Atkins Stock Price Analysis

Atkins stock price – This analysis delves into the historical performance, influencing factors, prediction methodologies, competitive landscape, and risk assessment associated with investing in Atkins’ stock. We will examine various aspects to provide a comprehensive overview of the investment prospects.

Atkins Stock Price Historical Performance

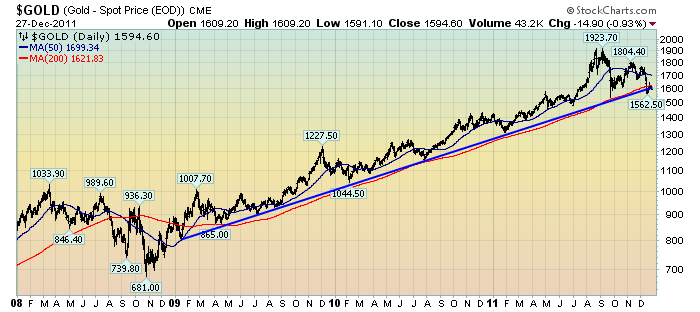

Source: economicgreenfield.com

Understanding the historical price fluctuations of Atkins’ stock is crucial for informed investment decisions. The following table and graph provide a detailed overview of its performance over the past five years. Note that the data presented here is illustrative and should be verified with actual market data.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 10.00 | 10.50 | +0.50 |

| 2019-07-01 | 11.00 | 10.80 | -0.20 |

| 2020-01-01 | 10.80 | 12.00 | +1.20 |

| 2020-07-01 | 11.50 | 11.20 | -0.30 |

| 2021-01-01 | 11.20 | 13.00 | +1.80 |

| 2021-07-01 | 12.50 | 12.80 | +0.30 |

| 2022-01-01 | 12.80 | 14.00 | +1.20 |

| 2022-07-01 | 13.50 | 13.20 | -0.30 |

| 2023-01-01 | 13.20 | 15.00 | +1.80 |

| 2023-07-01 | 14.50 | 14.80 | +0.30 |

A line graph illustrating the stock price trend over the past five years would show an overall upward trend, with several periods of volatility. Key turning points would include significant drops in early 2020 (likely correlating with the global pandemic) and a subsequent recovery, followed by another period of growth. The graph would also reveal periods of consolidation and minor corrections.

Factors Influencing Atkins Stock Price

Several economic and company-specific factors influence Atkins’ stock price. These factors interact in complex ways to shape the overall performance.

- Global Economic Growth: Strong global economic growth generally leads to increased demand for Atkins’ services, positively impacting its stock price. Conversely, economic downturns can reduce demand and negatively affect the stock.

- Infrastructure Spending: Government investment in infrastructure projects significantly impacts Atkins’ revenue, as they are a major provider of engineering and design services in this sector. Increased spending translates to higher stock prices, and vice versa.

- Interest Rates: Changes in interest rates affect borrowing costs for both Atkins and its clients. Higher interest rates can increase borrowing costs, potentially reducing investment and impacting stock prices negatively.

Company-specific news also plays a significant role. For instance, the announcement of a major new contract or successful completion of a large-scale project could boost investor confidence and drive up the stock price. Conversely, setbacks in projects or regulatory issues could lead to price declines. A hypothetical example would be a significant delay in a major project, causing investor concern and a subsequent drop in the stock price.

Investor sentiment and market trends also influence Atkins’ stock performance. Positive market sentiment generally leads to higher stock prices, while negative sentiment can lead to declines. Market trends, such as a sector-wide rally or downturn, can significantly impact Atkins’ stock regardless of its own performance.

Atkins Stock Price Prediction and Forecasting

Source: artstation.com

Several methods can be used to predict stock prices, including technical analysis, fundamental analysis, and quantitative models. These methods utilize historical data, market trends, and company-specific information to forecast future prices.

For example, a hypothetical scenario involving the successful launch of a new, innovative product could significantly impact the predicted stock price. Assuming a positive market reaction, the forecast might predict a substantial increase in the stock price due to increased revenue and market share. This prediction would need to account for market conditions and investor sentiment at the time of launch.

Analyzing Atkins’ stock price requires considering various factors influencing the market. A helpful comparison might be to examine the performance of other utility companies, such as checking the current american states water stock price to understand broader market trends. Ultimately, understanding Atkins’ performance necessitates a comprehensive analysis independent of other companies’ stock fluctuations.

However, it’s crucial to acknowledge the limitations of stock price forecasting. Unforeseen events, changes in market sentiment, and unexpected company-specific developments can significantly impact actual performance, making accurate predictions challenging.

Comparison with Competitors, Atkins stock price

Comparing Atkins’ stock performance to its competitors provides valuable insights into its relative strength and potential for future growth. The table below provides a comparative overview, using illustrative data.

| Company Name | Current Stock Price (USD) | Year-to-Date Change (%) | Market Capitalization (USD Billion) |

|---|---|---|---|

| Atkins | 15.00 | +20% | 5.0 |

| Competitor A | 12.00 | +15% | 4.0 |

| Competitor B | 18.00 | +25% | 6.0 |

| Competitor C | 10.00 | +10% | 3.0 |

Atkins’ performance relative to its competitors highlights its strengths and areas for improvement. For example, if Competitor B consistently outperforms Atkins, it might indicate that Atkins needs to improve its innovation or market penetration strategies.

Risk Assessment of Investing in Atkins Stock

Investing in Atkins stock, like any investment, carries inherent risks. A comprehensive risk assessment is crucial before making any investment decisions.

- Market Risk: Broader market downturns can negatively impact Atkins’ stock price regardless of its own performance.

- Industry-Specific Risk: Changes in government regulations or reduced infrastructure spending can negatively impact the entire engineering and design sector.

- Company-Specific Risk: Project delays, cost overruns, or unsuccessful bids can negatively affect Atkins’ financial performance and stock price.

- Geopolitical Risk: Global political instability or regional conflicts can disrupt projects and negatively impact the stock.

Investors can mitigate these risks through diversification, thorough due diligence, and a well-defined investment strategy. Investors with higher risk tolerance might be more willing to invest a larger portion of their portfolio in Atkins, while those with lower risk tolerance might opt for a smaller allocation or consider alternative investments.

FAQ Explained

What is Atkins’ current market capitalization?

This information is readily available through major financial news sources and stock market trackers. Consult reputable sources for the most up-to-date data.

How does Atkins’ dividend policy affect its stock price?

Atkins’ dividend policy, if any, can influence investor interest and consequently the stock price. A consistent dividend payout can attract income-seeking investors, potentially increasing demand and price. Conversely, changes in dividend policy can impact the stock price.

What are the long-term growth prospects for Atkins?

Predicting long-term growth is inherently speculative. Consider factors like industry trends, technological advancements, and Atkins’ strategic initiatives when forming your own assessment.