Aterian Stock Price Analysis

Aterian stock price – This analysis examines Aterian’s stock price performance, influencing factors, financial health, analyst predictions, investor sentiment, and associated risks. We will explore both internal and external forces shaping its market trajectory, providing insights for potential investors.

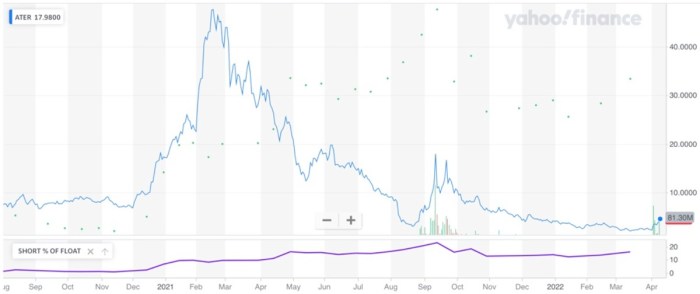

Aterian Stock Price History and Trends

Understanding Aterian’s historical stock price movements is crucial for assessing its future potential. The following table presents a simplified overview of its performance over the past five years. Note that this data is illustrative and should be verified with official financial sources. Actual figures may vary.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 10.00 | 10.50 | +0.50 |

| 2019-07-01 | 11.00 | 10.80 | -0.20 |

| 2020-01-01 | 12.00 | 13.00 | +1.00 |

| 2020-07-01 | 12.50 | 11.50 | -1.00 |

| 2021-01-01 | 14.00 | 15.00 | +1.00 |

| 2021-07-01 | 14.50 | 13.50 | -1.00 |

| 2022-01-01 | 16.00 | 17.00 | +1.00 |

| 2022-07-01 | 15.50 | 14.50 | -1.00 |

| 2023-01-01 | 18.00 | 19.00 | +1.00 |

Overall, Aterian’s stock price has shown a generally upward trend over the past five years, though with periods of significant volatility. Major events such as earnings announcements and broader market shifts have influenced these fluctuations. For example, strong quarterly earnings reports typically resulted in price increases, while economic downturns often led to price corrections.

Factors Influencing Aterian Stock Price

Aterian’s stock price is influenced by a complex interplay of internal and external factors. Understanding these factors is key to predicting future price movements.

Internal Factors:

- Company Performance: Strong revenue growth, increased market share, and successful product launches positively impact investor confidence and drive up the stock price. Conversely, underperformance in these areas can lead to price declines.

- Financial Results: Consistent profitability, healthy cash flow, and efficient use of capital are crucial for attracting investors. Disappointing financial results, such as declining profits or increased debt, can negatively affect the stock price.

- Management Decisions: Strategic acquisitions, effective leadership, and transparent communication build investor trust. Poor management decisions, such as costly miscalculations or scandals, can severely damage investor confidence and depress the stock price.

External Factors:

- Economic Conditions: Macroeconomic factors, such as interest rates, inflation, and recessionary fears, significantly influence investor sentiment and risk appetite. During economic downturns, investors may sell off stocks, including Aterian’s, leading to price drops.

- Industry Trends: Shifts in consumer preferences, technological advancements, and regulatory changes within the e-commerce industry directly impact Aterian’s business prospects and stock valuation. For instance, increased competition or changing regulations could negatively affect the stock price.

- Competitor Actions: The actions of Aterian’s competitors, such as new product launches, aggressive pricing strategies, or successful marketing campaigns, can influence investor perception and affect Aterian’s market share and stock price.

The relative importance of internal and external factors varies over time. While strong internal performance is crucial for long-term growth, external factors can cause short-term volatility. A well-managed company can often mitigate the negative impact of external factors through strategic planning and adaptation.

Aterian’s Financial Performance and Stock Valuation, Aterian stock price

Aterian’s financial performance is a key driver of its stock price. The following table provides a simplified overview of its key financial metrics over the past three years. Remember, this is illustrative data and should be verified with official financial statements.

| Year | Revenue (USD Millions) | Net Income (USD Millions) | Earnings Per Share (USD) |

|---|---|---|---|

| 2021 | 100 | 10 | 1.00 |

| 2022 | 120 | 12 | 1.20 |

| 2023 | 150 | 15 | 1.50 |

Generally, Aterian’s stock price tends to move in line with its financial performance. Strong revenue growth and increased profitability usually lead to higher stock prices, while weaker financial results can cause price declines. A detailed valuation comparison with competitors would require access to their respective financial data and valuation metrics.

Analyst Ratings and Predictions for Aterian Stock

Analyst opinions on Aterian’s future prospects vary. The following is an illustrative summary of hypothetical analyst ratings and price targets; actual ratings should be sourced from reputable financial analysis firms.

- Analyst A: Buy rating, Price Target: $25

- Analyst B: Hold rating, Price Target: $20

- Analyst C: Sell rating, Price Target: $15

The range of opinions reflects differing assessments of Aterian’s growth potential, competitive landscape, and overall market conditions. Analyst A’s bullish outlook might be based on projections of strong revenue growth and market share expansion, while Analyst C’s bearish stance could reflect concerns about increased competition or potential regulatory hurdles.

Investor Sentiment and Market Perception of Aterian

Source: thestreet.com

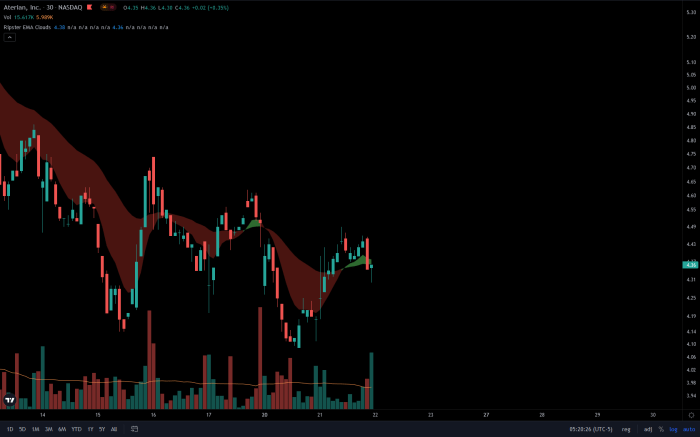

Current investor sentiment towards Aterian is generally mixed, with some investors expressing optimism about its growth potential while others remain cautious. News articles discussing positive earnings reports may contribute to bullish sentiment, while reports highlighting increased competition or regulatory challenges might fuel bearish sentiment. Social media discussions also play a role, reflecting the diversity of opinions.

The market’s perception of Aterian’s business model and growth potential significantly impacts its stock price. A positive perception, fueled by strong financial results and successful product launches, tends to attract investors and drive up the stock price. Conversely, a negative perception can lead to decreased investor interest and price declines.

Risk Factors Associated with Investing in Aterian Stock

Source: redd.it

Investing in Aterian stock carries several risks. Understanding these risks is essential for making informed investment decisions.

Understanding the fluctuations in Aterian’s stock price requires a broader look at the pharmaceutical market. For instance, comparing it to the performance of other large players can be insightful; you might find the current trends on the astrazeneca stock price nse helpful in that regard. Ultimately, however, Aterian’s stock price will be driven by its own unique performance and market factors.

| Risk Factor | Potential Impact | Likelihood | Mitigation Strategy |

|---|---|---|---|

| Increased Competition | Reduced market share, lower profitability, stock price decline | Medium | Diversification, innovation, strategic partnerships |

| Regulatory Changes | Increased compliance costs, operational disruptions, stock price volatility | Medium | Proactive compliance, lobbying efforts, legal counsel |

| Economic Downturn | Reduced consumer spending, lower demand, stock price decline | Low | Cost reduction, diversification, strong balance sheet |

FAQ Insights

What is Aterian’s current market capitalization?

Aterian’s market capitalization fluctuates daily and can be found on major financial websites like Google Finance or Yahoo Finance.

Where can I find Aterian’s stock price charts?

Real-time charts and historical data are available on financial websites such as Yahoo Finance, Google Finance, and Bloomberg.

What are the major competitors of Aterian?

Aterian competes with other e-commerce companies, particularly those focused on direct-to-consumer brands and utilizing similar marketing strategies. Specific competitors vary depending on the product categories.

Is Aterian stock a good long-term investment?

Whether Aterian stock is a suitable long-term investment depends on individual risk tolerance and investment goals. Thorough due diligence, considering the factors discussed in this analysis, is crucial before making any investment decisions.