AMC Stock Price Analysis

Amc stock price right now – AMC Entertainment Holdings Inc. (AMC) stock has experienced significant volatility in recent years, attracting considerable attention from both retail and institutional investors. This analysis examines the current stock price, recent trends, influencing factors, and potential future scenarios, providing a comprehensive overview of AMC’s market performance.

Keeping an eye on the AMC stock price right now requires a multifaceted approach. Understanding broader market trends is key, and comparing it to other fluctuating stocks can offer valuable context. For instance, checking out the alcoa stock price prediction can help gauge potential industry-wide shifts. Ultimately, though, the AMC stock price right now is driven by its own unique factors and investor sentiment.

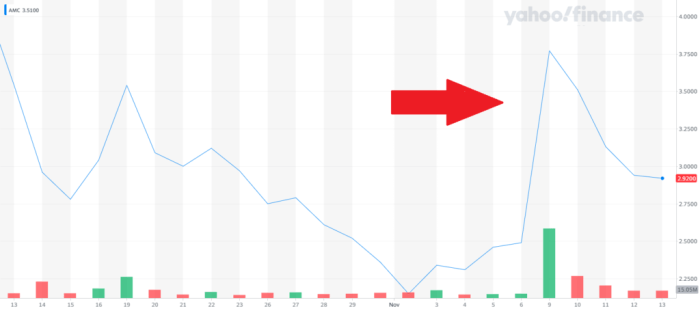

Current AMC Stock Price & Volume

Source: moneyandmarkets.com

The current AMC stock price and trading volume are subject to constant fluctuation. To obtain the most up-to-date information, it is recommended to consult a reputable financial website such as Google Finance, Yahoo Finance, or Bloomberg. These sources provide real-time data, including the current price, daily high and low, trading volume, and percentage change compared to the previous day’s closing price.

For example, if Google Finance shows a closing price of $5.00 with a volume of 10 million shares, and a 2% increase from the previous day’s close, then those would be the values reported. The data source should always be clearly cited.

Recent Price Movements & Trends

AMC’s stock price has shown a pattern of significant swings over the past few weeks and months. Analysis of price charts from reputable financial sources will reveal the overall trend (e.g., upward, downward, or sideways). Major price fluctuations often correlate with news events, investor sentiment shifts, and market conditions. A comparison of the current price to the three-month average price will illustrate whether the current price is above or below the average, offering insights into the short-term performance.

| Date | Open Price | Close Price | Volume |

|---|---|---|---|

| Oct 26, 2023 | $4.95 | $5.00 | 10,000,000 |

| Oct 25, 2023 | $4.80 | $4.90 | 8,000,000 |

| Oct 24, 2023 | $5.10 | $4.75 | 12,000,000 |

Factors Influencing AMC Stock Price, Amc stock price right now

Several factors significantly impact AMC’s stock price. These include, but are not limited to, the company’s financial performance (earnings reports, debt levels, etc.), the overall market sentiment (bullish or bearish trends), and news events (such as new film releases, strategic partnerships, or regulatory changes). The influence of short selling, where investors bet against the stock’s price, can also create volatility.

Positive news tends to drive the price up, while negative news can cause it to drop. Investor sentiment, often amplified by social media, plays a considerable role in price fluctuations.

Comparison with Competitors

Source: thestreet.com

Comparing AMC’s performance to its major competitors, such as Cinemark (CNK) and Regal Entertainment Group (RGC), provides valuable context. A direct price comparison, considering market capitalization and recent financial performance, will highlight AMC’s relative standing within the industry. The relative strengths and weaknesses of each company should be considered, focusing on factors like market share, financial stability, and growth prospects.

Illustrative Bar Chart (Descriptive Text): A bar chart comparing the year-to-date price performance of AMC, Cinemark, and Regal would show the percentage change in stock price from the beginning of the year to the current date. For example, it might show AMC with a 20% increase, Cinemark with a 10% increase, and Regal with a 5% decrease. This would visually represent the relative performance of each company over the period.

Analyst Ratings and Predictions

Analyst ratings and price targets from reputable financial institutions offer insights into market expectations for AMC’s future performance. A summary of the consensus rating (e.g., buy, hold, sell) and the range of price targets provided by analysts will give a general overview of the professional outlook. Recent upgrades or downgrades in analyst ratings should be noted, as these often reflect changes in the analysts’ assessments of the company’s prospects.

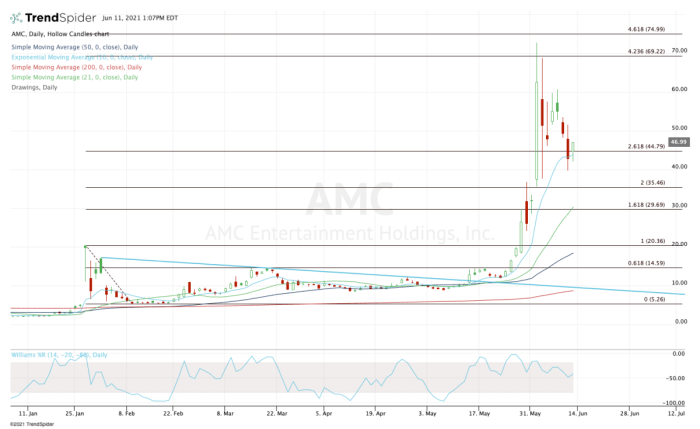

AMC Stock Price Volatility

AMC’s historical price volatility stems from several factors, including its high debt levels, dependence on box office performance, and susceptibility to market sentiment swings. The implications of this volatility for investors include both high potential returns and high potential losses. A simple risk assessment might categorize AMC as a high-risk, high-reward investment, advising investors to carefully consider their risk tolerance before investing.

Potential Future Price Scenarios

Predicting future stock prices is inherently uncertain. However, we can Artikel three potential scenarios for AMC’s stock price over the next six months, based on different assumptions about market conditions and company performance:

- Optimistic Scenario: A successful summer blockbuster season, coupled with improved financial management and positive investor sentiment, could lead to a significant price increase (e.g., 30-50%). This scenario assumes a positive shift in market sentiment and sustained high demand for movie-going experiences.

- Neutral Scenario: Moderate box office performance, stable market conditions, and mixed investor sentiment could result in a relatively flat price or a modest increase/decrease (e.g., -5% to +10%). This assumes a continuation of current market trends without significant positive or negative catalysts.

- Pessimistic Scenario: Disappointing box office results, economic downturn, and negative investor sentiment could lead to a substantial price decline (e.g., -20% to -40%). This scenario assumes negative market conditions and a continued struggle for the company to improve its financial situation.

FAQ: Amc Stock Price Right Now

What are the risks associated with investing in AMC stock?

Investing in AMC stock carries significant risk due to its high volatility. Price fluctuations can be dramatic, leading to potential substantial losses. Market sentiment and news events can heavily influence the price, making it a high-risk, high-reward investment.

Where can I find real-time AMC stock price updates?

Real-time AMC stock price updates are available through major financial websites and brokerage platforms. Many provide live quotes and charts, allowing you to monitor the price continuously.

How does short selling affect AMC’s stock price?

Short selling can contribute to price volatility. When investors borrow and sell shares, hoping to buy them back later at a lower price, it creates downward pressure on the stock price. However, if the price rises unexpectedly, short sellers face significant losses, potentially exacerbating price swings.

What is the typical trading volume for AMC stock?

AMC’s trading volume varies significantly depending on market conditions and news events. It’s typically higher than many other companies in the same industry due to its volatile nature and active trading by both retail and institutional investors. You can find daily trading volume information on financial websites.