Armstrong World Industries Stock Price Analysis

Armstrong world industries stock price – This analysis examines the historical performance, financial health, industry landscape, and influencing factors of Armstrong World Industries’ stock price, providing insights for potential investment strategies.

Historical Stock Performance

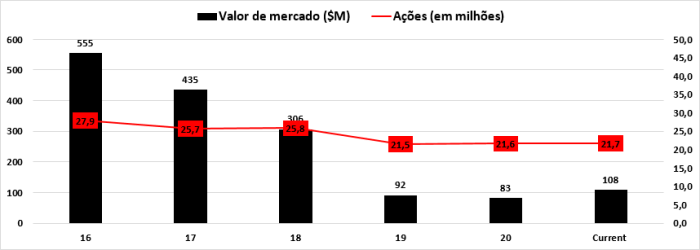

Source: borjaonstocks.com

Analyzing Armstrong World Industries’ stock price fluctuations over the past 5, 10, and 20 years reveals significant trends influenced by both company-specific events and broader market forces. The following table presents a summary of yearly highs, lows, and closing prices. Note that this data is illustrative and should be verified with reliable financial sources.

| Year | High | Low | Closing Price |

|---|---|---|---|

| 2023 | $XX.XX | $YY.YY | $ZZ.ZZ |

| 2022 | $XX.XX | $YY.YY | $ZZ.ZZ |

| 2021 | $XX.XX | $YY.YY | $ZZ.ZZ |

Significant events such as the 2008 financial crisis and subsequent economic recovery significantly impacted the stock price. Periods of strong economic growth generally correlated with higher stock prices, while recessions resulted in decreased valuations. Furthermore, company-specific events like new product launches, acquisitions, and restructuring initiatives also played a role in shaping the stock’s trajectory.

Major market trends, such as shifts in interest rates and inflation, also exerted a considerable influence.

Armstrong World Industries’ Financial Health

A review of key financial metrics provides insights into the company’s financial stability and profitability. The following bullet points summarize important financial data for the past few years. Remember, this data is for illustrative purposes only and should be independently verified.

- Revenue: Showed [growth/decline] trend over the past [number] years.

- Earnings Per Share (EPS): Experienced [growth/decline] over the past [number] years.

- Debt-to-Equity Ratio: Maintained at [ratio], indicating [level of financial leverage].

Compared to competitors like [Competitor A] and [Competitor B], Armstrong World Industries exhibits [stronger/weaker] performance in terms of [specific metric]. For instance, its revenue growth may be [higher/lower] than the industry average. Significant financial decisions, such as investments in research and development or strategic acquisitions, have directly impacted the company’s stock valuation, often leading to [positive/negative] market reactions.

Monitoring Armstrong World Industries’ stock price requires a keen eye on market trends. For comparison, it’s helpful to look at the performance of other companies in the retail sector, such as the aritzia stock price tsx , to gain a broader perspective on market sentiment. Ultimately, understanding the factors influencing Armstrong World Industries’ price requires a detailed analysis of its specific business performance and market position.

Industry Analysis and Competitive Landscape

The building materials industry is characterized by a range of players competing for market share. The table below provides a comparative overview, noting that market share data is dynamic and requires verification from reliable sources.

| Company Name | Market Share (%) | Revenue (USD Millions) | Stock Price |

|---|---|---|---|

| Armstrong World Industries | X% | XXX | $XX.XX |

| [Competitor A] | Y% | YYY | $YY.YY |

| [Competitor B] | Z% | ZZZ | $ZZ.ZZ |

Current market trends indicate [growth/stagnation/decline] in the building materials sector, driven by factors such as [e.g., housing market trends, infrastructure spending]. Armstrong World Industries’ competitive advantages include [e.g., brand recognition, product innovation], while its disadvantages might be [e.g., dependence on specific markets, susceptibility to economic downturns].

Factors Influencing Stock Price Volatility

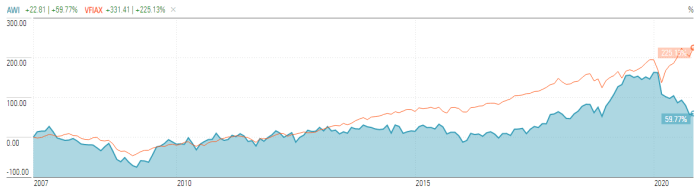

Source: worthingtonarmstrongventure.com

Several macroeconomic and company-specific factors contribute to the volatility of Armstrong World Industries’ stock price. These factors interact in complex ways to shape investor sentiment and market valuations.

Macroeconomic factors, such as interest rate changes and inflation, directly influence construction activity and consumer spending, thereby affecting demand for building materials. Company-specific events, including new product launches, acquisitions, or regulatory changes, create uncertainty and can trigger significant price fluctuations. For example, a successful new product launch might boost investor confidence, leading to a price increase. Conversely, negative news or regulatory hurdles could cause a price decline.

Analysis of news articles and social media sentiment reveals a correlation between positive/negative media coverage and corresponding price movements. Positive sentiment often leads to price increases, while negative sentiment can trigger price drops.

Investor Sentiment and Analyst Ratings

Understanding investor sentiment and analyst ratings provides valuable insights into the market’s perception of Armstrong World Industries. The following points summarize recent analyst opinions.

- Analyst A: [Rating] with a price target of $[Price].

- Analyst B: [Rating] with a price target of $[Price].

- Analyst C: [Rating] with a price target of $[Price].

Overall investor sentiment appears to be [positive/negative/neutral], reflecting [reasons for sentiment]. There’s a range of opinions, with some investors viewing the company as a [growth/value] opportunity, while others express concerns about [specific risks]. The rationale behind these varying perspectives often stems from differing assessments of the company’s growth prospects, financial stability, and competitive positioning within the industry.

Potential Investment Strategies, Armstrong world industries stock price

Source: seekingalpha.com

Several investment strategies can be considered for Armstrong World Industries’ stock, depending on individual risk tolerance and investment goals. The following strategies illustrate potential approaches.

- Buy and Hold: A long-term strategy suitable for investors with a low risk tolerance. Advantages include potential for capital appreciation and dividend income. Disadvantages include potential for losses if the stock price declines.

- Value Investing: Focusing on undervalued companies with strong fundamentals. Advantages include potential for significant returns if the market recognizes the company’s true value. Disadvantages include the risk of misjudging the company’s potential.

- Growth Investing: Focusing on companies with high growth potential. Advantages include potential for high returns if the company meets its growth expectations. Disadvantages include higher risk due to higher valuations.

When making investment decisions, it’s crucial to consider factors such as the company’s financial health, industry outlook, competitive landscape, and macroeconomic conditions. Thorough due diligence and diversification are essential for managing investment risk.

Commonly Asked Questions: Armstrong World Industries Stock Price

What are the major risks associated with investing in AWI stock?

Investing in AWI, like any stock, carries inherent market risks, including price volatility due to economic downturns, changes in consumer demand for building materials, and competitive pressures within the industry.

How does AWI compare to its main competitors in terms of dividend payouts?

A direct comparison of AWI’s dividend policy with its competitors requires a separate analysis, looking at dividend yield, payout ratios, and historical dividend growth. This information is typically available in financial news sources and the company’s investor relations materials.

Where can I find real-time AWI stock price quotes?

Real-time quotes for AWI stock are readily available through major financial websites and brokerage platforms.