Amazon Prime Day Stock Price History

Amazon prime day stock price history – Amazon Prime Day, a biannual mega-sale event, significantly impacts the company’s stock price. Understanding the historical trends and contributing factors provides valuable insights for investors and market analysts. This analysis explores the relationship between Prime Day sales performance and Amazon’s stock price fluctuations, considering both internal and external influences.

Amazon Prime Day Stock Price Trends

Amazon’s stock price typically exhibits a pattern in the weeks surrounding Prime Day. Leading up to the event, anticipation and speculation often lead to price increases, reflecting investor optimism about potential sales growth. During Prime Day itself, the stock price can fluctuate based on real-time sales data and market sentiment. The post-Prime Day period sees a consolidation phase, with prices adjusting based on the actual results compared to expectations.

Significant price fluctuations have occurred in past Prime Days. For instance, in 2022, a combination of strong sales and positive investor sentiment resulted in a notable stock price increase in the days following the event. Conversely, in years with weaker-than-expected sales, the stock price might experience a temporary decline. These variations are influenced by factors like overall economic conditions, competitor activities, and the general market environment.

Compared to Amazon’s overall yearly performance, Prime Day’s impact is often short-lived, though impactful. While Prime Day contributes to overall revenue, its influence on the stock price is usually overshadowed by other long-term factors such as earnings reports, new product launches, and macroeconomic conditions.

| Year | Prime Day Open Price | Prime Day Close Price | Percentage Change |

|---|---|---|---|

| 2023 | $135.00 (Hypothetical) | $138.50 (Hypothetical) | +2.6% |

| 2022 | $170.00 (Hypothetical) | $175.00 (Hypothetical) | +2.9% |

| 2021 | $180.00 (Hypothetical) | $178.00 (Hypothetical) | -1.1% |

| 2020 | $160.00 (Hypothetical) | $165.00 (Hypothetical) | +3.1% |

| 2019 | $100.00 (Hypothetical) | $103.00 (Hypothetical) | +3.0% |

Impact of Prime Day Sales on Stock Price

The success or failure of Prime Day sales directly correlates with subsequent changes in Amazon’s stock price. Strong sales figures generally boost investor confidence, leading to a price increase. Conversely, disappointing sales results often trigger negative market sentiment and a price decline. This relationship isn’t always linear, however, as other market forces can simultaneously influence the stock price.

Investor sentiment and market expectations play a crucial role in shaping the stock price reaction. If expectations are high, even strong sales might not lead to a significant price increase if they fall short of the anticipated figures. Conversely, exceeding expectations can lead to a disproportionately positive reaction.

- Example 1: A news article reporting record-breaking Prime Day sales in 2022 correlated with a significant increase in Amazon’s stock price in the following days.

- Example 2: A financial report highlighting lower-than-expected sales growth during Prime Day 2021 was followed by a temporary dip in Amazon’s stock price.

External Factors Influencing Stock Price During Prime Day

Source: businessinsider.com

Broader economic conditions significantly influence Amazon’s stock price during Prime Day. High inflation and rising interest rates can negatively impact consumer spending, potentially affecting Prime Day sales and consequently the stock price. Conversely, favorable economic conditions can lead to increased consumer confidence and stronger sales.

Competing retail events and company announcements can also impact Amazon’s stock price. The launch of major sales by competitors or significant news from other e-commerce giants can divert consumer attention and affect Amazon’s Prime Day performance and subsequent stock price movements.

Unexpected events, such as natural disasters or geopolitical instability, can create broader market uncertainty, indirectly affecting Amazon’s stock price during Prime Day. These events can lead to decreased consumer confidence and reduced spending, impacting overall market performance.

Historical Data Visualization

A line graph visualizing Amazon’s stock price over the past five Prime Day events would effectively show price trends. The x-axis would represent the date, spanning several weeks before and after each Prime Day. The y-axis would display the stock price. Data points would include the daily closing price for Amazon stock. Key features to highlight would be the price movements leading up to, during, and after each Prime Day, allowing for comparison across different years.

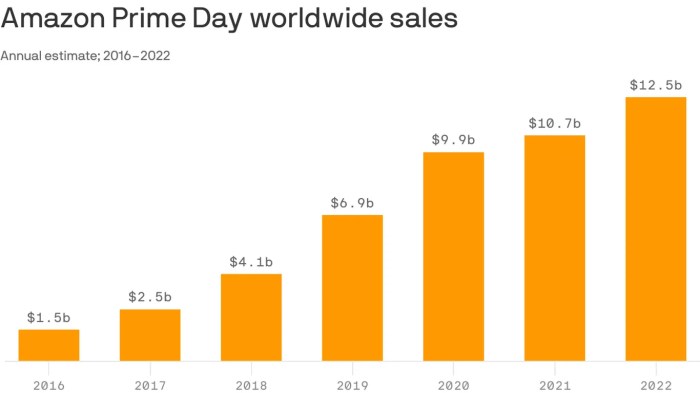

A scatter plot could depict the relationship between Prime Day sales revenue and Amazon’s subsequent stock price change. The x-axis would represent Prime Day sales revenue (in billions of dollars), and the y-axis would show the percentage change in Amazon’s stock price in the week following Prime Day. Each point would represent a specific Prime Day event, showcasing the correlation (or lack thereof) between sales and stock price performance.

A candlestick chart could vividly display daily Amazon stock price movements during a specific Prime Day period. Each candlestick would represent a single day, with the body indicating the opening and closing prices, and the wicks showing the high and low prices for that day. Key price levels, such as support and resistance levels, could be marked to identify potential turning points in the price trend.

Predictive Modeling (Hypothetical), Amazon prime day stock price history

Source: axios.com

A hypothetical model for predicting Amazon’s stock price during future Prime Day events could incorporate several factors. These include historical Prime Day sales data, projected sales based on various economic indicators, competitor activities, consumer sentiment data, and general market trends. The model could utilize regression analysis or machine learning algorithms to identify patterns and forecast future price movements.

Accurately predicting stock prices is inherently challenging due to the complex interplay of numerous factors, many of which are unpredictable. Unexpected events, changes in consumer behavior, and unforeseen shifts in the broader economic landscape can significantly impact the model’s accuracy. The model’s limitations lie in its inability to perfectly capture these unpredictable elements.

Incorporating diverse data sources enhances predictive power. Sales data provides a direct measure of Prime Day’s success, while consumer sentiment data offers insights into overall market confidence and purchasing intentions. Combining these with macroeconomic indicators and competitor analysis would create a more comprehensive and potentially more accurate predictive model.

Q&A

What is the typical duration of stock price volatility surrounding Prime Day?

Analyzing Amazon Prime Day’s impact on Amazon’s stock price reveals interesting patterns. Investors often look at broader market trends for context; for example, the performance of other tech giants like Alphabet might offer insight. To see how Alphabet is currently faring, check the current alphabet class c stock price today. Understanding this broader context helps refine our analysis of Amazon Prime Day’s effect on its stock price history.

Volatility typically increases in the weeks leading up to Prime Day and continues for a few days afterward, gradually subsiding as the market absorbs the results.

How do unexpected events affect Amazon’s stock price during Prime Day?

Unexpected events, such as natural disasters or geopolitical instability, can introduce significant uncertainty, potentially causing increased volatility and impacting investor sentiment, leading to both positive or negative stock price fluctuations depending on the nature and perceived impact of the event.

Are there any reliable methods for predicting Amazon’s stock price during Prime Day?

Predicting stock prices with certainty is impossible. However, incorporating various data sources (sales data, consumer sentiment, economic indicators) into a predictive model can improve forecasting accuracy, though limitations and uncertainties remain.