AST SpaceMobile Stock Price Analysis

Ast spacemobile stock price analysis – This analysis delves into the various factors influencing AST SpaceMobile’s stock price, encompassing its business model, financial performance, market position, technological advancements, regulatory landscape, and inherent risks. We will explore its growth potential and provide a comprehensive overview to aid in investment decision-making.

Analyzing AST SpaceMobile’s stock price requires considering various factors, including technological advancements and market competition. Understanding the performance of related companies can offer valuable context; for instance, checking the current value with a quick glance at aphlf stock price today might provide insights into broader market trends. Ultimately, though, a thorough AST SpaceMobile stock price analysis needs a focus on its own unique trajectory and prospects.

Company Overview and Financial Health

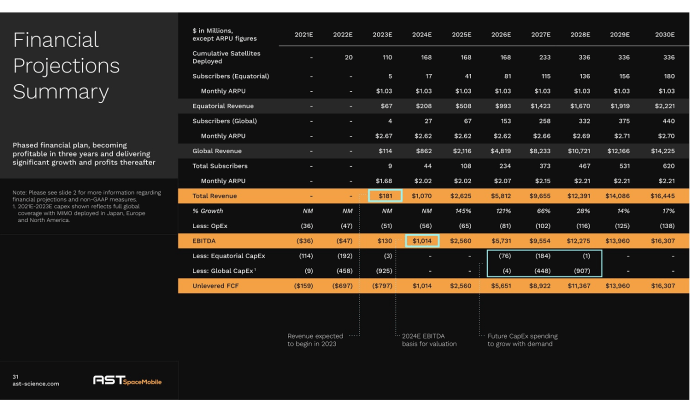

AST SpaceMobile aims to provide global mobile broadband coverage via a space-based network. Its primary revenue stream is projected to come from service agreements with mobile network operators (MNOs), enabling them to extend their coverage to underserved areas. Currently, the company is in its development phase, thus detailed financial analysis focuses on expenditures related to technology development, satellite deployment, and operational costs.

Profitability is not yet a primary focus; instead, the metrics emphasize the progress towards operational capability and future revenue generation potential.

Direct comparison to established competitors is challenging due to AST SpaceMobile’s unique business model and stage of development. Established satellite communication companies operate on different scales and often focus on different market segments. However, key financial ratios like burn rate, research and development (R&D) expenditure as a percentage of revenue (where applicable), and projected future revenue growth can be used for comparative analysis, albeit with caveats.

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue (USD Millions) | 0 | 0 | (Projected) X |

| Expenses (USD Millions) | Y | Z | (Projected) A |

| Net Loss (USD Millions) | Y | Z | (Projected) B |

| Burn Rate (USD Millions/Quarter) | C | D | (Projected) E |

Note: Replace X, Y, Z, A, B, C, D, and E with actual or projected financial data from reliable sources. This table illustrates the structure; the actual data needs to be filled in from publicly available financial reports.

Market Analysis and Competitive Landscape, Ast spacemobile stock price analysis

Source: ast-science.com

The space-based mobile communication market includes established satellite operators, emerging space technology companies, and terrestrial mobile network operators exploring satellite integration. The potential market size is substantial, driven by the need for global connectivity, especially in remote and underserved areas. AST SpaceMobile’s competitive advantage lies in its direct-to-cellphone technology, potentially reducing infrastructure costs and complexities compared to traditional satellite solutions.

However, competition from other space-based broadband providers and the continued expansion of terrestrial 5G networks pose significant challenges.

- AST SpaceMobile: Direct-to-cellphone technology, aiming for broad global coverage.

- Competitor A: Focus on high-throughput satellite internet, targeting enterprise and government clients.

- Competitor B: Provides satellite-based broadband services through specialized terminals.

- Competitor C: Develops low earth orbit (LEO) satellite constellations for broadband access.

Technological Assessment and Development

AST SpaceMobile’s technology uses a constellation of satellites equipped with advanced antennas to communicate directly with standard mobile phones. This eliminates the need for specialized ground equipment. The company has made significant progress in developing and testing its satellite technology, with key milestones including successful tests of its BlueWalker 3 prototype. However, challenges remain in scaling the technology for global deployment and ensuring the reliability and efficiency of the satellite network in a complex space environment.

Further technological hurdles may include interference mitigation and spectrum management.

| Milestone | Date | Description |

|---|---|---|

| BlueWalker 3 Launch | [Insert Date] | Successful deployment of the large-scale antenna prototype. |

| Initial Satellite Constellation Launch | [Insert Projected Date] | Deployment of the first operational satellites. |

| Commercial Service Launch | [Insert Projected Date] | Beginning of commercial service to MNO partners. |

Regulatory and Legal Environment

AST SpaceMobile’s operations are subject to international and national regulations governing space activities, spectrum allocation, and telecommunications. These regulations cover areas such as orbital debris mitigation, frequency licensing, and safety standards. Potential legal challenges could arise from disputes over spectrum rights, liability issues related to satellite operations, and compliance with evolving regulatory frameworks. The company must navigate a complex and evolving legal landscape to ensure successful deployment and operation.

- International Telecommunication Union (ITU) regulations: Governing spectrum allocation and satellite operations.

- National licensing requirements: Varying regulations across different countries for satellite operation and telecommunications services.

- Space debris mitigation guidelines: Regulations aimed at minimizing the risk of collisions and orbital debris.

Stock Price Drivers and Valuation

Source: marketrealist.com

AST SpaceMobile’s stock price is influenced by various factors, including technological progress, regulatory approvals, partnerships with MNOs, financial performance, and overall market sentiment towards the space technology sector. Valuation methodologies such as discounted cash flow (DCF) analysis, comparable company analysis, and precedent transactions can be applied, though with significant uncertainty given the company’s early stage and lack of substantial revenue.

| Factor | Impact on Stock Price (Positive/Negative) | Example |

|---|---|---|

| Successful Satellite Launches | Positive | Increased investor confidence in technological capabilities. |

| Major Partnership Announcements | Positive | Securing contracts with significant MNOs. |

| Regulatory Delays | Negative | Setbacks in obtaining necessary licenses and approvals. |

| Increased Competition | Negative | Entry of new competitors with similar technologies. |

Risk Factors and Potential Challenges

Source: seekingalpha.com

Investing in AST SpaceMobile carries significant risks. These include technological challenges in deploying and maintaining a large-scale satellite network, regulatory hurdles, intense competition, financial risks associated with high capital expenditure and a prolonged path to profitability, and geopolitical uncertainties affecting international operations. The company’s success is highly dependent on successful technology deployment and securing partnerships with major telecommunication companies.

| Risk Category | Specific Risk | Priority |

|---|---|---|

| Technological | Satellite malfunction or failure | High |

| Regulatory | Delays or denials of necessary licenses | High |

| Financial | Inability to secure sufficient funding | High |

| Competitive | Increased competition from established players | Medium |

Future Outlook and Growth Projections

AST SpaceMobile’s future growth hinges on the successful deployment and commercialization of its satellite network. Positive projections depend on securing partnerships with major MNOs, achieving high levels of network reliability, and effectively managing operational costs. Technological advancements, such as improved satellite technology and advancements in 5G and 6G, could significantly enhance its capabilities and market appeal. A successful future scenario involves a large-scale operational network, strong partnerships, significant revenue generation, and a leading market position in global mobile broadband coverage.

FAQ Resource

What are the main risks associated with investing in AST SpaceMobile?

Key risks include technological challenges, regulatory uncertainty, competition from established players, and the inherent volatility of the space industry. Market acceptance of the service and successful deployment of the technology are also critical success factors.

How does AST SpaceMobile’s technology compare to its competitors?

AST SpaceMobile aims to differentiate itself through its unique approach to providing direct-to-cell phone connectivity from space, a different approach compared to other satellite communication providers. A detailed comparison requires analyzing each competitor’s specific technologies and capabilities.

What is AST SpaceMobile’s current market capitalization?

The current market capitalization fluctuates and should be checked on a reputable financial website providing real-time market data.

What are AST SpaceMobile’s key revenue streams?

Revenue is primarily projected from providing mobile network services via its space-based network to mobile network operators and potentially directly to consumers in the future.