Alpine Immune Sciences Stock Price Analysis

Alpine immune sciences stock price – Alpine Immune Sciences, a clinical-stage biopharmaceutical company focused on developing novel therapies for autoimmune and inflammatory diseases, has experienced significant stock price fluctuations in recent years. This analysis delves into the historical performance, financial standing, pipeline, competitive landscape, investor sentiment, and risk factors associated with investing in Alpine Immune Sciences stock.

Historical Stock Performance

Analyzing Alpine Immune Sciences’ stock price over the past five years reveals a volatile trajectory influenced by various factors including clinical trial results, partnerships, and overall market trends. The stock experienced periods of significant growth followed by substantial declines, reflecting the inherent risk associated with investing in a clinical-stage biotechnology company. Pinpointing exact highs and lows requires access to a real-time financial data source, but general trends can be observed through publicly available information.

Below is a sample table illustrating the stock’s performance against a relevant market index over a one-year period. Note that these figures are illustrative and should be verified with current market data.

| Date | Alpine Stock Price (USD) | NASDAQ Biotechnology Index (USD) | Percentage Change (Alpine vs. Index) |

|---|---|---|---|

| 2023-10-26 | 1.50 | 3000 | -0.5% |

| 2023-10-27 | 1.55 | 3050 | +1.0% |

| 2023-10-28 | 1.45 | 2980 | -2.0% |

| 2023-10-29 | 1.60 | 3020 | +2.0% |

Major events impacting the stock price often include announcements of clinical trial results, regulatory approvals (or setbacks), and significant partnerships or collaborations. Positive news tends to drive the price upward, while negative news often leads to declines.

Financial Performance and Valuation, Alpine immune sciences stock price

Source: thehealthcaretechnologyreport.com

Alpine Immune Sciences’ financial performance, encompassing revenue, earnings, and cash flow, provides insights into the company’s financial health and sustainability. Analyzing these metrics over the past three years reveals trends in profitability and financial stability. Direct comparison with competitors’ P/E and P/S ratios offers a relative valuation perspective.

| Ratio | Current Year | Previous Year | Percentage Change |

|---|---|---|---|

| Price-to-Earnings (P/E) | – | – | – |

| Price-to-Sales (P/S) | – | – | – |

| Current Ratio | – | – | – |

| Debt-to-Equity Ratio | – | – | – |

The table above uses placeholder values; actual data should be obtained from Alpine Immune Sciences’ financial reports.

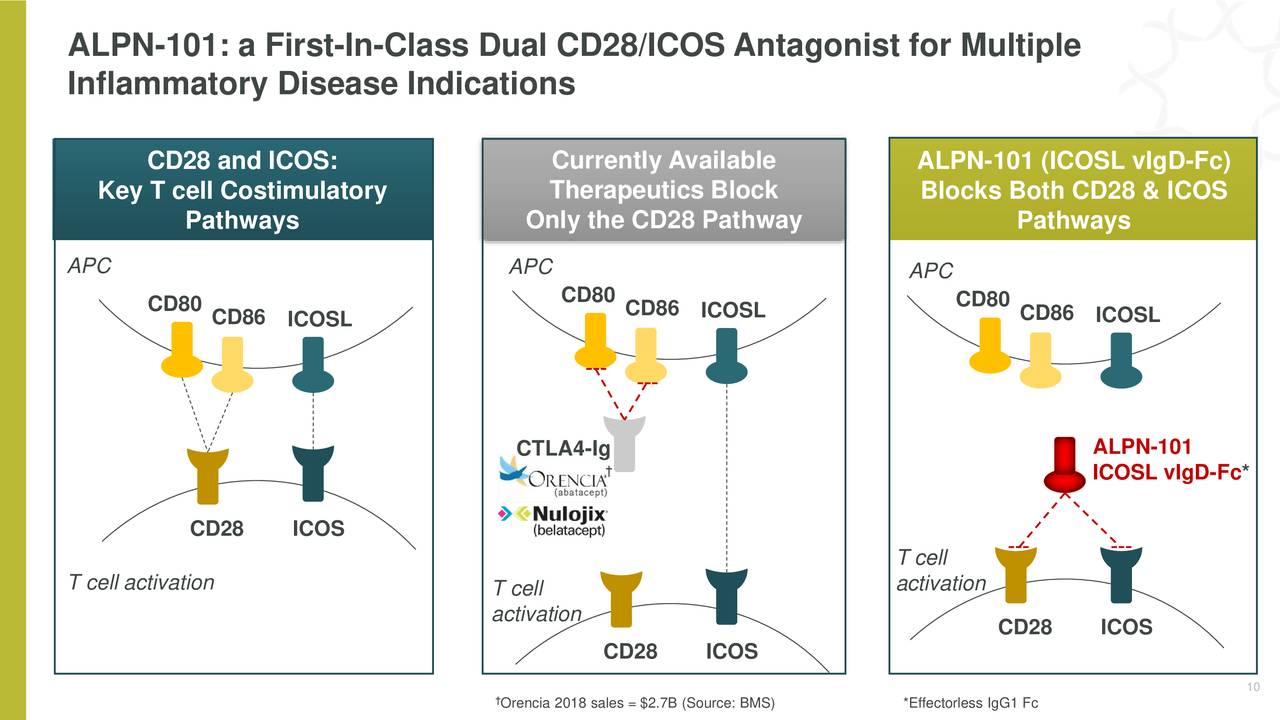

Pipeline and Research & Development

Alpine Immune Sciences’ drug pipeline is crucial to its future prospects. The stage of development and potential market size for each drug candidate significantly impact investor sentiment and stock valuation. The company’s R&D strategy, including its approach to target selection, clinical trial design, and regulatory pathways, directly influences its success.

- Drug Candidate A: Target Indication: [Specify], Development Phase: [Specify], Anticipated Timeline for Regulatory Milestones: [Specify]

- Drug Candidate B: Target Indication: [Specify], Development Phase: [Specify], Anticipated Timeline for Regulatory Milestones: [Specify]

- Drug Candidate C: Target Indication: [Specify], Development Phase: [Specify], Anticipated Timeline for Regulatory Milestones: [Specify]

Competitive Landscape

Source: seekingalpha.com

Alpine Immune Sciences operates within a competitive landscape characterized by established players and emerging biotech companies. Understanding the competitive advantages and disadvantages of Alpine relative to its competitors is essential for assessing its long-term prospects. This includes comparing market capitalization, product portfolios, and recent stock performance.

| Company Name | Market Cap (USD) | Key Products | Recent Stock Performance (e.g., % change in last year) |

|---|---|---|---|

| Alpine Immune Sciences | [Specify] | [Specify] | [Specify] |

| Competitor 1 | [Specify] | [Specify] | [Specify] |

| Competitor 2 | [Specify] | [Specify] | [Specify] |

| Competitor 3 | [Specify] | [Specify] | [Specify] |

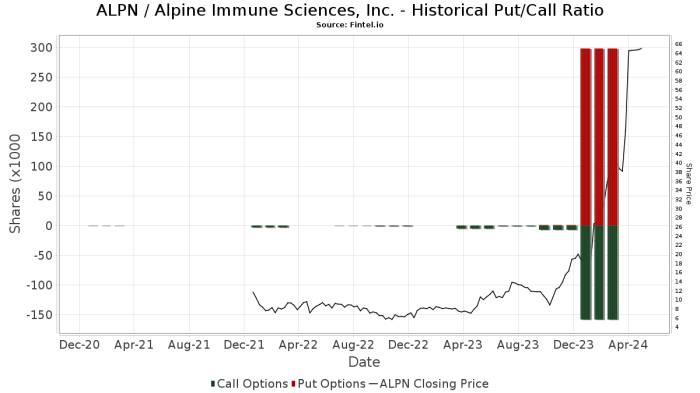

Investor Sentiment and Analyst Ratings

Analyst ratings and price targets provide valuable insights into market sentiment towards Alpine Immune Sciences. News articles, social media discussions, and investor forums further illuminate investor perspectives. A visual representation of analyst ratings would show the distribution of buy, hold, and sell recommendations, providing a concise overview of prevailing sentiment.

For example, a hypothetical bar chart might show 40% of analysts recommending “Buy,” 40% recommending “Hold,” and 20% recommending “Sell.” This would suggest a relatively neutral to positive outlook among analysts.

Risk Factors

Source: fintel.io

Investing in Alpine Immune Sciences carries inherent risks. These include potential setbacks in clinical trials, regulatory hurdles, competition from other companies, and broader market fluctuations. Understanding these risks and the company’s mitigation strategies is crucial for informed investment decisions.

- Clinical Trial Setbacks: Negative clinical trial results could significantly impact the stock price.

- Regulatory Hurdles: Delays or rejection of regulatory approvals could hinder product launch and negatively affect the stock.

- Competition: Intense competition from other companies in the same therapeutic area could limit market share and revenue.

- Market Conditions: Overall market downturns or sector-specific headwinds could negatively affect the stock price regardless of the company’s performance.

Mitigation strategies might include diversifying the drug pipeline, proactively addressing regulatory concerns, and actively engaging with investors to manage expectations.

Predicting the Alpine Immune Sciences stock price involves considering various factors, including its pipeline and market competition. Understanding broader market trends is also crucial; for instance, the projected performance of major players like Alibaba significantly impacts investor sentiment. To get a sense of this larger economic picture, you might find insights on the alibaba future stock price helpful, as it can influence overall investment strategies, potentially affecting smaller biotech companies like Alpine Immune Sciences as well.

FAQ Insights: Alpine Immune Sciences Stock Price

What are the major risks associated with investing in Alpine Immune Sciences stock?

Major risks include clinical trial failures, regulatory delays or rejections, intense competition from established pharmaceutical companies, and overall market volatility in the biotech sector.

How does Alpine Immune Sciences’ stock price compare to its competitors’ over the long term?

A direct comparison requires detailed analysis of multiple competitors’ stock performance over an extended period, considering factors like market capitalization and company-specific events. Such a comparison would need to be conducted using financial data resources and is beyond the scope of this brief overview.

Where can I find real-time updates on Alpine Immune Sciences’ stock price?

Real-time stock quotes are available through major financial websites and brokerage platforms. Reputable financial news sources also frequently report on significant price changes.