AMC Stock Pre-Market Price Volatility

Amc stock pre market price – AMC Entertainment Holdings Inc. (AMC) stock, known for its dramatic price swings, exhibits significant volatility even during pre-market trading hours. Understanding the factors driving these fluctuations is crucial for investors seeking to navigate the complexities of this volatile stock.

Factors Contributing to Pre-Market Price Fluctuations

Source: surferseo.art

Several factors contribute to AMC’s pre-market price volatility. These include news announcements (both company-specific and broader market news), social media sentiment, algorithm-driven trading, and the relatively low liquidity compared to regular trading hours. The pre-market period often sees a concentration of large institutional trades which can significantly impact price discovery.

Historical Pre-Market Price Behavior

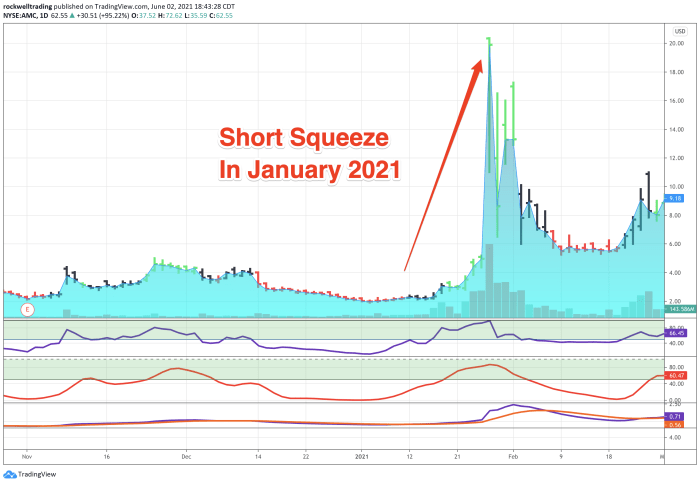

Historically, AMC’s pre-market price has shown a tendency to mirror, though often with amplified swings, the overall market sentiment. Periods of positive news or strong overall market performance usually lead to higher pre-market prices, while negative news or bearish market conditions often result in significant declines. Significant trends include heightened volatility around earnings announcements and periods of significant social media activity concerning the stock.

Comparison with Similar Stocks

Source: marketbeat.com

Comparing AMC’s pre-market volatility to other entertainment sector stocks provides valuable context. While direct comparison requires detailed intraday data, generally, AMC exhibits higher volatility than more established and less meme-stock influenced companies.

| Stock | Daily Pre-Market High | Daily Pre-Market Low | Daily Pre-Market Volume |

|---|---|---|---|

| AMC | Example: $15.50 | Example: $14.00 | Example: 500,000 |

| Example Stock 1 (e.g., Cinemark) | Example: $20.25 | Example: $19.75 | Example: 200,000 |

| Example Stock 2 (e.g., Regal Cinemas) | Example: $18.00 | Example: $17.50 | Example: 150,000 |

| Example Stock 3 (e.g., Disney) | Example: $105.00 | Example: $102.00 | Example: 750,000 |

News Impact on Pre-Market Price

News events significantly influence AMC’s pre-market price. The speed and reach of modern communication mean that information, both accurate and inaccurate, rapidly impacts trading decisions.

Recent News Events and Their Impact

- Example: Positive earnings report leading to a surge in pre-market price.

- Example: Negative analyst rating causing a pre-market decline.

- Example: A significant market-wide event impacting all stocks, including AMC, during pre-market hours.

Mechanism of News Impact

News affects pre-market trading through several channels. Algorithmic trading systems react instantly to news headlines, triggering buy or sell orders. Individual investors, informed by news reports, also adjust their trading strategies accordingly. This creates a ripple effect, amplifying the initial price movement.

Role of Social Media Sentiment

- Social media platforms, especially platforms like Reddit and Twitter, significantly influence AMC’s price. Positive sentiment can drive up the price, while negative sentiment can lead to sell-offs.

- The speed of information dissemination on social media exacerbates pre-market volatility, as traders react quickly to trending topics and opinions.

- The amplification of both positive and negative sentiment can create self-fulfilling prophecies, where initial price movements driven by social media sentiment further influence subsequent trading activity.

Pre-Market Trading Volume and Liquidity: Amc Stock Pre Market Price

Understanding AMC’s pre-market trading volume and liquidity is crucial for assessing the reliability of price signals during this period. The lower volume and liquidity compared to regular trading hours mean that price movements can be more extreme and less reflective of the overall market.

Typical Trading Volume

AMC’s pre-market trading volume is typically lower than its regular trading volume. This lower volume makes the stock more susceptible to manipulation by large traders or significant news events.

Comparison of Pre-Market and Regular Market Liquidity

Pre-market liquidity is considerably lower than during regular trading hours. This means that even small orders can have a disproportionately large impact on the price. This low liquidity makes it harder to buy or sell large quantities of shares without significantly impacting the price.

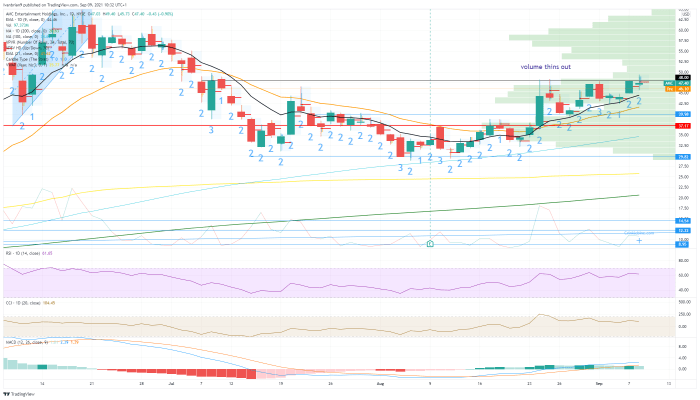

Relationship Between Pre-Market Volume and Subsequent Price Movements

Source: fxstreet.com

A chart illustrating this relationship would have pre-market trading volume on the x-axis and the percentage change in price from the pre-market close to the regular market close on the y-axis. Data points would represent individual trading days. A positive correlation would suggest that higher pre-market volume generally leads to more significant price changes during regular trading. The visual representation could be a scatter plot, with a trendline to show the overall correlation.

Relationship Between Pre-Market and Regular Market Prices

AMC’s pre-market price doesn’t always accurately predict its opening price. Various factors can cause divergences between the two.

Instances of Significant Divergence

There have been numerous instances where AMC’s pre-market price moved significantly differently from its opening price. For example, a strong pre-market gain might be reversed at the open due to profit-taking or a change in overall market sentiment.

Reasons Behind Divergences, Amc stock pre market price

Several factors contribute to these divergences. The increased liquidity and participation of a broader range of investors during regular trading hours often lead to price corrections. News that emerges after the pre-market close but before the regular market open can also cause significant shifts.

Predictability of Regular Market Price Based on Pre-Market Performance

- Overall market sentiment

- News events released after the pre-market close

- Order flow during the regular market opening

- Institutional investor activity

Impact of Institutional Investors

Institutional investors play a significant role in shaping AMC’s pre-market price. Their large trading volumes can influence price discovery and overall market sentiment.

AMC’s pre-market price action is often a key indicator for the day’s trading, reflecting investor sentiment. It’s interesting to compare this volatility to other sectors; for instance, observing the performance of utilities like Algonquin Power, whose stock price you can check here: algonquin power stock price , provides a contrasting perspective. Ultimately, understanding the interplay between these different sectors helps to better predict AMC’s overall market behavior.

Major Institutional Investors and Their Influence

Identifying specific major institutional investors and their exact holdings is challenging due to reporting lags and complexities in public data. However, it’s understood that significant institutional participation exists, and their actions can create substantial pre-market price movements.

Effect of Large Institutional Trades

Large institutional trades can significantly impact pre-market price discovery, especially given the relatively low liquidity during this period. A large buy order, for instance, can push the price up significantly, while a large sell order can have the opposite effect.

Comparison of Trading Patterns

- Institutional investors may be more active in the pre-market to execute large trades before the market opens, minimizing price impact.

- Their trading strategies may differ between pre-market and regular market hours, influenced by factors like risk tolerance and liquidity considerations.

- Pre-market trades may reflect more anticipatory actions based on information asymmetry or upcoming news events.

Technical Analysis of Pre-Market Price

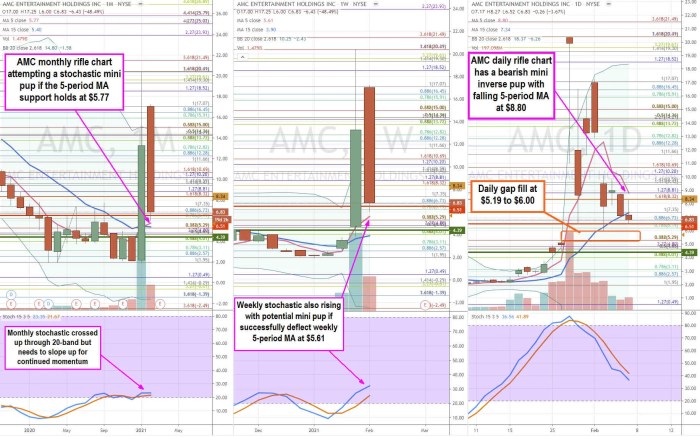

Technical analysis can be applied to AMC’s pre-market price movements, although the lower volume and liquidity should be considered.

Common Technical Indicators

Indicators such as moving averages, relative strength index (RSI), and volume analysis can be used, but their interpretation needs to account for the limited data and heightened volatility of the pre-market. Support and resistance levels identified during regular trading hours might provide some guidance, but their relevance in the pre-market is less certain.

Application of Indicators for Short-Term Price Prediction

For example, a bullish crossover of a short-term moving average over a long-term moving average during the pre-market might suggest a potential price increase. However, this signal should be viewed with caution, considering the low liquidity and potential for reversals.

Hypothetical Scenario Illustrating Contrasting Predictions

Imagine a scenario where the RSI is oversold, suggesting a potential bounce, but the volume is extremely low. One analyst might interpret this as a potential short-term buying opportunity, while another might view the low volume as a sign of weakness and predict further decline. This highlights the inherent uncertainty and limitations of technical analysis in the pre-market.

Questions Often Asked

What time does AMC’s pre-market trading typically begin and end?

Pre-market trading for AMC typically begins around 4:00 AM ET and ends at 9:30 AM ET, aligning with the regular market opening.

Are pre-market price movements always indicative of the regular market’s direction?

No, while pre-market activity can offer clues, it’s not a guaranteed predictor of regular market price movements. Other factors influencing the regular market can outweigh pre-market trends.

How does the liquidity of AMC’s pre-market compare to after-hours trading?

Generally, liquidity is lower during pre-market and after-hours sessions compared to regular trading hours. This means price swings can be more pronounced due to lower trading volume.

What are some common risks associated with pre-market trading?

Risks include increased volatility due to lower liquidity, the potential for inaccurate or delayed information, and the possibility of significant price gaps between the pre-market close and the regular market open.