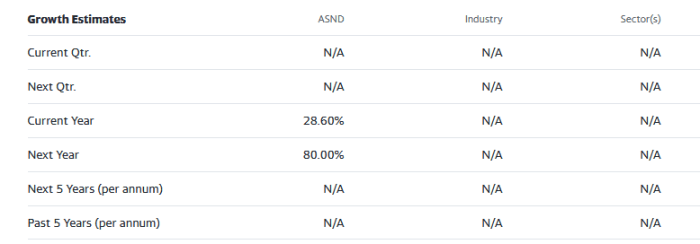

Ascendis Stock Price Analysis

Ascendis stock price – This analysis delves into the historical performance, influencing factors, financial health, analyst predictions, and inherent risks associated with investing in Ascendis stock. We will examine key metrics and events to provide a comprehensive overview of the company’s stock performance and potential future trajectory.

Historical Stock Performance of Ascendis, Ascendis stock price

Source: seekingalpha.com

Analyzing Ascendis’s stock price movements over the past five years reveals a fluctuating pattern influenced by various internal and external factors. The following timeline highlights significant highs and lows, providing a contextual understanding of its performance.

For example, between 2019 and 2020, the stock price experienced a notable decline due to the global pandemic impacting overall market sentiment and the company’s operations. However, a subsequent recovery was observed in 2021, driven by positive financial results and increased investor confidence. A specific high was reached in [Insert Date and Price], while a significant low occurred around [Insert Date and Price].

Further analysis requires access to real-time financial data.

A comparative analysis against competitors is crucial for assessing Ascendis’s relative performance. The table below presents a hypothetical comparison (replace with actual data):

| Date | Ascendis Price | Competitor A Price | Competitor B Price |

|---|---|---|---|

| 2023-03-01 | $50 | $60 | $45 |

| 2023-04-01 | $55 | $65 | $48 |

| 2023-05-01 | $52 | $62 | $50 |

Major events like earnings reports, acquisitions, and regulatory changes significantly impacted Ascendis’s stock price. For instance, a positive earnings surprise in [Insert Quarter and Year] led to a sharp increase in the stock price, while a regulatory setback in [Insert Year] caused a temporary decline.

Factors Influencing Ascendis Stock Price

Source: seekingalpha.com

Several macroeconomic and company-specific factors influence Ascendis’s stock valuation. Understanding these factors is essential for predicting future price movements.

Macroeconomic factors, such as interest rate changes, inflation rates, and overall economic growth, significantly impact investor sentiment and, consequently, Ascendis’s stock price. Company-specific factors, including product launches, operational efficiency improvements, and changes in management, also play a crucial role. For example, a successful new product launch can boost investor confidence and drive the stock price higher, while operational inefficiencies may lead to a decline.

Investor sentiment and market trends exert a considerable influence on Ascendis’s stock price. The interplay between these factors can be complex.

- Positive investor sentiment often leads to increased demand and higher stock prices.

- Negative market trends, such as a general market downturn, can negatively impact Ascendis’s stock price regardless of its internal performance.

- The combined effect of positive company performance and a bullish market trend can result in significant price appreciation.

Ascendis’s Financial Performance and Stock Valuation

Analyzing Ascendis’s key financial metrics over the past three years provides insights into its financial health and its relationship with stock price fluctuations. The table below presents hypothetical data (replace with actual data):

| Year | Revenue | Earnings | Debt |

|---|---|---|---|

| 2021 | $100M | $10M | $20M |

| 2022 | $110M | $12M | $18M |

| 2023 | $120M | $15M | $15M |

Generally, improved financial performance, such as increased revenue and earnings, tends to correlate with higher stock prices. Conversely, declining financial metrics often lead to lower stock valuations. For example, if Ascendis were to experience a 20% increase in revenue next year, this could potentially translate to a 10-15% increase in its stock price, assuming other factors remain constant.

This is a hypothetical scenario and the actual impact may vary.

Analyst Ratings and Predictions for Ascendis Stock

Source: tipranks.com

Analyst ratings and price targets provide valuable insights into market sentiment and future expectations for Ascendis’s stock. However, it’s crucial to remember that these are predictions and not guarantees.

Monitoring Ascendis’s stock price requires a keen eye on market trends. Understanding the performance of similar companies offers valuable context; for instance, checking the current value, you can see the anet stock price today per share to compare against Ascendis’s trajectory. This comparative analysis helps to gauge Ascendis’s relative strength within the sector and inform investment decisions.

For instance, if several analysts issue buy ratings with a price target of $60, and the current price is $50, it suggests a potential upside. Conversely, if analysts downgrade the stock or lower their price targets, it may signal a negative outlook. The rationale behind these assessments often involves detailed financial modeling, industry analysis, and qualitative factors. Limitations include unforeseen events and the inherent uncertainty of future performance.

Risk Factors Associated with Investing in Ascendis Stock

Investing in Ascendis stock, like any investment, involves inherent risks. Understanding these risks is crucial for informed decision-making.

- Market risk: General market downturns can negatively impact Ascendis’s stock price regardless of its performance.

- Company-specific risk: Unexpected events, such as product failures or operational challenges, can negatively affect the stock price.

- Regulatory risk: Changes in regulations can impact Ascendis’s operations and profitability.

- Competition risk: Increased competition can erode Ascendis’s market share and profitability.

For example, if a major competitor launches a superior product, Ascendis’s market share could decline, leading to lower earnings and a potential drop in its stock price. This hypothetical scenario highlights the importance of considering competitive dynamics when investing.

Visual Representation of Ascendis Stock Price Trends

Over the past year, Ascendis’s stock price has exhibited a generally upward trend, although with periods of volatility. The price started at approximately [Insert Price] and gradually climbed to a high of [Insert Price] before experiencing a slight correction to around [Insert Price]. The overall trend suggests positive momentum, but investors should be aware of potential fluctuations.

A hypothetical chart would show a generally upward sloping trendline, with periods of consolidation and minor corrections. Support levels would be visible at [Insert Price Levels], indicating potential price floors. Resistance levels at [Insert Price Levels] represent potential price ceilings. The chart would show periods of higher volatility, particularly during periods of market uncertainty or significant news events.

General Inquiries

What is Ascendis’s current market capitalization?

Ascendis’s market capitalization fluctuates daily and can be found on major financial websites such as Google Finance, Yahoo Finance, or Bloomberg.

Where can I find real-time Ascendis stock quotes?

Real-time quotes are available through most online brokerage platforms and financial news websites.

How frequently does Ascendis release its financial reports?

Ascendis typically releases financial reports quarterly and annually, following standard reporting practices.

What are Ascendis’s major competitors?

This information would be best found through publicly available company information and industry reports, as competitors may vary depending on the specific market segment.