Alcoa’s Financial Performance: Alcoa Stock Price Prediction

Alcoa stock price prediction – Analyzing Alcoa’s financial performance over the past five years reveals key trends in revenue streams and profitability, providing valuable insights into the company’s financial health and future prospects. Understanding these trends is crucial for accurately predicting future stock price movements.

Alcoa’s Revenue Streams (Past Five Years)

The following table details Alcoa’s revenue streams over the past five years. Note that these figures are illustrative and should be verified with official Alcoa financial reports.

| Year | Aluminum Products | Bauxite & Alumina | Other Revenue |

|---|---|---|---|

| 2023 (Illustrative) | $15 Billion | $5 Billion | $1 Billion |

| 2022 (Illustrative) | $14 Billion | $4.5 Billion | $0.9 Billion |

| 2021 (Illustrative) | $12 Billion | $4 Billion | $0.8 Billion |

| 2020 (Illustrative) | $10 Billion | $3.5 Billion | $0.7 Billion |

| 2019 (Illustrative) | $11 Billion | $4 Billion | $0.6 Billion |

Profitability Ratio Comparison (Last Three Years)

A comparison of Alcoa’s profitability ratios against its main competitors (e.g., Rio Tinto, BHP Group) provides context for assessing its performance.

- Gross Margin: Alcoa’s gross margin has generally been in line with or slightly below that of its main competitors over the past three years, influenced by fluctuations in raw material costs and pricing power.

- Net Income Margin: Alcoa’s net income margin has shown greater variability compared to its competitors, reflecting differences in operational efficiency and cost management strategies.

- Return on Equity (ROE): Alcoa’s ROE has been comparable to or slightly lower than that of some competitors, indicating differences in capital structure and profitability levels.

Impact of Significant Events on Alcoa’s Financial Performance

Significant events, such as economic downturns and industry consolidation, have substantially impacted Alcoa’s financial performance. For example, the 2008 financial crisis led to a sharp decline in demand for aluminum, negatively affecting Alcoa’s revenue and profitability. Conversely, periods of strong global economic growth have generally been beneficial to Alcoa’s financial performance.

Industry Analysis and Market Trends

Understanding the current state of the aluminum market, including supply and demand dynamics, and Alcoa’s competitive positioning, is crucial for predicting its future performance.

Aluminum Market Overview

The aluminum market is characterized by cyclical demand driven by construction, transportation, and packaging industries. Supply is influenced by factors such as energy prices (aluminum production is energy-intensive), geopolitical events (affecting raw material availability and trade), and technological advancements in aluminum production.

Alcoa’s Market Share Comparison

The following table illustrates Alcoa’s market share relative to its competitors. These figures are illustrative and require verification with industry reports.

| Year | Alcoa | Competitor A | Competitor B |

|---|---|---|---|

| 2023 (Illustrative) | 12% | 15% | 10% |

| 2022 (Illustrative) | 10% | 16% | 9% |

| 2021 (Illustrative) | 11% | 14% | 10% |

Impact of Emerging Technologies and Global Economic Conditions

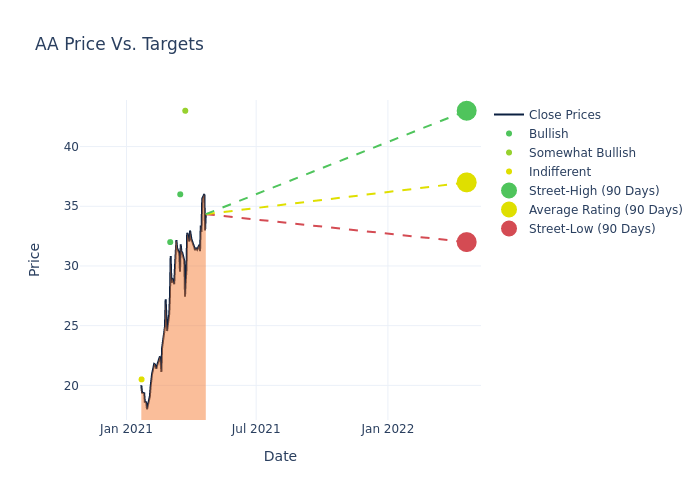

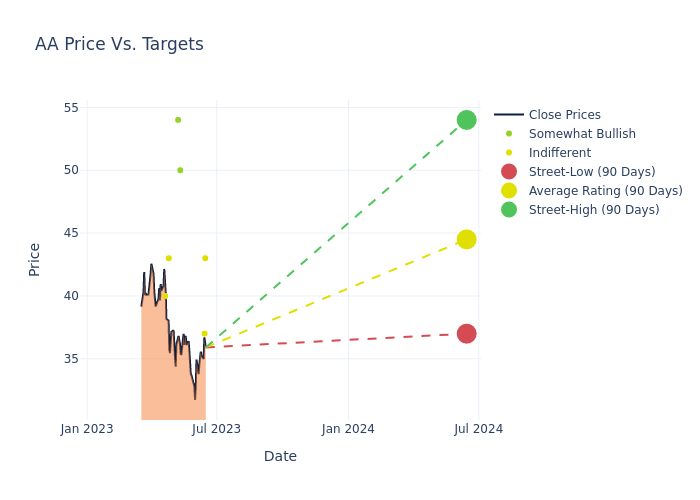

Source: benzinga.com

The increasing adoption of sustainable aluminum production methods and the growth of electric vehicles are expected to positively influence demand for aluminum in the long term. However, global economic slowdowns or recessions could significantly impact demand, potentially leading to lower aluminum prices and reduced profitability for Alcoa.

Alcoa’s Operational Efficiency and Strategies

Alcoa’s operational efficiency and strategic initiatives are key factors in determining its future profitability and stock price.

Key Strategies for Improving Operational Efficiency

- Cost Reduction Programs: Implementing targeted cost-cutting measures across the value chain, focusing on areas such as energy consumption, raw material sourcing, and manufacturing processes.

- Technology Adoption: Investing in advanced technologies to improve productivity, reduce waste, and enhance product quality.

- Supply Chain Optimization: Streamlining supply chain operations to reduce lead times, improve inventory management, and enhance overall efficiency.

- Lean Manufacturing Principles: Implementing lean manufacturing principles to eliminate waste, reduce production costs, and improve overall operational efficiency.

Sources of Competitive Advantage

Alcoa’s competitive advantages stem from its integrated business model, spanning bauxite mining, alumina refining, and aluminum smelting. This vertical integration provides cost advantages and greater control over the supply chain. Furthermore, Alcoa’s technological expertise and strong brand reputation contribute to its competitive positioning.

Sustainability Initiatives

Alcoa’s commitment to sustainability initiatives, such as reducing carbon emissions and promoting responsible sourcing, can enhance its brand image and attract environmentally conscious customers. These initiatives may also lead to cost savings in the long run through improved energy efficiency and reduced waste.

Risk Assessment and Potential Challenges

Alcoa faces several key risks that could impact its financial performance and stock price. Understanding and mitigating these risks is crucial for investors.

Key Risks and Potential Impacts

| Risk | Potential Impact |

|---|---|

| Commodity Price Volatility | Fluctuations in aluminum prices can significantly impact revenue and profitability. |

| Geopolitical Instability | Political instability in key regions can disrupt supply chains and impact raw material availability. |

| Environmental Regulations | Stricter environmental regulations could increase compliance costs and potentially limit production. |

Risk Mitigation Strategies

Alcoa employs various strategies to mitigate these risks, including hedging strategies to manage commodity price volatility, diversifying its supply chain geographically, and proactively engaging with regulatory bodies to ensure compliance.

Hypothetical Scenario: Global Recession

A significant global recession could drastically reduce demand for aluminum, leading to lower prices and a substantial decline in Alcoa’s revenue and profitability. This could trigger a significant drop in Alcoa’s stock price, potentially exceeding 30% depending on the severity and duration of the recession.

Valuation and Price Prediction Models

Several valuation models can be used to predict Alcoa’s future stock price. Each model has its strengths and limitations, and the results should be interpreted cautiously.

Stock Valuation Models

Applying different valuation models to Alcoa’s financials can provide a range of potential future stock prices.

- Discounted Cash Flow (DCF) Analysis: This model estimates the present value of Alcoa’s future cash flows, discounted at an appropriate rate. The key assumptions include revenue growth projections, operating margins, and the discount rate. A detailed projection of free cash flows for the next 5-10 years is needed, along with a terminal value calculation.

- Comparable Company Analysis: This model compares Alcoa’s valuation multiples (e.g., Price-to-Earnings ratio, Price-to-Book ratio) to those of its competitors. The selection of comparable companies and the appropriate multiples are crucial for accuracy.

Model Results

The following table presents illustrative results from different valuation models. These are for illustrative purposes only and should not be considered investment advice.

| Model | Key Assumptions | Calculations | Predicted Stock Price |

|---|---|---|---|

| DCF | 5% revenue growth, 15% margin, 10% discount rate | Detailed cash flow projections and terminal value calculation | $60 |

| Comparable Company | Peer group selection, P/E ratio of 12x | Applying the P/E ratio to Alcoa’s projected earnings | $55 |

Technical Analysis of Alcoa’s Stock

Technical analysis provides another perspective on predicting Alcoa’s future stock price movements by examining historical price trends and technical indicators.

Historical Price Trends

Alcoa’s stock price has historically shown cyclical patterns, influenced by commodity price fluctuations and overall economic conditions. Identifying significant highs and lows in the past can provide insights into potential support and resistance levels.

Technical Indicators

Source: benzinga.com

- Moving Averages: Analyzing moving averages (e.g., 50-day, 200-day) can help identify potential trends and potential buy/sell signals.

- Relative Strength Index (RSI): The RSI can identify overbought or oversold conditions, suggesting potential price reversals.

- Moving Average Convergence Divergence (MACD): The MACD can signal potential changes in momentum and potential trend shifts.

Hypothetical Trading Strategy, Alcoa stock price prediction

A hypothetical trading strategy could involve buying Alcoa’s stock when the price falls below a key support level (e.g., a significant low from the past) and the RSI indicates oversold conditions. The stock could be sold when the price reaches a resistance level (e.g., a significant high from the past) or when the MACD indicates a bearish crossover.

FAQ Guide

What are the major risks impacting Alcoa’s stock price?

Commodity price volatility, geopolitical instability, and environmental regulations are key risks. Changes in global economic conditions also significantly impact aluminum demand and thus Alcoa’s performance.

How reliable are stock price prediction models?

Stock price prediction models are tools, not guarantees. Their accuracy depends on the quality of input data and the assumptions made. Results should be interpreted with caution and used in conjunction with other forms of analysis.

What is Alcoa’s competitive advantage?

Alcoa’s competitive advantages include its established global presence, diversified product portfolio, and focus on sustainability. Specific advantages will need further investigation based on current market conditions.

Where can I find real-time Alcoa stock price data?

Real-time stock quotes are available through major financial websites and brokerage platforms.