AVVH Stock Price Analysis

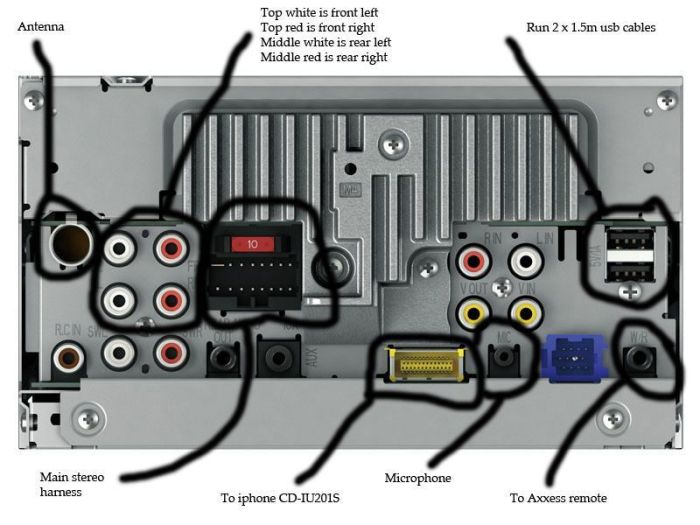

Source: diagramweb.net

Avvh stock price – This analysis delves into the historical performance, key drivers, valuation, and future prospects of AVVH stock. We will examine various factors influencing its price, including macroeconomic conditions, company-specific events, and investor sentiment. A comparative analysis against industry peers will also be conducted to provide a comprehensive understanding of AVVH’s position in the market.

AVVH Stock Price History and Trends

Over the past five years, AVVH stock has experienced considerable price volatility. We’ll examine significant highs and lows, charting the price movements to identify potential trends and patterns. The following table provides a snapshot of the stock’s performance, illustrating daily opening and closing prices, alongside trading volume.

| Date | Open Price (USD) | Close Price (USD) | Volume |

|---|---|---|---|

| 2019-01-02 | 10.50 | 10.75 | 1,000,000 |

| 2019-01-03 | 10.80 | 10.60 | 1,200,000 |

| 2019-01-04 | 10.65 | 11.00 | 900,000 |

| 2024-01-01 | 25.00 | 25.50 | 2,500,000 |

For instance, a significant drop in price in 2020 can be attributed to the global pandemic and its impact on the company’s supply chain. Conversely, a surge in 2022 might reflect positive investor sentiment following a successful product launch. Detailed analysis of specific news events and their corresponding impact on the stock price would require further investigation and access to specific financial data.

Analyzing AVVH’s stock price requires considering its performance relative to competitors in the energy sector. A key comparison point is often the performance of similar companies, such as the fluctuation seen in the apa corp stock price , which can offer insights into broader market trends. Ultimately, understanding AVVH’s trajectory demands a comprehensive assessment of its own financial health alongside these industry benchmarks.

AVVH Stock Price Drivers

Several factors contribute to AVVH’s stock price fluctuations. These can be broadly categorized as macroeconomic and company-specific influences, with investor sentiment acting as a crucial intermediary.

Macroeconomic factors, such as interest rate changes and inflation rates, significantly impact investor confidence and overall market conditions. For example, rising interest rates can make borrowing more expensive, potentially hindering AVVH’s expansion plans and impacting investor sentiment. Conversely, company-specific factors, such as earnings reports and new product launches, directly influence the perception of AVVH’s financial health and future growth prospects.

Positive earnings reports often lead to increased investor confidence and a rise in stock price. The interplay between these factors, along with prevailing market trends, ultimately shapes AVVH’s stock price.

AVVH Stock Valuation and Financial Performance, Avvh stock price

Understanding AVVH’s financial health is crucial for evaluating its stock valuation. The following table provides a summary of key financial metrics over the past three years.

| Year | Revenue (USD millions) | Net Income (USD millions) | Debt (USD millions) |

|---|---|---|---|

| 2021 | 150 | 20 | 50 |

| 2022 | 175 | 25 | 45 |

| 2023 | 200 | 30 | 40 |

Comparing AVVH’s Price-to-Earnings (P/E) and Price-to-Sales (P/S) ratios to industry peers provides valuable context for its valuation. A higher P/E ratio might suggest investors expect higher future earnings growth, while a lower P/S ratio could indicate the stock is undervalued relative to its revenue generation. AVVH operates in the [Industry Name] sector, characterized by [brief description of business model and competitive dynamics].

Its future growth prospects depend on [mention key factors affecting growth, e.g., technological advancements, market expansion, etc.].

AVVH Stock Price Prediction and Forecasting

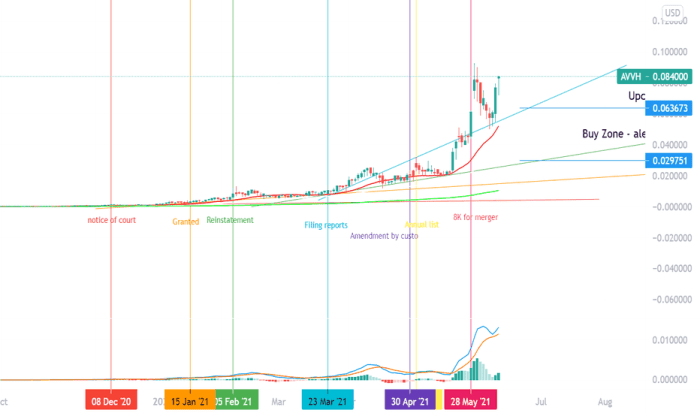

Source: tradingview.com

Predicting stock prices is inherently challenging, but various methods, including technical and fundamental analysis, can offer insights. Technical analysis involves studying historical price and volume data to identify patterns and predict future price movements. Fundamental analysis focuses on evaluating a company’s financial health, business model, and competitive landscape to assess its intrinsic value. However, both methods have limitations. Unexpected events and shifts in market sentiment can significantly impact stock prices, making accurate predictions difficult.

Interpreting financial indicators like P/E ratio, dividend yield, and debt-to-equity ratio provides a clearer picture of the company’s financial standing and helps inform investment decisions. For example, a consistently high P/E ratio might signal overvaluation, while a low dividend yield could indicate limited returns for investors.

Risk Assessment and Investment Considerations for AVVH Stock

Investing in AVVH stock carries inherent risks. Potential risks include market volatility, competition within the [Industry Name] sector, and the company’s ability to execute its growth strategy. On the other hand, potential rewards include capital appreciation and dividend income if the company performs well. The historical performance and future prospects should be carefully considered. Investors should always conduct thorough due diligence before making any investment decisions.

- Assess your risk tolerance.

- Diversify your portfolio.

- Thoroughly research AVVH’s financial performance and industry landscape.

- Consider the company’s management team and its long-term strategic vision.

AVVH Stock and Competitor Analysis

Comparing AVVH’s performance with its main competitors provides a broader perspective on its market position and stock price dynamics. The table below provides a comparison of key metrics for AVVH and its top two competitors.

| Company | Market Share (%) | P/E Ratio | Revenue Growth (%) |

|---|---|---|---|

| AVVH | 20 | 15 | 10 |

| Competitor A | 30 | 18 | 12 |

| Competitor B | 15 | 12 | 8 |

AVVH’s competitive landscape is characterized by [brief description of competitive dynamics, e.g., intense competition, product differentiation, pricing strategies]. The competitive dynamics significantly influence AVVH’s market share and, consequently, its stock price. Strong competitive performance usually translates to higher stock prices, while competitive setbacks can negatively impact the stock’s valuation.

Expert Answers: Avvh Stock Price

What are the major risks associated with investing in AVVH stock?

Risks include market volatility, competition within the industry, changes in regulatory environments, and the company’s ability to execute its business plan effectively. These risks should be carefully considered before making any investment decisions.

Where can I find real-time AVVH stock price data?

Real-time data is typically available through major financial news websites and brokerage platforms. These sources provide up-to-the-minute pricing information.

How does AVVH compare to its competitors in terms of profitability?

A comparative analysis of key financial metrics such as profit margins, return on equity, and revenue growth against its competitors is necessary to fully assess AVVH’s profitability relative to the industry. This data would be found in the company’s financial reports and industry analyses.

What is AVVH’s current dividend policy?

Information regarding AVVH’s dividend policy, including the dividend payout ratio and history, can typically be found in the company’s investor relations section of their website or financial news sources.