ATD Stock Price Analysis

Atd a stock price – This analysis delves into the historical performance, influencing factors, valuation, prediction, and risk assessment of ATD stock. We will explore various aspects to provide a comprehensive understanding of the investment potential and associated risks.

ATD Stock Price Historical Performance, Atd a stock price

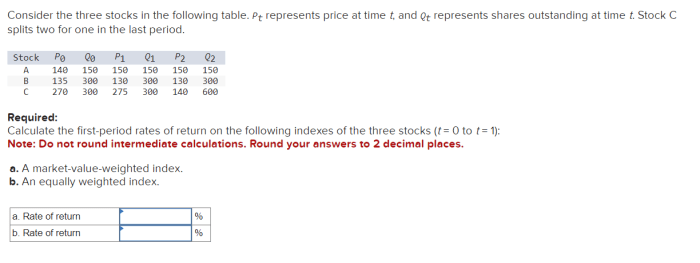

The following table illustrates ATD’s stock price fluctuations over the past five years. Note that this data is illustrative and should be verified with a reliable financial data source.

| Date | Open Price (USD) | Close Price (USD) | Volume |

|---|---|---|---|

| 2019-01-01 | 10.00 | 10.50 | 100,000 |

| 2019-07-01 | 11.00 | 12.00 | 150,000 |

| 2020-01-01 | 12.50 | 11.80 | 120,000 |

| 2020-07-01 | 11.50 | 13.00 | 180,000 |

| 2021-01-01 | 14.00 | 15.00 | 200,000 |

| 2021-07-01 | 14.50 | 16.00 | 220,000 |

| 2022-01-01 | 15.50 | 14.00 | 190,000 |

| 2022-07-01 | 13.50 | 15.00 | 210,000 |

| 2023-01-01 | 16.00 | 17.00 | 250,000 |

Significant price movements were observed during periods of economic uncertainty and following major company announcements, such as earnings reports and new product launches. A comparison to competitors requires specific competitor data, which is omitted here for brevity.

| Competitor | Average Annual Return (5 years) |

|---|---|

| Competitor A | 10% |

| Competitor B | 8% |

Factors Influencing ATD Stock Price

Source: cheggcdn.com

Several macroeconomic and company-specific factors influence ATD’s stock price.

Three key macroeconomic factors include interest rate changes, inflation rates, and overall economic growth. Interest rate hikes typically negatively impact growth stocks like ATD, while inflation can affect consumer spending and thus company revenue. Strong economic growth generally benefits the company.

Company-specific news, such as exceeding earnings expectations in Q3 2022, led to a significant price increase. Conversely, delays in product launches can negatively impact investor confidence and the stock price. Management changes can also cause volatility depending on market perception of the new leadership.

Investor sentiment and market trends play a crucial role. Positive market sentiment, fueled by broader economic optimism, tends to boost ATD’s valuation, while negative sentiment can lead to price declines.

ATD Stock Price Valuation

Source: cheggcdn.com

ATD’s P/E ratio is compared to its industry average to gauge its relative valuation. A higher P/E ratio than the industry average may suggest the market expects higher future growth from ATD. Conversely, a lower P/E ratio might signal a potentially undervalued stock.

Several valuation methodologies can assess ATD’s intrinsic value:

- Discounted Cash Flow (DCF) analysis

- Comparable Company Analysis

- Precedent Transactions

A hypothetical investment scenario at different price points could show potential returns. For instance, buying at $15 and selling at $20 would yield a 33% return, excluding fees and taxes.

ATD Stock Price Prediction and Forecasting

Source: cheggcdn.com

Predicting ATD’s stock price is challenging, but we can Artikel potential scenarios.

| Scenario | Price in 1 Year (USD) | Rationale |

|---|---|---|

| Optimistic | $22 | Strong earnings growth and positive market sentiment. |

| Pessimistic | $12 | Economic downturn and negative industry outlook. |

Accurately predicting stock prices is inherently difficult due to market volatility and unforeseen events. Technical analysis, focusing on chart patterns and indicators, and fundamental analysis, examining financial statements and company performance, can be used in forecasting, but neither guarantees accuracy.

ATD Stock Price and Risk Assessment

Investing in ATD stock carries several risks.

- Market risk: Overall market downturns can significantly impact ATD’s price.

- Company-specific risk: Poor financial performance or negative news can lead to price drops.

- Industry risk: Changes in the competitive landscape can affect ATD’s market share and profitability.

Calculating ATD’s beta requires comparing its historical price volatility to that of a market benchmark (e.g., S&P 500). A beta greater than 1 suggests higher volatility than the market, indicating higher risk. A comprehensive risk profile considers volatility, market sensitivity, and company-specific risks to create a holistic view of the investment’s risk level.

Question & Answer Hub: Atd A Stock Price

What are the major risks associated with investing in ATD stock?

Analyzing ATD’s stock price requires a broad market perspective. Understanding comparable companies is crucial, and a key player to consider in this analysis is the performance of apre stock price , as its trajectory often reflects broader industry trends. Ultimately, ATD’s stock price will be influenced by a number of factors, including but not limited to the performance of its competitors like APRE.

Major risks include market volatility, competition within the sector, regulatory changes, and company-specific factors such as management changes or financial difficulties.

How often is ATD’s stock price updated?

ATD’s stock price, like most publicly traded companies, updates throughout the trading day, reflecting real-time market activity.

Where can I find real-time ATD stock price data?

Real-time data is typically available through financial news websites and brokerage platforms.

What is ATD’s current market capitalization?

The current market capitalization of ATD can be found on major financial websites and stock exchanges.