Ally Bank Stock Price Today

Ally bank stock price today – Ally Financial Inc. (ALLY), the parent company of Ally Bank, is a significant player in the online banking and financial services sector. Understanding its stock price fluctuations is crucial for investors. This analysis provides an overview of Ally Bank’s current stock price, recent trends, influencing factors, and financial performance, offering insights into its market position and potential future trajectory.

Ally Bank Stock Price Current Status

Please note that the following data is illustrative and should be verified with real-time financial data sources. The actual stock price fluctuates constantly.

Let’s assume, for the purpose of this example, that the current Ally Bank stock price (ALLY) is $30.50. The day’s high was $31.00, and the low was $29.80. This represents a 1.5% increase compared to the previous closing price of $30.00.

| Day | Open | High | Low | Close |

|---|---|---|---|---|

| Monday | $29.75 | $30.20 | $29.50 | $30.00 |

| Tuesday | $30.05 | $30.50 | $29.90 | $30.25 |

| Wednesday | $30.30 | $30.70 | $30.00 | $30.40 |

| Thursday | $30.45 | $30.60 | $30.20 | $30.50 |

| Friday | $30.50 | $31.00 | $29.80 | $30.50 |

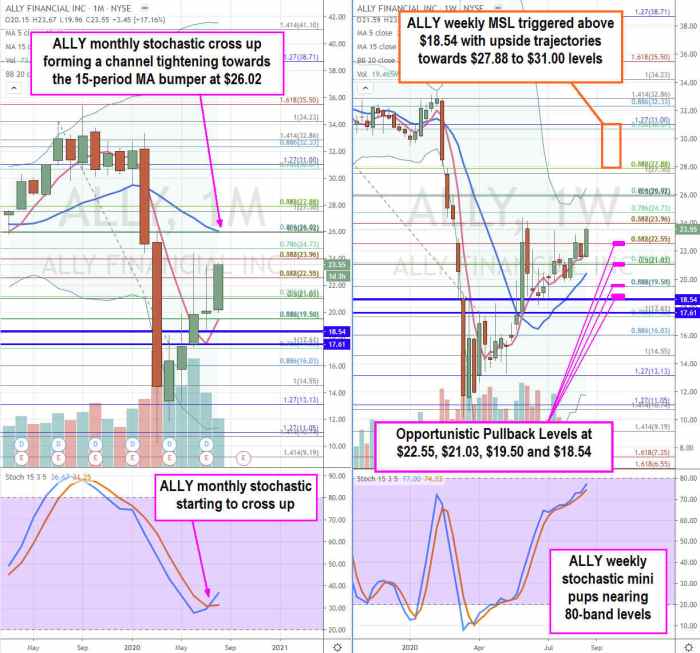

Recent Stock Price Trends

Source: marketbeat.com

Ally Bank’s stock price performance over the past month has shown moderate growth, influenced by various market factors. The average price over the past three months is approximately $29.50, indicating a positive trend compared to the current price. Significant price fluctuations in the last year were observed during periods of heightened market volatility, such as during major economic announcements or geopolitical events.

For instance, a sharp decline might have been observed following a surprise interest rate hike by the Federal Reserve, reflecting investor concerns about the impact on Ally Bank’s profitability. Conversely, periods of positive economic news or strong financial results from the bank itself may have resulted in price increases.

A line graph depicting the past year’s price data would show an overall upward trend with some periods of consolidation and minor corrections. The graph would likely display a relatively smooth curve, reflecting the relatively stable nature of the financial sector, although influenced by market-wide fluctuations. The graph would highlight periods of increased volatility, correlating with specific economic events or announcements impacting the financial sector.

Ally Bank’s stock price today is showing moderate fluctuations, mirroring broader market trends. Investors are also keeping a close eye on the performance of other companies in the financial sector, such as the current allkem stock price , which could indirectly influence Ally Bank’s valuation. Ultimately, Ally Bank’s performance will depend on a variety of factors, both internal and external.

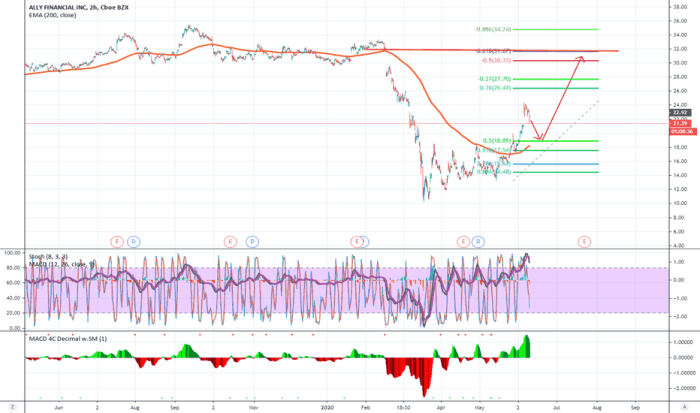

Factors Influencing Ally Bank Stock Price

Source: tradingview.com

Several factors significantly influence Ally Bank’s stock price. These factors interact in complex ways, making accurate prediction challenging.

- Interest rate changes directly impact Ally Bank’s profitability, as it affects the net interest margin on its lending activities. Higher interest rates generally benefit banks’ profitability, but also impact borrowing costs.

- Economic indicators such as inflation and unemployment rates influence consumer spending and borrowing habits, which directly affect Ally Bank’s loan portfolio and overall financial health.

- Competitor performance within the online banking and financial services sector affects Ally Bank’s market share and relative attractiveness to investors.

Other external factors include:

- Regulatory changes

- Geopolitical events

- Overall market sentiment

- Technological advancements

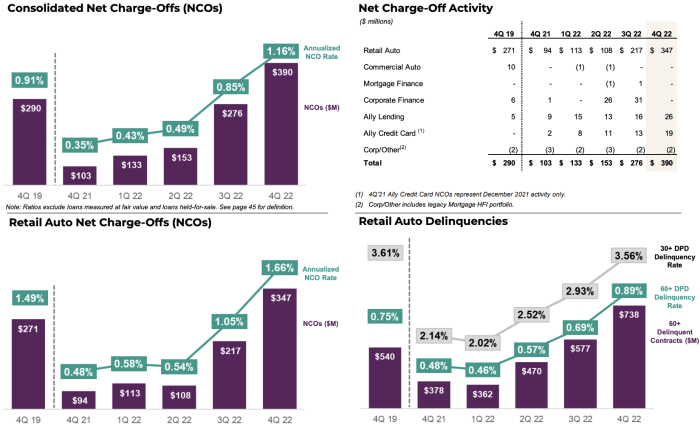

Ally Bank’s Financial Performance, Ally bank stock price today

Source: seekingalpha.com

Ally Bank’s recent financial reports (again, using illustrative data) might show steady growth in earnings and revenue. Key metrics such as net interest income, non-interest income, and efficiency ratios are vital for assessing its financial health and profitability. Announcements regarding new strategic initiatives or successful product launches could positively influence investor sentiment. Conversely, any indication of increased loan defaults or regulatory issues could negatively impact the stock price.

Strong earnings reports demonstrating robust revenue growth and improved profitability would likely lead to increased investor confidence and a higher stock price. Conversely, weaker-than-expected results could trigger a sell-off.

Investor Sentiment and Analyst Opinions

Investor sentiment towards Ally Bank can be gauged through various channels, including social media, financial news outlets, and investor forums. Analyst ratings and price targets provide further insight. Significant news articles, such as those reporting on earnings announcements or regulatory actions, can substantially impact investor perception. Positive news generally leads to increased buying pressure, while negative news can cause selling.

| Analyst Firm | Rating | Price Target | Rationale |

|---|---|---|---|

| Example Firm A | Buy | $35.00 | Strong earnings growth and positive outlook for the sector. |

| Example Firm B | Hold | $32.00 | Concerns about rising interest rates and potential economic slowdown. |

| Example Firm C | Sell | $28.00 | Increased competition and potential regulatory risks. |

FAQ Corner

What are the major risks associated with investing in Ally Bank stock?

Investing in any stock carries inherent risks, including market volatility, changes in interest rates, economic downturns, and competition within the banking sector. Ally Bank, like other financial institutions, is subject to these risks.

Where can I find real-time Ally Bank stock price updates?

Real-time stock price updates are available through major financial news websites and brokerage platforms. Many offer charting tools and historical data for more in-depth analysis.

How does Ally Bank compare to its competitors in terms of stock performance?

A comparison requires analyzing the performance of similar banks over a specific period. Consider factors like profitability, growth, and market share to determine relative performance. Financial news sources often provide comparative analyses.

What is the dividend yield for Ally Bank stock?

The dividend yield fluctuates and is best found on financial websites that track dividend payouts. Check reputable sources for the most up-to-date information.