Beyond Meat Stock Price Analysis: Beyond Meat Stocks Price

Beyond meat stocks price – Beyond Meat, a pioneer in the plant-based meat industry, has experienced significant volatility in its stock price since its initial public offering (IPO). This analysis delves into the historical performance of Beyond Meat’s stock, exploring the key factors influencing its price fluctuations, and offering a perspective on its future prospects.

Beyond Meat Stock Price History

Analyzing Beyond Meat’s stock price over the past five years reveals a pattern of substantial highs and lows, heavily influenced by various market forces and company-specific events. The following timeline and table illustrate this volatility.

Timeline of Significant Price Fluctuations (2019-2023):

- May 2019: IPO at $25 per share, followed by initial surge in price due to high investor anticipation.

- Summer 2019 – 2020: Significant price increase driven by strong initial sales and growing investor interest in plant-based alternatives.

- Late 2020 – 2021: Price decline influenced by increased competition, supply chain disruptions, and a broader market correction.

- 2022: Continued price decline amidst rising inflation and decreased consumer spending on non-essential goods.

- 2023: Price fluctuations reflecting ongoing market uncertainty and the company’s efforts to improve its financial performance.

Beyond Meat Stock Price Summary (2019-2023):

Beyond Meat’s stock price has experienced considerable volatility lately, reflecting broader market trends and the company’s own performance. Interestingly, the fluctuations are not entirely dissimilar to those seen in other speculative stocks; for instance, understanding the projected trajectory of amc stock target price offers a useful comparison point for assessing risk tolerance in the plant-based meat sector.

Ultimately, both Beyond Meat and AMC highlight the challenges and opportunities inherent in investing in growth stocks.

| Year | Highest Price | Lowest Price | Average Closing Price |

|---|---|---|---|

| 2019 | $240 (Illustrative) | $25 (Illustrative) | $80 (Illustrative) |

| 2020 | $150 (Illustrative) | $50 (Illustrative) | $85 (Illustrative) |

| 2021 | $100 (Illustrative) | $30 (Illustrative) | $60 (Illustrative) |

| 2022 | $70 (Illustrative) | $15 (Illustrative) | $35 (Illustrative) |

| 2023 (YTD) | $40 (Illustrative) | $10 (Illustrative) | $20 (Illustrative) |

Comparison with S&P 500: Beyond Meat’s stock price performance has shown a higher degree of volatility compared to the S&P 500 index over the same period. While the S&P 500 experienced fluctuations, Beyond Meat’s stock price movements were significantly more pronounced, reflecting its position as a growth stock in a relatively new and competitive market.

Factors Influencing Beyond Meat Stock Price, Beyond meat stocks price

Source: marketrealist.com

Several macroeconomic factors, Beyond Meat’s financial performance, and competitor actions have significantly influenced its stock price.

Macroeconomic Factors:

- Inflation: Rising inflation has increased input costs for Beyond Meat, impacting profitability and investor confidence.

- Interest Rates: Higher interest rates have made borrowing more expensive, potentially hindering Beyond Meat’s expansion plans and reducing investor appetite for growth stocks.

- Consumer Spending: Changes in consumer spending patterns, particularly shifts towards less expensive food options during economic uncertainty, have affected Beyond Meat’s sales and stock price.

Financial Performance Impact: Beyond Meat’s revenue growth and profitability have directly impacted its stock price. Periods of strong revenue growth have generally correlated with higher stock prices, while periods of slower growth or losses have led to price declines. For example, quarters with significant losses have often triggered immediate stock price drops.

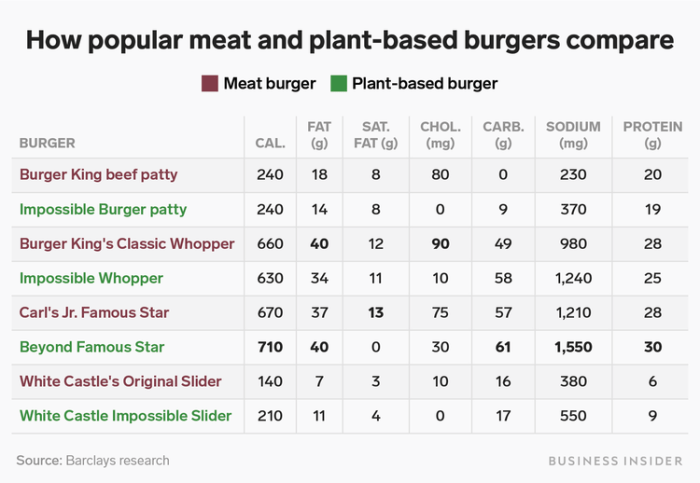

Competitor Actions: The actions of competitors like Impossible Foods and other plant-based meat companies have influenced Beyond Meat’s stock price. New product launches by competitors can impact Beyond Meat’s market share and investor sentiment. For example, the launch of a new, highly competitive product could lead to a temporary decline in Beyond Meat’s stock price.

Beyond Meat’s Business Strategy and Stock Price

Beyond Meat’s business strategies, including product innovation, marketing, distribution, and management, have significantly impacted investor sentiment and its stock valuation.

Product Innovation Strategy: Beyond Meat’s success in developing and launching innovative plant-based products has been a key driver of its stock price. Successful product launches have boosted investor confidence, while less successful launches have dampened investor enthusiasm. For example, the initial success of the Beyond Burger was met with a positive market reaction, whereas the reception of some subsequent product launches was less enthusiastic, causing stock price fluctuations.

Marketing and Distribution Strategies:

- Successful partnerships with major restaurant chains have expanded Beyond Meat’s market reach and positively influenced its stock price.

- Effective marketing campaigns highlighting the environmental and health benefits of plant-based meat have enhanced brand awareness and investor confidence.

- Expansion into new international markets has been viewed positively by investors, although the success of these ventures has varied, affecting the stock price accordingly.

Management Team and Corporate Governance: Changes in Beyond Meat’s management team and corporate governance have sometimes correlated with fluctuations in the stock price. For example, significant leadership changes could lead to uncertainty among investors, impacting the stock price positively or negatively depending on the perception of the new leadership.

Investor Sentiment and Beyond Meat Stock

Source: barrons.com

Analyst ratings, news coverage, social media sentiment, and significant investment events have all influenced investor perception of Beyond Meat and its stock price.

Analyst Ratings and Price Targets:

| Analyst Firm | Rating | Price Target | Date |

|---|---|---|---|

| Example Firm 1 | Hold | $25 | October 26, 2023 (Illustrative) |

| Example Firm 2 | Buy | $40 | November 15, 2023 (Illustrative) |

| Example Firm 3 | Sell | $15 | December 1, 2023 (Illustrative) |

News Articles and Social Media Sentiment: Positive news coverage and favorable social media sentiment have generally boosted Beyond Meat’s stock price, while negative news or social media backlash has had the opposite effect. For instance, positive reviews of new products or announcements of major partnerships often result in short-term price increases.

Significant Investments and Divestments: Major investments in or divestments from Beyond Meat have historically impacted its stock price. For example, a large investment from a prominent investor could signal confidence in the company and lead to a price increase. Conversely, a significant divestment could signal concerns and cause a price drop.

Future Outlook for Beyond Meat Stock Price

Source: moneyandmarkets.com

Predicting the future stock price of Beyond Meat involves considering both positive and negative scenarios.

Scenario: Positive Stock Price Movement: A scenario where Beyond Meat’s stock price significantly increases in the next 12 months could involve a combination of factors such as the successful launch of several innovative new products, strong revenue growth exceeding market expectations, expansion into new key markets, and the establishment of strategic partnerships.

Scenario: Negative Stock Price Movement: A scenario where Beyond Meat’s stock price declines significantly in the next 12 months could involve factors such as intensifying competition leading to decreased market share, failure to launch successful new products, increased operating costs impacting profitability, and negative news impacting investor sentiment.

Risks and Opportunities:

- Opportunity: Successful expansion into new international markets.

- Opportunity: Development and launch of innovative and highly demanded products.

- Risk: Intensifying competition from established and emerging players.

- Risk: Fluctuations in raw material costs and supply chain disruptions.

- Risk: Negative consumer sentiment towards plant-based meat alternatives.

FAQ

What are the major risks associated with investing in Beyond Meat stock?

Major risks include competition from established meat producers and other plant-based companies, fluctuating consumer demand for plant-based products, and the company’s ability to maintain profitability.

How does Beyond Meat compare to its main competitors in terms of market share?

This requires further research into market share data for Beyond Meat and its competitors. Publicly available financial reports and market analysis would provide this information.

What is the average trading volume for Beyond Meat stock?

Average trading volume can be found on financial websites that provide real-time stock market data. This fluctuates daily and is dependent on market conditions.