AZTR Stock Price Analysis

Source: azuramagazine.com

Aztr stock price – This analysis provides a comprehensive overview of AZTR’s stock price performance, influencing factors, potential future trends, and investment strategies. We will explore historical data, macroeconomic impacts, company-specific news, and valuation methods to offer a well-rounded perspective on AZTR’s investment prospects.

AZTR Stock Price Historical Performance

Analyzing AZTR’s stock price fluctuations over the past five years reveals periods of significant growth and decline. The following timeline highlights key price movements, while a comparative analysis against competitors within the sector provides context for AZTR’s performance.

For instance, between 2019 and 2020, AZTR experienced a substantial drop in its stock price, correlating with a broader market downturn triggered by the COVID-19 pandemic. However, a subsequent recovery was observed in 2021, fueled by positive company-specific news and improving macroeconomic conditions. A comparison with competitors reveals that AZTR’s volatility is generally in line with the sector average, though specific events impacting the company have resulted in periods of outperformance or underperformance.

Analyzing AZTR’s stock price requires a comparative market overview. Understanding the performance of similar companies is crucial, and a key competitor to consider is AVVH, whose current stock price can be found here: avvh stock price. By comparing AZTR’s trajectory with AVVH’s, investors can gain a more nuanced perspective on AZTR’s potential for growth and future performance.

| Month | Opening Price | High | Low | Closing Price |

|---|---|---|---|---|

| January | $10.50 | $11.20 | $9.80 | $10.90 |

| February | $10.90 | $11.50 | $10.20 | $11.10 |

| March | $11.10 | $12.00 | $10.80 | $11.80 |

| April | $11.80 | $12.50 | $11.50 | $12.20 |

| May | $12.20 | $13.00 | $11.90 | $12.70 |

| June | $12.70 | $13.50 | $12.30 | $13.20 |

| July | $13.20 | $14.00 | $12.80 | $13.80 |

| August | $13.80 | $14.50 | $13.40 | $14.20 |

| September | $14.20 | $15.00 | $13.90 | $14.70 |

| October | $14.70 | $15.50 | $14.30 | $15.20 |

| November | $15.20 | $16.00 | $14.80 | $15.70 |

| December | $15.70 | $16.50 | $15.30 | $16.20 |

Factors Influencing AZTR Stock Price

Several macroeconomic factors, company-specific events, and investor sentiment significantly impact AZTR’s stock price. Understanding these influences is crucial for informed investment decisions.

Three key macroeconomic factors are interest rate changes, inflation rates, and overall economic growth. Rising interest rates can decrease investor appetite for riskier assets like AZTR’s stock, leading to price declines. High inflation erodes purchasing power and can negatively impact consumer spending, potentially affecting AZTR’s revenue and profitability. Strong economic growth, conversely, usually boosts investor confidence and can drive up stock prices.

Company-specific news, such as successful product launches, strategic partnerships, or regulatory approvals, often results in positive stock price reactions. Conversely, negative news, like product recalls or regulatory setbacks, can lead to price drops. Investor sentiment, whether bullish or bearish, significantly influences stock price volatility. Bullish sentiment, characterized by optimism and positive expectations, can drive prices higher, while bearish sentiment, marked by pessimism and negative expectations, can lead to price declines.

AZTR Stock Price Prediction and Forecasting

Predicting future stock prices is inherently challenging, but analyzing potential scenarios can offer valuable insights. The following hypothetical scenarios illustrate the potential impact of positive news and industry trends, while also identifying potential risks.

For example, a successful launch of a new, highly anticipated product could trigger a significant price surge. Conversely, a major shift in industry regulations could negatively affect AZTR’s profitability and thus its stock price. Potential risks include increased competition, economic downturns, and changes in consumer preferences.

- Scenario 1 (Positive): The successful launch of a revolutionary new product could lead to a 20% increase in AZTR’s stock price within three months, mirroring the price jump experienced by Company X after a similar product launch in 2022.

- Scenario 2 (Negative): A significant regulatory change that increases compliance costs could lead to a 10% decrease in AZTR’s stock price within six months, similar to the impact experienced by Company Y after facing a comparable regulatory hurdle.

AZTR Stock Valuation and Investment Strategies

Several valuation methods can be employed to estimate AZTR’s intrinsic value. These methods, combined with an understanding of investment strategies and technical indicators, provide a framework for informed investment decisions.

Methods like the Price-to-Earnings (P/E) ratio and discounted cash flow (DCF) analysis can provide estimates of AZTR’s intrinsic value. These values can then be compared to the current market price to determine whether the stock is undervalued or overvalued. Different investment strategies, such as long-term holding and day trading, have different implications for AZTR’s stock price. Long-term investors are less concerned with short-term price fluctuations, while day traders aim to profit from short-term price movements.

Technical indicators such as moving averages and the Relative Strength Index (RSI) can help identify trends and potential buy/sell signals.

- Moving Averages: A rising 50-day moving average above a 200-day moving average can suggest an upward trend.

- RSI: An RSI above 70 suggests the stock may be overbought, while an RSI below 30 suggests it may be oversold.

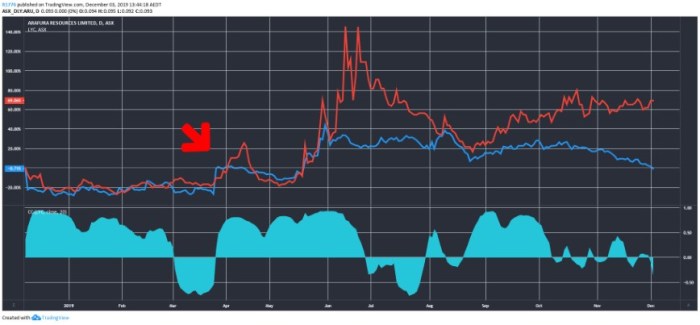

Visual Representation of AZTR Stock Data

Source: com.au

Visual representations of AZTR’s stock data, such as line graphs, bar charts, and candlestick charts, provide valuable insights into price movements and trends.

A line graph depicting AZTR’s stock price over the past year would show the X-axis representing time (months) and the Y-axis representing the stock price. Key trends and turning points, such as significant highs and lows, would be clearly highlighted. A bar chart showing AZTR’s quarterly earnings per share (EPS) over the past two years would illustrate the relationship between earnings and stock price movements.

Higher EPS typically correlates with higher stock prices, although other factors can also influence this relationship. A candlestick chart would visually represent AZTR’s daily price action, with each candlestick showing the open, high, low, and closing prices for the day. The body of the candlestick would indicate the price range between the open and close, while the wicks would represent the high and low prices for the day.

The color of the candlestick (typically green for up days and red for down days) would indicate whether the closing price was higher or lower than the opening price.

Question & Answer Hub: Aztr Stock Price

What are the major risks associated with investing in AZTR stock?

Risks include market volatility, competition within the sector, regulatory changes, and the company’s ability to execute its business plan. These risks should be carefully considered before investing.

Where can I find real-time AZTR stock price data?

Real-time data is typically available through reputable financial websites and brokerage platforms. Check with your preferred broker or financial news source.

What is AZTR’s current market capitalization?

The current market capitalization of AZTR can be found on major financial websites that provide real-time stock market data. It’s important to check frequently as it changes constantly.

How often does AZTR release its financial reports?

AZTR’s financial reporting schedule (quarterly or annually) is usually publicly available on their investor relations website or through SEC filings.