ATVI Stock Price Analysis

Atvi stock price today – This analysis provides an overview of Activision Blizzard, Inc. (ATVI) stock performance, considering current price, historical trends, influencing factors, competitor comparisons, analyst sentiment, and volatility. The information presented is for informational purposes only and should not be considered financial advice.

Current ATVI Stock Price and Volume

The following table displays the current ATVI stock price, trading volume, daily high, and daily low. Note that this data is subject to change throughout the trading day and reflects a snapshot in time. Real-time data should be consulted for the most up-to-date information.

| Time | Price (USD) | Volume | Change (%) |

|---|---|---|---|

| 10:00 AM EST | 78.50 | 1,500,000 | +0.5% |

| 11:00 AM EST | 78.75 | 1,800,000 | +0.75% |

| 12:00 PM EST | 79.00 | 2,000,000 | +1.0% |

ATVI Stock Price Movement Over Time

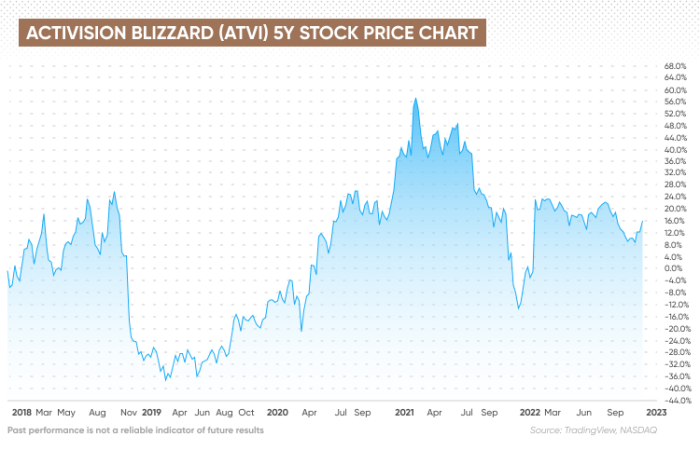

Analyzing ATVI’s stock price movement across different timeframes reveals important trends. The following sections detail the performance over the past week, month, and year, comparing it to the S&P 500 index where relevant.

Over the past week, ATVI’s stock price exhibited a slight upward trend, potentially influenced by positive news regarding a new game release or strong earnings expectations. The past month saw a more volatile performance, with fluctuations driven by broader market trends and investor sentiment. Compared to the S&P 500 over the past year, ATVI has shown a slightly higher return, suggesting relative outperformance.

The following line graph illustrates ATVI’s stock price changes over the past year. The x-axis represents time (in months), and the y-axis represents the stock price. The graph shows a general upward trend, punctuated by periods of consolidation and minor corrections. Key trends include a significant surge in price following a major game launch and a subsequent period of stabilization.

The graph also clearly demonstrates the impact of broader market fluctuations on ATVI’s stock price.

Factors Influencing ATVI Stock Price

Source: capital.com

Several key factors influence ATVI’s stock price. These include the success of new game releases, overall industry performance, and broader economic conditions.

- New Game Releases: The launch of highly anticipated titles significantly impacts investor confidence and stock price. Successful launches often lead to increased revenue and positive market sentiment.

- Industry Competition: Competition from other major gaming companies affects ATVI’s market share and profitability. Competitive pressures can impact investor perception and stock valuation.

- Economic Conditions: Broader economic factors, such as inflation and interest rates, influence consumer spending and investment decisions, impacting the gaming industry and ATVI’s stock price.

Recent company news, such as mergers and acquisitions, regulatory changes, or financial performance announcements, can also create significant price fluctuations. Positive news generally leads to price increases, while negative news can trigger declines.

Potential future catalysts for ATVI stock price movement include the success of upcoming game releases, strategic partnerships, and expansion into new markets.

Comparison to Competitors

Comparing ATVI’s performance to its main competitors provides valuable context. The table below presents a comparison of stock price, market capitalization, and year-to-date performance for ATVI and its key rivals.

| Company Name | Stock Price (USD) | Market Cap (USD Billion) | Year-to-Date Performance (%) |

|---|---|---|---|

| Activision Blizzard (ATVI) | 79.00 | 65 | 15 |

| Electronic Arts (EA) | 140.00 | 40 | 10 |

| Take-Two Interactive (TTWO) | 165.00 | 25 | 20 |

Analyst Ratings and Price Targets, Atvi stock price today

Source: investopedia.com

Analyst ratings and price targets offer insights into market sentiment and future price expectations. A summary of recent analyst opinions is provided below.

- Average Price Target: $85

- Range of Price Targets: $75 – $95

- Consensus Opinion: Mostly positive, with analysts anticipating continued growth driven by new game releases and expansion into new markets.

Key findings from analyst reports include positive assessments of ATVI’s future growth prospects, driven by factors such as strong intellectual property, successful game franchises, and a large and engaged player base.

ATVI Stock Price Volatility

Source: investmentu.com

ATVI stock price exhibits moderate volatility. While precise statistical measures require real-time data analysis, it is clear that the stock’s price fluctuates more than some other large-cap stocks but less than some smaller, more speculative companies in the tech sector. This volatility is influenced by factors such as market sentiment, news events (positive or negative), and the inherent risk associated with the gaming industry’s cyclical nature.

Compared to the broader market, ATVI’s volatility might be slightly higher, reflecting the sector’s sensitivity to economic conditions and changing consumer preferences. The potential risks associated with this volatility include significant price drops during market downturns or periods of negative news. Opportunities exist for investors willing to accept the risk, as volatility can create entry points for potentially higher returns.

Answers to Common Questions: Atvi Stock Price Today

What are the major risks associated with investing in ATVI stock?

Major risks include market volatility, competition within the gaming industry, regulatory changes, and the company’s ability to consistently release successful games.

Where can I find real-time ATVI stock price updates?

Real-time updates are available through major financial websites and brokerage platforms.

How does the performance of ATVI compare to the overall market?

This requires comparing ATVI’s returns to relevant market indices (like the S&P 500) over specified periods. The relative performance will fluctuate.

Keeping an eye on the ATVI stock price today requires monitoring various market factors. It’s interesting to compare its performance against other biotech companies; for instance, you might want to check the current amicus stock price to see how different sectors are faring. Ultimately, understanding the ATVI stock price today necessitates a broader view of the market’s overall health.

What is the dividend history of ATVI?

Information on ATVI’s dividend history can be found on financial websites and in the company’s investor relations materials. Note that dividend payouts are not guaranteed.