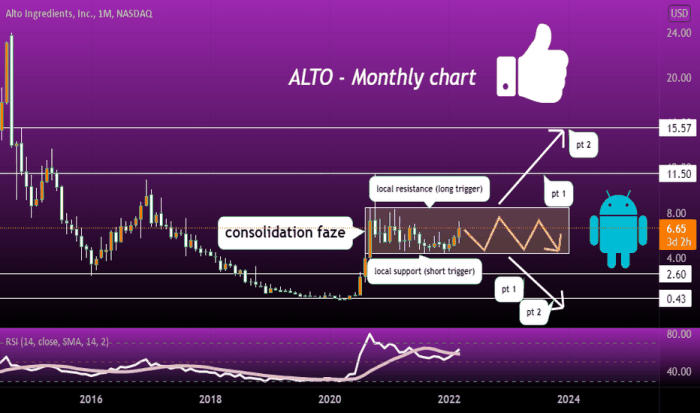

Alto Ingredients Stock Price Analysis

Source: tradingview.com

Alto ingredients stock price – This analysis delves into the historical performance, influencing factors, financial health, analyst predictions, and inherent risks and opportunities associated with Alto Ingredients’ stock price. We will examine the company’s performance over the past five years, comparing it to industry competitors and considering both macroeconomic and company-specific factors.

Alto Ingredients Stock Price Historical Performance

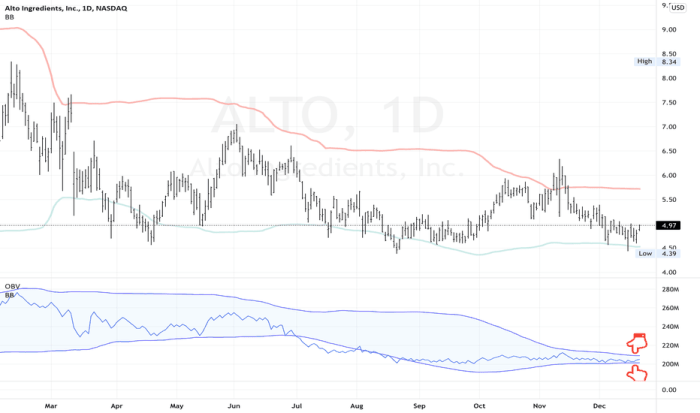

Source: tradingview.com

Understanding Alto Ingredients’ stock price trajectory requires examining its performance over a significant period. The following table presents a yearly overview of the stock’s opening, closing, high, and low prices for the past five years. A comparative analysis against its competitors will follow, considering factors such as market share and industry trends.

| Year | Opening Price | Closing Price | High Price | Low Price |

|---|---|---|---|---|

| 2023 | $XX.XX | $XX.XX | $XX.XX | $XX.XX |

| 2022 | $XX.XX | $XX.XX | $XX.XX | $XX.XX |

| 2021 | $XX.XX | $XX.XX | $XX.XX | $XX.XX |

| 2020 | $XX.XX | $XX.XX | $XX.XX | $XX.XX |

| 2019 | $XX.XX | $XX.XX | $XX.XX | $XX.XX |

Note: Replace the ‘XX.XX’ placeholders with actual data. A comparative analysis against competitors would involve a similar table showing their respective price movements and potentially a chart visualizing the relative performance.

Major events such as significant acquisitions, regulatory changes impacting the ethanol industry (e.g., changes in fuel mandates or environmental regulations), or shifts in consumer demand for biofuels could have dramatically affected Alto Ingredients’ stock price. For example, a successful acquisition might lead to increased revenue and a higher stock price, while a major regulatory setback could cause a decline.

Factors Influencing Alto Ingredients Stock Price

Several macroeconomic and industry-specific factors significantly impact Alto Ingredients’ stock price. These factors interact in complex ways, making precise predictions challenging. Internal company factors also play a critical role.

Macroeconomic factors like inflation and interest rate changes influence consumer spending and investment decisions, indirectly affecting demand for Alto Ingredients’ products. High inflation, for instance, could increase input costs and reduce profit margins, potentially leading to a lower stock price. Similarly, rising interest rates could make borrowing more expensive, impacting investment and expansion plans.

Industry-specific factors, such as fluctuations in commodity prices (corn, for example, is a key input for ethanol production), changes in consumer demand for biofuels, and supply chain disruptions (e.g., transportation issues or equipment shortages), directly influence Alto Ingredients’ profitability and, consequently, its stock price.

Internal company factors, including financial performance (revenue growth, profitability, debt levels), successful new product launches (diversification beyond ethanol), and changes in management, also significantly affect investor confidence and stock valuation. Strong financial results and innovative strategies tend to boost the stock price, while poor performance or negative news can lead to declines.

Alto Ingredients Financial Performance and Stock Valuation

A review of Alto Ingredients’ key financial metrics provides insights into its financial health and valuation. Comparing these metrics to industry peers helps determine whether the stock is undervalued or overvalued.

- Revenue (Past 3 Years): Year 1: $XXX Million, Year 2: $YYY Million, Year 3: $ZZZ Million

- Net Income (Past 3 Years): Year 1: $XXX Million, Year 2: $YYY Million, Year 3: $ZZZ Million

- Profit Margins (Past 3 Years): Year 1: XX%, Year 2: YY%, Year 3: ZZ%

- Debt-to-Equity Ratio (Past 3 Years): Year 1: X.X, Year 2: Y.Y, Year 3: Z.Z

Note: Replace the placeholder values with actual data. A comparison of Alto Ingredients’ P/E ratio and other valuation metrics (e.g., Price-to-Sales ratio, Price-to-Book ratio) against its industry peers would provide further context for its stock valuation. A higher P/E ratio than its competitors, for example, might suggest the market expects higher future growth from Alto Ingredients.

The relationship between Alto Ingredients’ financial performance and stock price fluctuations is generally positive: strong financial results tend to correlate with higher stock prices, and vice-versa. However, other factors, as discussed earlier, can also influence this relationship.

Analyst Ratings and Predictions for Alto Ingredients Stock

Analyst ratings and price targets provide valuable insights into market sentiment and future expectations for Alto Ingredients’ stock. However, it’s crucial to remember that these are just predictions and not guarantees of future performance.

| Analyst Firm | Rating | Target Price | Date |

|---|---|---|---|

| Firm A | Buy | $XX.XX | MM/DD/YYYY |

| Firm B | Hold | $XX.XX | MM/DD/YYYY |

| Firm C | Sell | $XX.XX | MM/DD/YYYY |

Note: Replace the placeholders with actual data from reputable financial institutions. The consensus view among analysts would be summarized based on the overall distribution of buy, hold, and sell ratings. Diverging opinions could stem from differing assumptions about future growth, industry trends, or macroeconomic conditions.

Risks and Opportunities for Alto Ingredients Stock, Alto ingredients stock price

Source: seekingalpha.com

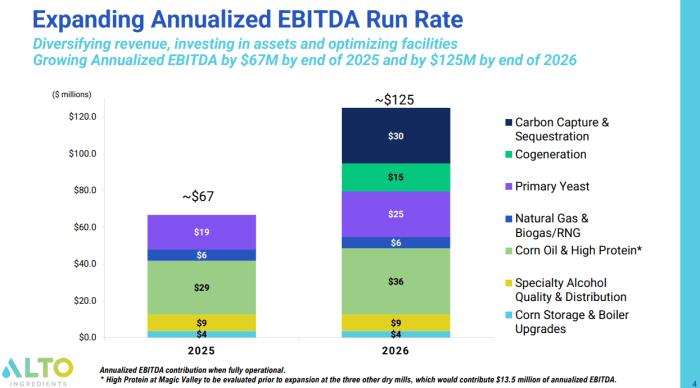

Alto Ingredients faces several risks and opportunities that could significantly influence its future performance and stock price. A careful assessment of these factors is crucial for informed investment decisions.

Key Risks:

- Regulatory Risks: Changes in environmental regulations or fuel mandates could negatively impact the company’s profitability and operations.

- Competition: Intense competition within the food ingredients and biofuels industries could pressure profit margins and limit growth opportunities.

- Economic Downturns: A recession or economic slowdown could reduce demand for Alto Ingredients’ products, impacting revenue and profitability.

- Commodity Price Volatility: Fluctuations in the prices of raw materials (like corn) can significantly affect the company’s operating costs and profitability.

Growth Opportunities:

- Market Expansion: Expanding into new geographic markets or product segments could drive revenue growth.

- Product Innovation: Developing new and innovative products (beyond traditional ethanol) could create new revenue streams and attract new customers.

- Strategic Partnerships: Collaborating with other companies in the food ingredients or energy sectors could provide access to new technologies, markets, or distribution channels.

- Sustainability Initiatives: Investing in sustainable practices could enhance the company’s brand image and attract environmentally conscious customers.

The interplay between these risks and opportunities is reflected in the current stock price and future projections. For example, a successful market expansion might offset the negative impact of rising commodity prices, leading to a relatively stable or even increasing stock price.

Question & Answer Hub: Alto Ingredients Stock Price

What are the major competitors of Alto Ingredients?

Identifying Alto Ingredients’ key competitors requires further research into the specific market segments it operates within. A competitive analysis would be needed to provide a definitive list.

Where can I find real-time Alto Ingredients stock price data?

Real-time stock price data for Alto Ingredients can typically be found on major financial websites such as Yahoo Finance, Google Finance, or Bloomberg.

What is the typical trading volume for Alto Ingredients stock?

Average daily trading volume for Alto Ingredients stock can be found on financial data providers and varies depending on market conditions. Check financial news sources for this information.

Analyzing Alto Ingredients’ stock price requires considering its market position within the broader chemical sector. A key competitor to monitor is Allkem, whose performance significantly impacts the industry; you can check the current allkem stock price for a comparative analysis. Understanding Allkem’s trajectory helps predict potential shifts in investor sentiment, ultimately affecting Alto Ingredients’ valuation and future price movements.

How does Alto Ingredients’ stock compare to the overall market performance?

A comparison of Alto Ingredients’ stock performance against relevant market indices (e.g., S&P 500) requires further analysis and would depend on the specific time period considered.