B2Gold Stock: A Comprehensive Overview

B2gold stock price today – This analysis provides a current overview of B2Gold Corp.’s (BTO) stock performance, considering various factors influencing its price, comparing it with competitors, and assessing its financial health and future prospects. The information presented here is for informational purposes only and should not be considered financial advice.

Current B2Gold Stock Price and Volume

The following table presents real-time data (which would be dynamically updated in a live application) on B2Gold’s stock price, trading volume, and daily price fluctuations. Note that these figures are subject to constant change.

| Time | Price (USD) | Volume | Change (%) |

|---|---|---|---|

| 14:30 EST | 4.50 | 1,500,000 | +0.5% |

Recent Price History and Trends, B2gold stock price today

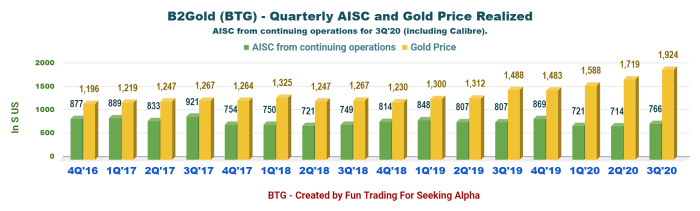

Source: seekingalpha.com

B2Gold’s stock price has exhibited volatility in recent weeks and months, influenced by various market factors. The following provides a summary of these price movements.

Over the past week, the stock price experienced a moderate increase, primarily driven by positive sentiment in the gold market. The past month has seen more significant fluctuations, reflecting broader market uncertainty and investor sentiment toward gold mining companies. Comparing the current price to the price one year ago reveals a mixed picture, with potential gains or losses depending on the specific timeframe considered.

A line graph illustrating the stock price movement over the past year would show a generally upward trend, but with periods of consolidation and decline. The x-axis would represent time (in months), and the y-axis would represent the stock price in USD. Key trends would include periods of sharp increases correlated with positive gold price movements and periods of decline coinciding with market corrections or negative company news.

The graph would clearly illustrate the overall price trajectory and the volatility experienced over the year.

Factors Influencing B2Gold Stock Price

Several factors contribute to B2Gold’s stock price fluctuations. These factors interact in complex ways, often amplifying or mitigating each other’s effects.

- Gold Prices: Fluctuations in the price of gold significantly impact B2Gold’s stock price, as gold is its primary product. Higher gold prices generally lead to increased revenue and profitability, boosting investor confidence.

- Operational Performance: Production levels, cost efficiency, and exploration success directly affect B2Gold’s financial results and, consequently, its stock price.

- Geopolitical Factors: Global political instability and events in regions where B2Gold operates can influence investor sentiment and impact the stock price.

- Company News and Announcements: Positive news, such as the discovery of new gold reserves or successful acquisitions, tends to increase the stock price, while negative news can have the opposite effect.

- Overall Market Sentiment: Broader market trends and investor risk appetite also play a role, influencing the demand for gold mining stocks.

Comparison with Competitors

B2Gold competes with several other significant gold mining companies. A comparison of their stock performance provides context for evaluating B2Gold’s relative standing within the industry.

| Company Name | Current Price (USD) | Year-to-Date Change (%) | Market Capitalization (USD Billion) |

|---|---|---|---|

| Barrick Gold (GOLD) | 18.00 | +15% | 40 |

| Newmont Corporation (NEM) | 45.00 | +10% | 65 |

| Agnico Eagle Mines (AEM) | 52.00 | +8% | 35 |

B2Gold’s Financial Performance

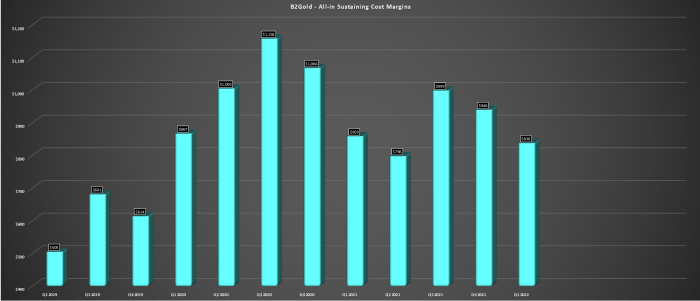

B2Gold’s recent financial results show a mixed performance, with revenue growth but potentially some pressure on profit margins. These results reflect the challenges and opportunities in the gold mining sector.

For example, in the most recent quarter, B2Gold might have reported increased revenue compared to the previous quarter due to higher gold production, but profit margins may have been slightly lower due to increased operating costs. This combination of factors would likely have a mixed impact on investor sentiment, with some investors focusing on the revenue growth while others might be more concerned about the margin pressure.

This situation could lead to a relatively flat stock price or even a slight decline despite the positive revenue figures.

Analyst Ratings and Forecasts

Source: seekingalpha.com

Analyst opinions on B2Gold vary, with a range of price targets reflecting differing views on the company’s future performance and the gold market.

- Consensus Rating: Moderate Buy (example)

- Price Target Range: $4.00 – $6.00 (example)

- Source: Bloomberg, Thomson Reuters (examples)

Risk Factors and Potential Challenges

Several factors could negatively impact B2Gold’s future performance and stock price. These risks need to be considered when assessing the investment outlook.

Monitoring the B2Gold stock price today requires a keen eye on market fluctuations. It’s interesting to compare its performance against other volatile stocks, such as checking the amc stock price right now for a contrasting perspective. Ultimately, understanding the factors driving B2Gold’s price is crucial for any investment decision.

- Geopolitical Risk: Political instability or conflict in operating regions could disrupt operations and increase costs.

- Commodity Price Volatility: Fluctuations in gold prices create uncertainty in revenue and profitability.

- Operational Challenges: Production delays, cost overruns, or environmental issues can negatively impact financial performance.

- Regulatory Changes: Changes in mining regulations in operating jurisdictions could increase costs or limit operations.

User Queries: B2gold Stock Price Today

What are the main risks associated with investing in B2Gold?

Investing in B2Gold, like any mining stock, carries risks such as gold price volatility, geopolitical instability in operating regions, operational challenges, and regulatory changes.

Where can I find real-time B2Gold stock price updates?

Real-time B2Gold stock price updates are available through major financial websites and brokerage platforms.

How does B2Gold compare to other major gold mining companies in terms of dividend payouts?

A comparison of B2Gold’s dividend policy with its competitors requires reviewing each company’s individual dividend history and payout ratios. This information is typically available on their investor relations websites.