct comparison requires reviewing current market data. Consult financial news websites for up-to-date market capitalization figures for Arbutus and its competitors.

Where can I find real-time Arbutus stock price quotes?

Real-time quotes are available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

What is Arbutus’s current dividend policy?

Arbutus’s dividend policy should be checked on their investor relations page or through financial news sources. Biotech companies often reinvest profits into research and development rather than paying dividends.