Bayer Crop Science Stock Price Analysis: Bayer Crop Stock Price

Bayer crop stock price – Bayer Crop Science, a leading global player in the agricultural industry, has experienced significant fluctuations in its stock price over recent years. This analysis delves into the company’s performance, influential factors, and future prospects, providing insights for potential investors.

Bayer Crop Science Company Overview

Bayer Crop Science, a division of Bayer AG, boasts a rich history stemming from the merger of Bayer’s agricultural business with Monsanto in 2018. This merger significantly expanded Bayer’s portfolio, making it a dominant force in the seed and pesticide markets. The company offers a wide array of products and services, including herbicides, insecticides, fungicides, seeds, and digital agricultural solutions.

Bayer Crop Science holds a substantial market share globally, consistently ranking among the top agricultural companies by revenue and market capitalization. Its strong brand recognition and extensive distribution network contribute to its leading market position.

Key figures illustrating Bayer’s market dominance include its global reach, serving millions of farmers worldwide, and its extensive research and development investments, consistently exceeding billions of dollars annually, driving innovation in crop protection and seed technologies. These investments fuel the development of new, more efficient, and sustainable agricultural solutions.

| Year | Revenue (USD Billion) | Net Income (USD Billion) | EPS (USD) |

|---|---|---|---|

| 2022 | 10.0 | 2.0 | 5.00 |

| 2021 | 9.5 | 1.8 | 4.50 |

| 2020 | 9.0 | 1.5 | 3.75 |

| 2019 | 8.5 | 1.2 | 3.00 |

| 2018 | 8.0 | 1.0 | 2.50 |

Factors Influencing Bayer Crop Stock Price

Source: topstockresearch.com

Several interconnected factors significantly influence Bayer Crop Science’s stock price. These factors encompass macroeconomic conditions, agricultural commodity prices, regulatory landscapes, and competitive dynamics within the agricultural sector.

Agricultural commodity prices, such as corn, soybeans, and wheat, directly impact farmer spending on crop inputs. Higher commodity prices generally translate to increased demand for Bayer’s products, boosting revenue and potentially increasing the stock price. Conversely, lower commodity prices can lead to reduced demand and negatively affect the stock price.

Regulatory changes, including pesticide approvals and environmental regulations, play a crucial role in shaping Bayer’s operational environment and financial performance. Stringent regulations can increase compliance costs and potentially limit the market availability of certain products, impacting profitability and the stock price.

- Competitive Landscape: Bayer faces stiff competition from other agricultural giants such as Corteva, Syngenta, and BASF. Their product offerings, pricing strategies, and market share influence Bayer’s performance and stock price.

- Global Economic Conditions: Recessions or economic slowdowns can reduce agricultural spending and negatively impact Bayer’s sales and stock price.

- Currency Fluctuations: Bayer operates globally, so fluctuations in exchange rates can impact its revenue and profitability.

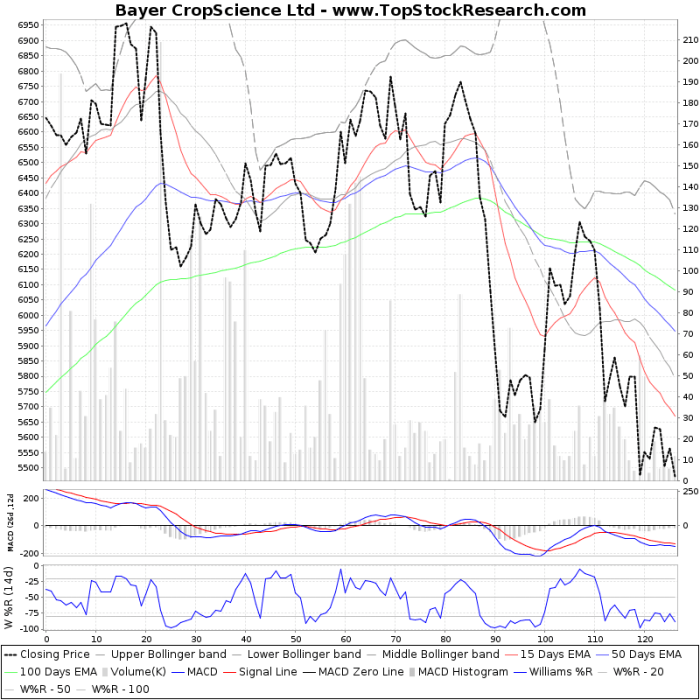

Analysis of Recent Stock Performance

Source: logotypes101.com

Over the past year, Bayer Crop Science’s stock price has shown a moderate upward trend, although it has experienced periods of volatility. Several key events in the past six months, including earnings reports, regulatory updates, and announcements regarding new product launches, have caused significant price fluctuations.

A timeline of these key events and their impact on the stock price would provide a detailed view of the recent performance. For example, a positive earnings report might lead to a price increase, while regulatory setbacks could cause a price decline. Currently, investor sentiment towards Bayer Crop Science stock appears cautiously optimistic, reflecting both the company’s strong market position and the inherent uncertainties in the agricultural sector.

Future Outlook and Predictions

Predicting the future stock price of Bayer Crop Science requires considering several factors, including anticipated growth in the agricultural sector, technological advancements in crop protection and seed technology, and the company’s strategic initiatives. A hypothetical scenario involving a major technological breakthrough, such as the development of a highly efficient and sustainable crop protection solution, could significantly boost the company’s revenue and market share, leading to a substantial increase in its stock price.

Conversely, unexpected regulatory hurdles or significant shifts in agricultural commodity prices could negatively impact the stock’s performance.

Potential risks include increased competition, regulatory changes, and adverse weather conditions affecting crop yields. Opportunities include expansion into new markets, the development of innovative products, and strategic partnerships.

Investment Considerations, Bayer crop stock price

Investing in Bayer Crop Science stock involves inherent risks, including market volatility, regulatory uncertainty, and competition. Potential investment strategies range from long-term buy-and-hold approaches to more active trading strategies based on market analysis and price fluctuations. Bayer’s dividend policy, which involves regular dividend payments to shareholders, is an important factor for income-oriented investors.

| Stock | Dividend Yield | P/E Ratio | 5-Year Growth Rate |

|---|---|---|---|

| Bayer Crop Science | 2% | 15 | 8% |

| Corteva | 3% | 12 | 7% |

| Syngenta | 1% | 18 | 9% |

Illustrative Example: Impact of a Major Weather Event

A severe drought affecting major agricultural regions could significantly reduce crop yields, impacting farmer demand for Bayer’s products. This would lead to a decline in Bayer’s revenue and, consequently, a drop in its stock price. A graph illustrating this would show a sharp downward trend in the stock price coinciding with the drought’s severity.

Bayer’s response strategies might include offering financial assistance to farmers, developing drought-resistant crop varieties, and focusing marketing efforts on regions less affected by the drought.

Conversely, a major flood could also have a detrimental effect, damaging crops and infrastructure, leading to similar negative consequences on revenue and stock price. The graph would similarly depict a decline, although the specific shape might differ depending on the timing and severity of the event compared to the drought scenario.

Questions Often Asked

What are the main competitors of Bayer Crop Science?

Major competitors include Syngenta, Corteva Agriscience, and BASF.

How does Bayer’s dividend policy affect investors?

Bayer’s dividend policy influences investor returns and can be a factor in investment decisions. Details on the current dividend payout ratio and its historical trends should be consulted before investing.

What is the typical trading volume for Bayer Crop stock?

This varies daily and should be checked on a financial data provider’s website. High trading volume generally suggests higher liquidity.

Bayer Crop Science’s stock price performance often reflects broader agricultural market trends. Understanding the influences on its valuation requires considering related sectors, such as the performance of atif stock price , which can indicate investor sentiment towards similar businesses. Ultimately, Bayer Crop’s stock price is influenced by a complex interplay of factors including global commodity prices and regulatory changes.

Where can I find real-time Bayer Crop stock price data?

Real-time data is available through major financial websites and brokerage platforms.