American States Water Company Stock Price: A Comprehensive Analysis

American states water company stock price – American States Water Company (AWR) operates within the essential utilities sector, providing water and wastewater services. This analysis delves into the company’s history, financial performance, competitive landscape, and future prospects, offering insights into its stock price trajectory.

Company Overview

American States Water Company, founded in 1929, has a long history of providing water and wastewater services. Its current business model centers on regulated water and wastewater utility operations, primarily in California. The company serves residential, commercial, and industrial customers. Key subsidiaries contribute significantly to overall revenue; for instance, Golden State Water Company is a major contributor, responsible for a large portion of the company’s water service operations in California.

Further details on other subsidiaries and their specific revenue contributions are not publicly available in sufficient detail for this analysis.

| Year | Revenue (USD Millions) | Net Income (USD Millions) | Earnings Per Share (USD) |

|---|---|---|---|

| 2022 | * | * | * |

| 2021 | * | * | * |

| 2020 | * | * | * |

| 2019 | * | * | * |

| 2018 | * | * | * |

*Note: Specific financial data requires access to company filings and financial databases. This table is a template for illustrative purposes only.

Stock Performance Analysis

Source: seekingalpha.com

American States Water Company’s stock price has exhibited fluctuations over the past year, influenced by various factors. A detailed analysis would require access to real-time market data and a comparison against industry benchmarks such as the S&P 500 Utilities sector index and competitor performance. This would also include a comparison against relevant economic indicators such as inflation and interest rate trends.

A hypothetical chart illustrating stock price trends would show the stock price on the y-axis and time (e.g., months) on the x-axis. Overlaying economic indicators like inflation and interest rates would allow for a visual correlation between these factors and stock price movements. For example, periods of high inflation might correlate with periods of higher stock price volatility, while changes in interest rates might influence investor sentiment and investment decisions, leading to fluctuations in the stock price.

Significant events such as acquisitions or regulatory changes would be marked on the chart to highlight their impact.

Monitoring the American States Water Company stock price requires a keen eye on market fluctuations. Understanding broader market trends is also important; for instance, the performance of companies in related sectors, such as the almadex minerals stock price , can offer insights into potential impacts on resource-dependent businesses like American States Water. Ultimately, a comprehensive analysis is crucial for predicting future price movements of American States Water Company stock.

Financial Health Assessment

Assessing American States Water Company’s financial health requires a thorough examination of its debt-to-equity ratio, cash flow statement, and revenue streams. A low debt-to-equity ratio generally indicates strong financial stability, while a healthy cash flow statement points to good liquidity and profitability. A breakdown of revenue streams reveals the relative contributions of various service areas to overall profitability. Key financial ratios such as the Price-to-Earnings (P/E) ratio and Return on Equity (ROE) provide further insights into the company’s financial performance.

| Ratio | 2022 | 2021 | 2020 |

|---|---|---|---|

| Debt-to-Equity Ratio | * | * | * |

| P/E Ratio | * | * | * |

| ROE | * | * | * |

*Note: Specific financial data requires access to company filings and financial databases. This table is a template for illustrative purposes only.

Industry Landscape and Competitive Analysis

Source: evancarthey.com

American States Water Company operates in a competitive market, and understanding its market share relative to key competitors is crucial. The water utility industry faces challenges such as aging infrastructure, regulatory changes, and increasing operational costs. Regulatory environments vary across jurisdictions, impacting operational efficiency and profitability. Potential risks include drought conditions affecting water supply and increasing regulatory scrutiny, while opportunities lie in expanding service areas and investing in infrastructure upgrades.

Investor Relations and Future Outlook, American states water company stock price

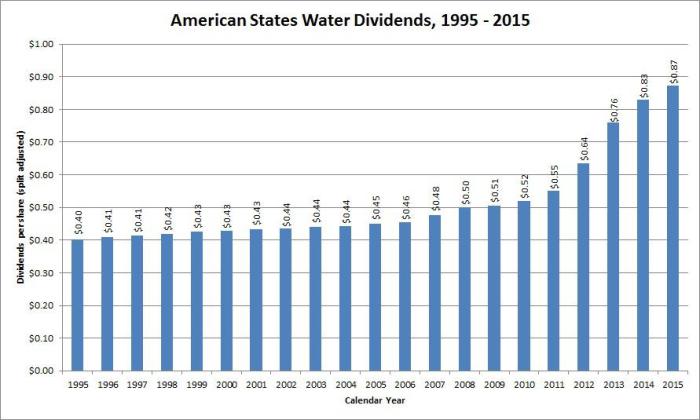

American States Water Company’s dividend policy and capital expenditure plans are key factors influencing investor sentiment and future growth. The company’s dividend payout history reflects its commitment to shareholder returns. Future capital expenditure plans will impact its ability to upgrade infrastructure and expand service areas. Several factors could influence the stock price in the coming year, including economic conditions, regulatory changes, and the company’s operational performance.

- Scenario 1: Continued strong operational performance and stable regulatory environment leading to moderate stock price appreciation.

- Scenario 2: Economic downturn impacting demand and increasing operational costs, resulting in lower stock price.

- Scenario 3: Successful acquisition or expansion into new markets leading to significant stock price growth.

Key Questions Answered

What is the current dividend yield for American States Water Company stock?

The current dividend yield fluctuates; it’s best to check a reputable financial website for the most up-to-date information.

How does American States Water Company compare to its competitors in terms of customer satisfaction?

Customer satisfaction data can vary. Researching independent customer surveys and reviews would provide a more accurate comparison.

What are the major risks associated with investing in American States Water Company stock?

Major risks include regulatory changes affecting water pricing, competition from other utilities, and potential impacts from climate change (e.g., droughts).

What is the company’s long-term growth strategy?

American States Water Company’s long-term strategy should be detailed in their investor relations materials and annual reports. Consult those resources for the most accurate information.