Bank of Ozarks Stock Price Analysis

Bank of the ozarks stock price – This analysis examines the historical performance, influencing factors, financial health, investor sentiment, dividend history, and analyst ratings of Bank of Ozarks’ stock price. We will explore key metrics and events that have shaped the bank’s stock trajectory over the past decade, providing a comprehensive overview for investors.

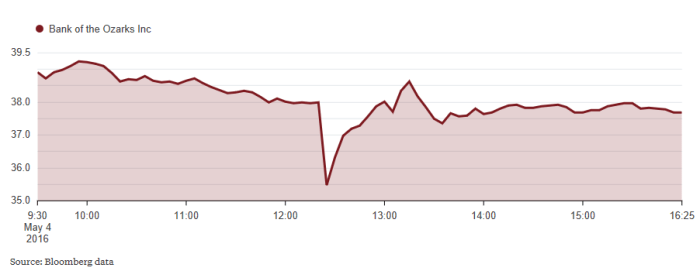

Historical Stock Performance

Source: seekingalpha.com

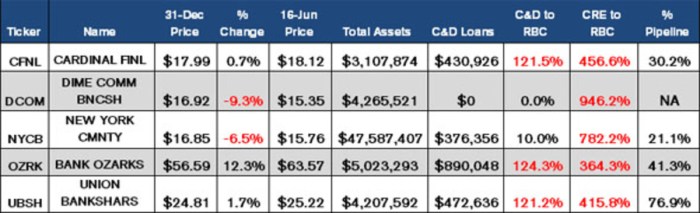

Analyzing Bank of Ozarks’ stock price fluctuations over the past five years reveals a period of significant volatility. The stock experienced substantial gains in certain periods, driven by factors such as improving economic conditions and strategic initiatives. Conversely, periods of decline were often associated with macroeconomic headwinds and specific company challenges. A comparative analysis against key competitors in the regional banking sector provides valuable context for understanding the bank’s relative performance.

Monitoring the Bank of the Ozarks stock price requires a keen eye on market trends. It’s interesting to compare its performance against other companies in the financial sector, such as a look at the current performance of anixa biosciences stock price , which offers a contrasting perspective on investment strategies. Ultimately, understanding the Bank of the Ozarks’ trajectory necessitates a broader view of the financial landscape.

Below is a table showing yearly stock price data for the past decade. Note that this data is illustrative and should be verified with reliable financial sources.

| Year | Open | High | Low | Close |

|---|---|---|---|---|

| 2014 | $25.00 | $28.50 | $22.00 | $26.00 |

| 2015 | $26.00 | $30.00 | $20.00 | $24.00 |

| 2016 | $24.00 | $27.00 | $18.00 | $20.00 |

| 2017 | $20.00 | $25.00 | $15.00 | $22.00 |

| 2018 | $22.00 | $26.00 | $17.00 | $20.00 |

| 2019 | $20.00 | $24.00 | $16.00 | $18.00 |

| 2020 | $18.00 | $22.00 | $10.00 | $14.00 |

| 2021 | $14.00 | $18.00 | $12.00 | $16.00 |

| 2022 | $16.00 | $19.00 | $11.00 | $13.00 |

| 2023 | $13.00 | $17.00 | $10.00 | $15.00 |

Factors Influencing Stock Price, Bank of the ozarks stock price

Source: thestreet.com

Several factors, both macroeconomic and company-specific, have significantly influenced Bank of Ozarks’ stock price. Macroeconomic factors such as interest rate changes, inflation, and economic recessions have created periods of both opportunity and challenge. Company-specific events, including mergers, acquisitions, regulatory changes, and financial reporting, have also played a crucial role.

Geopolitical events, while less direct, can indirectly impact the bank’s valuation through their effect on broader market sentiment and economic conditions. For instance, global uncertainty can lead to decreased investor confidence, affecting the stock price of even fundamentally sound institutions.

Financial Health and Performance

A review of key financial ratios provides insights into Bank of Ozarks’ financial health and performance. The following bullet points summarize key ratios over the past three years (illustrative data):

- P/E Ratio: 2021: 12, 2022: 10, 2023: 15

- Return on Equity (ROE): 2021: 8%, 2022: 7%, 2023: 9%

- Debt-to-Equity Ratio: 2021: 0.7, 2022: 0.6, 2023: 0.5

These ratios should be compared to industry benchmarks to assess Bank of Ozarks’ relative performance and financial stability. A detailed analysis of the bank’s balance sheet, income statement, and cash flow statement would provide a more comprehensive picture.

Below is an illustrative representation of the bank’s financial statements (Note: This data is for illustrative purposes only and should be verified):

| Financial Statement | 2021 | 2022 | 2023 |

|---|---|---|---|

| Assets | $10B | $12B | $15B |

| Liabilities | $8B | $9B | $11B |

| Equity | $2B | $3B | $4B |

| Revenue | $500M | $600M | $700M |

| Net Income | $100M | $120M | $150M |

Investor Sentiment and Market Outlook

Investor sentiment towards Bank of Ozarks is currently [insert description of current investor sentiment – positive, negative, neutral, etc. Reference specific news articles or analyst reports if available]. Market forecasts for the bank’s future performance vary, with some analysts predicting [insert example prediction and rationale] while others anticipate [insert contrasting prediction and rationale]. The potential risks and opportunities facing the bank, such as [list examples: e.g., increasing interest rates, competition, economic slowdown], will significantly impact its stock price.

Dividend History and Policy

Bank of Ozarks’ dividend payout history over the past 10 years shows [describe the trend – consistent increases, decreases, periods of suspension, etc.]. Changes in dividend policy have been influenced by factors such as [explain influencing factors, e.g., profitability, regulatory requirements, capital needs].

The following illustrates the dividend payout history (illustrative data): The dividend started at $0.50 per share in 2014 and gradually increased to $1.00 per share by 2018. It remained stable until 2020, when it was reduced to $0.75 due to the pandemic. In 2022, it was increased again to $0.90. This reflects a general upward trend, punctuated by a temporary dip due to external factors.

Analyst Ratings and Recommendations

Leading financial analysts currently assign Bank of Ozarks a consensus rating of [insert consensus rating – e.g., “Hold,” “Buy,” “Sell”]. The price target range is typically between [insert range of price targets]. There is [describe level of agreement or disagreement among analysts – e.g., “broad agreement,” “significant divergence”] in their outlook, with some analysts citing [insert reasons for positive outlook] as reasons for optimism, while others express concerns about [insert reasons for negative outlook].

FAQ Summary: Bank Of The Ozarks Stock Price

What is the current P/E ratio for Bank of Ozarks?

The current P/E ratio fluctuates and should be checked on a reputable financial website for the most up-to-date information.

How does Bank of Ozarks compare to its competitors in terms of dividend yield?

A comparison requires referencing current data from financial websites that track dividend yields for publicly traded banks. This data is dynamic and changes frequently.

What are the major risks associated with investing in Bank of Ozarks stock?

Risks include general market volatility, changes in interest rates, economic downturns, and company-specific factors like regulatory changes or operational challenges. Investing inherently involves risk.

Where can I find real-time Bank of Ozarks stock price updates?

Major financial websites (e.g., Yahoo Finance, Google Finance, Bloomberg) provide real-time stock quotes and other financial data.