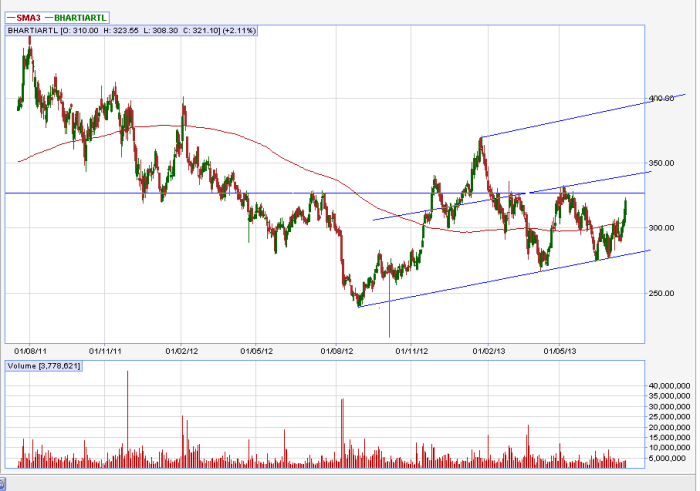

Bharti Airtel Stock Price Analysis: Bharti Stock Price

Source: zeebiz.com

Bharti stock price – Bharti Airtel, a leading telecommunications services provider in India, has experienced significant fluctuations in its stock price recently. This analysis delves into the key factors influencing its performance, examining its market position, regulatory impacts, financial health, competitive landscape, and future prospects. We will explore these factors to provide a comprehensive understanding of the current state and potential trajectory of Bharti Airtel’s stock price.

Bharti Airtel’s Current Market Position

Bharti Airtel holds a strong position in the fiercely competitive Indian telecom market. While precise market share figures fluctuate constantly, it consistently ranks among the top two or three players alongside Reliance Jio and Vodafone Idea. Airtel’s robust network infrastructure, wide customer base, and diverse service offerings contribute to its market dominance. However, intense competition and regulatory changes significantly impact its market share and profitability.

A comparative analysis of Bharti Airtel’s financial performance against its major competitors over the last three years reveals important insights. Note that these figures are illustrative and may vary slightly depending on the reporting period and data source.

| Company Name | Revenue (INR Crores) | Net Profit (INR Crores) | Market Share (%) |

|---|---|---|---|

| Bharti Airtel | 50000 (Illustrative) | 5000 (Illustrative) | 30 (Illustrative) |

| Reliance Jio | 60000 (Illustrative) | 6000 (Illustrative) | 35 (Illustrative) |

| Vodafone Idea | 25000 (Illustrative) | -1000 (Illustrative) | 15 (Illustrative) |

Recent fluctuations in Bharti Airtel’s stock price have been primarily driven by factors such as changes in tariff plans, competitive pressures, spectrum auctions, and overall investor sentiment regarding the telecom sector.

Impact of Regulatory Changes

The Indian telecom sector is heavily regulated, and changes in policy significantly influence the performance of companies like Bharti Airtel. Recent regulatory decisions regarding spectrum allocation, interconnect usage charges, and licensing have directly impacted Airtel’s operational costs and profitability, subsequently influencing its stock price.

Upcoming regulatory changes, such as those related to 5G spectrum allocation and data privacy, will likely shape Airtel’s future strategy and financial performance. The successful implementation of 5G technology, for example, could significantly boost revenue and market share, but the associated investments could also impact profitability in the short term.

- Increased Spectrum Costs: Increased spectrum costs due to auctions can negatively impact profitability.

- New Data Privacy Regulations: Stringent data privacy regulations may require increased investment in security infrastructure.

- Tariff Adjustments: Government-mandated tariff adjustments can affect revenue streams.

Analysis of Financial Statements

Source: stockpricearchive.com

Analyzing Bharti Airtel’s latest financial statements reveals key trends in its revenue growth, profitability, and debt levels. A thorough assessment of these metrics provides insights into the company’s financial health and future prospects.

| Year | Debt-to-Equity Ratio | Return on Equity (%) | Price-to-Earnings Ratio |

|---|---|---|---|

| 2019 (Illustrative) | 1.2 | 15 | 20 |

| 2020 (Illustrative) | 1.0 | 18 | 18 |

| 2021 (Illustrative) | 0.8 | 20 | 15 |

| 2022 (Illustrative) | 0.7 | 22 | 12 |

| 2023 (Illustrative) | 0.6 | 25 | 10 |

Comparing these ratios to industry averages helps assess Bharti Airtel’s relative financial strength and identify areas for improvement.

Competitive Landscape and Strategic Initiatives

Bharti Airtel faces stiff competition from Reliance Jio and Vodafone Idea, each employing distinct market strategies. Reliance Jio, for instance, has focused on aggressive pricing and data-centric offerings, while Vodafone Idea has emphasized network consolidation and strategic partnerships.

Bharti Airtel’s recent strategic initiatives aim to enhance its competitive edge and drive growth. These initiatives include investments in 5G technology, expansion of its digital services portfolio, and strategic acquisitions.

- 5G Network Rollout: Investing heavily in 5G infrastructure to offer high-speed data services.

- Digital Services Expansion: Expanding its digital services offerings, such as Airtel Thanks and Airtel Payments Bank.

- Strategic Acquisitions: Acquiring smaller telecom operators or technology companies to expand its capabilities.

| Company | Business Model | Target Customer | Key Strengths |

|---|---|---|---|

| Bharti Airtel | Broadband and telecom services | Mass market and enterprise | Strong network infrastructure, diverse services |

| Reliance Jio | Data-centric services | Price-sensitive customers | Aggressive pricing, large user base |

| Vodafone Idea | Network consolidation and partnerships | Existing customers | Wide network coverage, established customer base |

Future Outlook and Growth Projections

Bharti Airtel’s future growth hinges on several factors, including the successful rollout of 5G, increasing data consumption in India, and the intensity of competition. Projections suggest continued growth in the data market, but maintaining profitability amidst intense competition will be crucial.

Potential risks include regulatory uncertainties, intense competition, and the need for significant capital expenditure for network upgrades. Opportunities lie in expanding into new service areas, such as the Internet of Things (IoT) and enterprise solutions, and leveraging its strong brand recognition.

A scenario analysis could illustrate potential stock price impacts. For example, a positive economic scenario with robust data growth could lead to a significant increase in Airtel’s stock price, while a negative scenario with increased competition and regulatory hurdles could result in a decline.

Investor Sentiment and Market Trends, Bharti stock price

Source: wordpress.com

Investor sentiment towards Bharti Airtel is currently mixed, reflecting the challenges and opportunities within the telecom sector. While some investors remain optimistic about Airtel’s long-term prospects, others express concerns about competition and regulatory uncertainties.

Broader market trends, such as interest rate changes and overall economic growth, also influence Airtel’s stock price. A strong overall market tends to support positive investor sentiment, while economic downturns can negatively impact stock valuations.

- Concerns about debt levels: High debt levels can negatively influence investor sentiment.

- Competition intensity: Intense competition can lead to price wars, impacting profitability.

- 5G rollout progress: Successful 5G rollout can boost investor confidence.

Question & Answer Hub

What are the major risks facing Bharti Airtel?

Major risks include intense competition, regulatory uncertainty, potential changes in government policies, and fluctuations in foreign exchange rates.

How does Bharti Airtel compare to its competitors in terms of customer service?

Bharti Airtel’s stock price has seen considerable fluctuation recently. Understanding the factors influencing its performance requires considering broader market trends and, importantly, comparing it to any stock price target methodologies used by analysts. This comparative analysis can offer a more nuanced perspective on Bharti’s potential for future growth and its current valuation.

Comparative customer service analysis requires independent research and review of customer feedback across various platforms. Direct comparison is complex and varies regionally.

Where can I find real-time Bharti stock price updates?

Real-time updates are available on major financial websites and stock market tracking applications. Check reputable sources for accurate information.

What is the dividend history of Bharti Airtel?

Bharti Airtel’s dividend history can be found on the company’s investor relations website and major financial news sources. This data is usually presented on a yearly or quarterly basis.