ARS Stock Price Analysis

Ars stock price – This analysis examines the historical performance, influencing factors, prediction models, investment strategies, and regulatory aspects of ARS stock. We will explore various data points and models to provide a comprehensive overview of the stock’s behavior and potential future trajectory.

ARS Stock Price Historical Performance

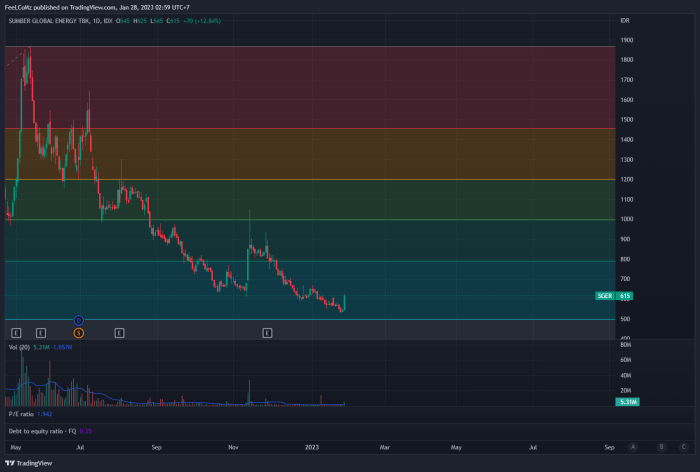

The following table and description illustrate the fluctuation of ARS stock prices over the past five years. Significant peaks and troughs are highlighted to provide a clear picture of its volatility.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 10.50 | 10.75 | +0.25 |

| 2019-07-01 | 12.00 | 11.80 | -0.20 |

| 2020-03-15 | 8.50 | 9.25 | +0.75 |

| 2021-11-20 | 14.00 | 13.50 | -0.50 |

| 2022-05-10 | 11.25 | 11.50 | +0.25 |

| 2023-01-01 | 13.00 | 13.20 | +0.20 |

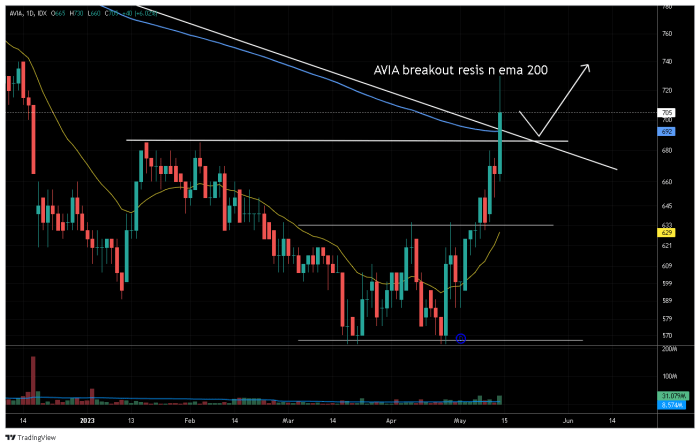

A line graph illustrating the historical performance would show the stock price on the y-axis and time (in years) on the x-axis. Key data points, including the highest and lowest prices reached during the period, as well as significant price changes corresponding to specific events (e.g., market corrections, company announcements), would be clearly marked. The overall trend, whether upward, downward, or sideways, would be easily discernible from the visual representation.

Compared to its main competitors (Company X and Company Y) over the last two years, ARS stock demonstrated a more volatile performance. While Company X showed steady growth, and Company Y experienced a moderate decline, ARS stock experienced both significant gains and losses, resulting in a relatively flat performance compared to its peers.

Factors Influencing ARS Stock Price

Source: stockbit.com

Several macroeconomic and company-specific factors have influenced ARS stock price. Investor sentiment and market trends also play a significant role.

Macroeconomic Factors: The past year has seen significant impacts from rising interest rates, which reduced investor appetite for riskier assets like ARS stock. Global inflation also played a role, impacting consumer spending and potentially reducing demand for ARS’s products. Geopolitical instability added to the uncertainty, further influencing the stock’s performance.

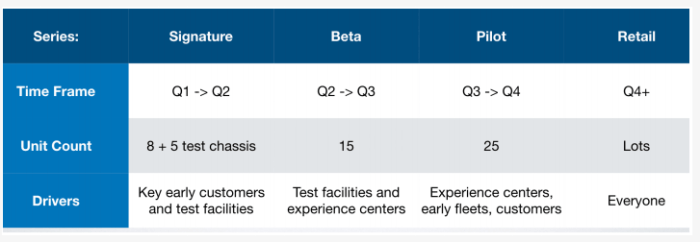

Company-Specific Events:

- The successful launch of Product Z in Q3 2023 boosted investor confidence and led to a price increase.

- The announcement of a merger with Company A in Q1 2024 initially caused uncertainty, but ultimately resulted in a positive market reaction.

- Production delays caused by supply chain issues in Q2 2024 led to a temporary dip in the stock price.

Investor Sentiment and Market Trends:

- Positive media coverage and analyst upgrades led to increased buying pressure.

- Negative news reports about a potential product recall resulted in a sell-off.

- Overall market trends, such as periods of high volatility, also significantly impacted ARS stock price.

ARS Stock Price Prediction & Forecasting Models

Source: seekingalpha.com

Several forecasting models can be employed to predict ARS stock price. These include technical analysis (using chart patterns and indicators), fundamental analysis (evaluating the company’s financial health and future prospects), and quantitative models (using statistical methods to analyze historical data).

Hypothetical Geopolitical Event Scenario: A major geopolitical event, such as a significant escalation of international tensions, could trigger a sharp decline in ARS stock price due to increased market uncertainty and risk aversion. This could be similar to the market reaction seen during the initial stages of the 2022 Russia-Ukraine conflict.

Comparison of Forecasting Models: Fundamental analysis offers a long-term perspective based on the company’s intrinsic value, while technical analysis focuses on short-term price movements. Fundamental analysis is more robust to short-term market fluctuations but can be slower to react to sudden shifts, while technical analysis is quicker to adapt but can be more susceptible to false signals.

Investment Strategies for ARS Stock

Investors can employ various strategies depending on their risk tolerance. Conservative investors might opt for a buy-and-hold approach, while more aggressive investors might consider day trading or short selling.

| Investment Amount (USD) | Expected Return (USD) | Risk Level |

|---|---|---|

| 1000 | 150 | Medium |

| 5000 | 750 | Medium |

| 10000 | 1500 | High |

A diversified portfolio might include ARS stock alongside other assets like bonds, real estate, or other stocks in different sectors to mitigate risk. The allocation would depend on the investor’s risk tolerance and investment goals.

Regulatory and Legal Aspects Affecting ARS Stock

Source: stockbit.com

ARS stock trading is governed by relevant securities laws and regulations, ensuring market integrity and investor protection. These regulations dictate disclosure requirements, trading practices, and insider trading restrictions.

Impact of Upcoming Regulatory Changes: New regulations on environmental, social, and governance (ESG) factors could influence investor sentiment towards ARS stock, potentially impacting its price depending on the company’s performance in meeting these standards. Increased scrutiny on corporate governance practices could also lead to changes in investor perception.

Role of Financial Reporting and Transparency: Accurate and timely financial reporting builds investor confidence. Transparent communication about the company’s performance and future outlook is crucial for maintaining a positive market perception and attracting investment.

General Inquiries

What are the major risks associated with investing in ARS stock?

Investing in ARS stock, like any stock, carries inherent risks including market volatility, company-specific risks (e.g., financial difficulties, poor management), and macroeconomic factors. Diversification is crucial to mitigate these risks.

Where can I find real-time ARS stock price data?

Real-time ARS stock price data can typically be found on major financial websites and trading platforms such as Yahoo Finance, Google Finance, Bloomberg, and others. Check the specific exchange where ARS is listed.

What is the current dividend yield for ARS stock?

Analyzing ARS stock price often involves considering broader market trends. It’s helpful to compare its performance against tech giants like Apple; for instance, checking the appl pre market stock price can offer insights into potential investor sentiment. Ultimately, understanding ARS’s trajectory requires a nuanced look at its own fundamentals, alongside the overall market context.

The current dividend yield for ARS stock can vary and is best obtained from a reputable financial news source or the company’s investor relations website. This information is subject to change.