Dividend Yield and Stock Price: A Comprehensive Analysis: Are Dividend Yield And Stock Price Positively Correlated

Are dividend yield and stock price positively correlated – The relationship between dividend yield and stock price is a complex one, often debated among investors and financial analysts. While a simple positive correlation might be assumed, the reality is far more nuanced, influenced by a multitude of factors ranging from market sentiment to company-specific characteristics. This analysis will delve into the intricacies of this relationship, exploring both theoretical underpinnings and empirical evidence.

While dividend yield and stock price aren’t always perfectly positively correlated, a high yield can sometimes attract investors, potentially boosting the price. However, factors like overall market sentiment and company performance play a significant role. For instance, examining the current situation with algonquin power stock price reveals how external pressures can influence this relationship, highlighting that the correlation is not always straightforward or guaranteed.

Introduction to Dividend Yield and Stock Price

Understanding the interplay between dividend yield and stock price requires a clear grasp of each component. Dividend yield represents the annual dividend per share relative to the current market price, essentially expressing the return an investor receives from dividends. The stock price, on the other hand, reflects the market’s collective assessment of a company’s future prospects and inherent value.

Several factors influence each. Dividend yield is influenced by the company’s dividend payout policy, its profitability, and the overall market interest rates. The stock price is influenced by a broader range of factors including earnings, growth prospects, market sentiment, and macroeconomic conditions.

The short-term and long-term behaviors of these two metrics often differ significantly. The following table highlights these differences:

| Factor | Short-term Impact on Dividend Yield | Short-term Impact on Stock Price | Long-term Impact on Both |

|---|---|---|---|

| Company Earnings Announcement | Minimal, unless a dividend change is announced. | Significant, positive for exceeding expectations, negative for underperformance. | Positive correlation if earnings consistently support higher dividends. |

| Interest Rate Changes | Inverse relationship; higher rates can decrease yield attractiveness. | Generally inverse; higher rates can decrease valuations. | Long-term impact depends on the overall economic environment and company performance. |

| Market Sentiment | Minor impact; primarily driven by company-specific factors. | Significant; positive sentiment boosts prices, negative sentiment depresses them. | Positive sentiment generally supports higher valuations, allowing for increased dividend payouts. |

| Unexpected Events (e.g., crisis) | Can fluctuate significantly depending on company response and industry impact. | Often experiences sharp declines. | Long-term impact highly variable depending on the severity and duration of the event. |

Theoretical Relationship Between Dividend Yield and Stock Price

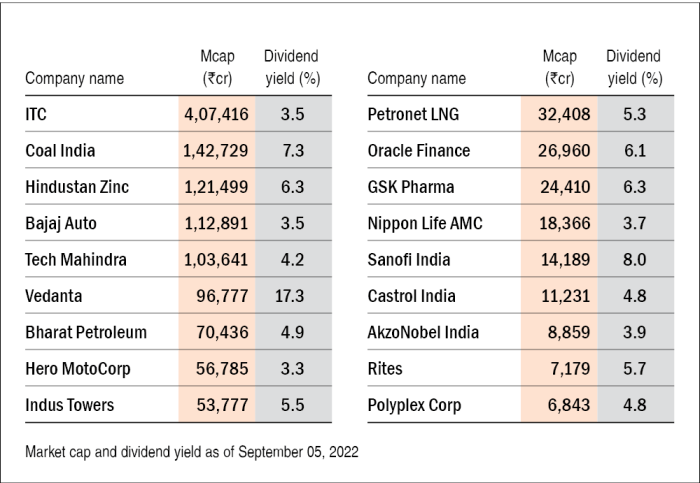

Source: valueresearchonline.com

The efficient market hypothesis suggests that stock prices fully reflect all available information. Under this assumption, any deviation from a theoretically “correct” relationship between dividend yield and stock price would be short-lived, quickly corrected by market forces. However, the signaling effect of dividend payouts must be considered. A consistent dividend increase can signal confidence in future earnings, potentially boosting stock prices.

Conversely, a dividend cut often signals financial distress, leading to a price decline. Investor preferences also play a significant role. Some investors prioritize income through dividends, while others focus on capital appreciation. This preference influences demand and ultimately affects the relationship between yield and price.

Various financial models attempt to predict this relationship. The Gordon Growth Model, for example, suggests a positive correlation, linking dividend yield to the expected growth rate of dividends and the required rate of return. Other models incorporate factors like risk and investor sentiment, leading to more complex relationships.

Empirical Evidence: Examining Historical Data

Analyzing historical data reveals a mixed relationship between dividend yield and stock price. Periods of economic expansion often show a positive correlation, as strong company performance supports both higher dividends and increased stock valuations. Conversely, during recessions or market downturns, the relationship can weaken or even become inverse, as investors prioritize capital preservation over dividend income. A robust methodology for analyzing this correlation would involve regressing dividend yield against stock price, controlling for macroeconomic factors and company-specific variables.

Statistical measures like correlation coefficients would quantify the strength and direction of the relationship.

- 1990s Bull Market: Generally positive correlation, driven by strong economic growth and high corporate profits.

- Dot-com Bubble (late 1990s): Weak correlation; high growth stocks with low or no dividends outperformed.

- 2008 Financial Crisis: Inverse correlation in many sectors; dividend cuts and stock price crashes were prevalent.

Impact of External Factors

External factors significantly influence the dividend yield and stock price relationship. Interest rate hikes, for example, tend to decrease stock valuations and can make high-dividend stocks less attractive compared to fixed-income investments. Economic growth typically strengthens the positive correlation, while recessions can weaken or invert it. Industry-specific factors, such as regulatory changes or technological disruptions, can also impact the relationship.

Finally, investor sentiment and market volatility introduce considerable noise, making it challenging to identify a consistent pattern.

Sectoral Differences and Company-Specific Factors, Are dividend yield and stock price positively correlated

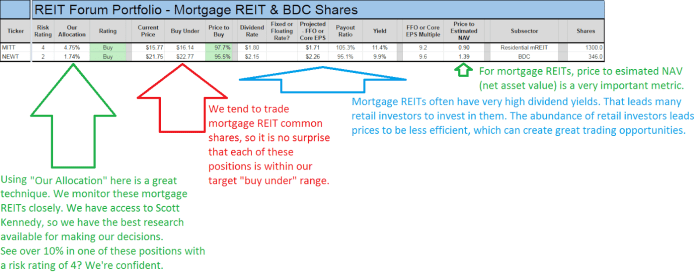

Source: seekingalpha.com

The relationship between dividend yield and stock price varies across sectors. Utilities and consumer staples, for instance, often exhibit a stronger positive correlation due to their stable earnings and consistent dividend payouts. Growth-oriented sectors, such as technology, may show a weaker or inverse correlation, as investors prioritize capital appreciation over immediate dividend income. Company size and financial health also play crucial roles.

Larger, financially stable companies tend to have a more predictable dividend policy, leading to a clearer relationship.

| Company Characteristic | Expected Impact on Dividend Yield | Expected Impact on Stock Price | Overall Correlation |

|---|---|---|---|

| Large, established company | Higher, more stable yield | Generally higher, less volatile price | Strong positive |

| Small, high-growth company | Lower or no yield (reinvestment in growth) | High potential for price appreciation, but also higher volatility | Weak or inverse |

| Financially distressed company | Potentially high yield (due to low price), but uncertain | Low and volatile price | Weak or inverse (high risk) |

| Company with high debt | Potentially high yield, but uncertain sustainability | Lower and more volatile price | Weak or inverse (high risk) |

Illustrative Examples

A high dividend yield associated with a low stock price might indicate investor concerns about the company’s future prospects or financial stability. For example, a mature company experiencing declining earnings might maintain a high dividend payout, resulting in a high yield but a depressed stock price due to the pessimistic outlook. Conversely, a low dividend yield coupled with a high stock price could reflect a growth company reinvesting its earnings to fuel expansion.

Investors are willing to pay a premium for future growth potential, even if current dividend payouts are low. Consider a comparison between a mature utility company (stable earnings, high dividend payout, strong positive correlation) and a fast-growing technology startup (high growth potential, low or no dividends, weak or inverse correlation). The key differences lie in their growth stages, risk profiles, and investor expectations.

Quick FAQs

What is a dividend yield?

Dividend yield is the annual dividend per share divided by the stock’s price. It represents the return an investor receives from dividends relative to the investment cost.

Can a high dividend yield be a bad sign?

Yes, sometimes a high dividend yield can indicate that the market is pessimistic about a company’s future prospects, leading to a lower stock price and a higher yield.

How do interest rate changes affect this relationship?

Rising interest rates can reduce the attractiveness of dividend-paying stocks, potentially weakening the positive correlation as investors seek higher returns in fixed-income securities.

Do all companies pay dividends?

No, many companies, especially growth-oriented ones, choose to reinvest profits rather than pay dividends.