Baker Hughes Company Overview and Financial Performance

Baker hughes stock price forecast – Baker Hughes Company (BKR) is a leading global provider of energy technology services and equipment. It operates across the oil and gas value chain, offering a diverse portfolio of products and services to exploration and production companies worldwide. This section will analyze Baker Hughes’ core business, recent financial performance, debt levels, and capital allocation strategies.

Core Business Activities and Market Position

Baker Hughes’ core business segments include Oilfield Services, Oilfield Equipment, and Digital Solutions. Oilfield Services encompasses drilling, completion, and production services. Oilfield Equipment involves manufacturing and supplying critical equipment for oil and gas extraction. Digital Solutions leverages advanced technologies to optimize operational efficiency and enhance production. Baker Hughes holds a significant market share globally, competing primarily with Schlumberger and Halliburton.

Recent Financial Performance

Baker Hughes’ recent financial performance has been characterized by fluctuating revenue and profitability, largely influenced by global oil price movements. While precise figures require referencing recent financial reports, a typical analysis would include revenue growth or decline percentages year-over-year and quarter-over-quarter, operating margins, net income, and earnings per share (EPS). Key financial ratios such as return on equity (ROE) and return on assets (ROA) would also be included to assess the efficiency and profitability of the company’s operations.

Debt Levels and Credit Rating

The company’s debt levels and credit rating are crucial indicators of its financial health and risk profile. A high debt-to-equity ratio might indicate a higher level of financial risk, while a strong credit rating from agencies like Moody’s or S&P suggests lower default risk. The level of debt should be analyzed in relation to the company’s cash flow generation capabilities to assess its ability to service its debt obligations.

Dividend Policy and Share Buyback Programs

Baker Hughes’ dividend policy and share buyback programs reflect its capital allocation strategy. A consistent dividend payout demonstrates a commitment to returning value to shareholders. Share buyback programs can increase earnings per share by reducing the number of outstanding shares. The details of the dividend payout ratio and the amount spent on share repurchases should be analyzed to understand the company’s approach to capital allocation.

Industry Analysis and Competitive Landscape

Understanding the oil and gas industry’s dynamics and Baker Hughes’ competitive position is crucial for assessing its future prospects. This section will examine industry trends, competitive pressures, and the impact of technological advancements.

Current State of the Oil and Gas Industry and Projected Growth

The oil and gas industry is cyclical, heavily influenced by global demand and geopolitical factors. Growth projections vary depending on factors such as energy transition policies, global economic growth, and technological innovations in renewable energy sources. Analysis should consider various industry forecasts and reports to provide a balanced perspective on projected growth.

Comparison with Major Competitors

Baker Hughes competes primarily with Schlumberger and Halliburton. A comparative analysis should examine key performance indicators (KPIs) such as revenue, market share, profitability, and technological innovation across these companies. This will help determine Baker Hughes’ relative competitive strength and identify potential areas for improvement.

Key Industry Trends Impacting Baker Hughes’ Stock Price

Several industry trends can significantly impact Baker Hughes’ stock price. These include the shift towards renewable energy, technological advancements in oil and gas extraction (e.g., automation, digitalization), and changes in environmental regulations. Analyzing these trends and their potential impact on the company’s revenue and profitability is vital for stock price prediction.

Impact of Technological Advancements

Technological advancements, such as automation and digitalization, are transforming the oil and gas industry. Baker Hughes’ ability to adapt and integrate these technologies into its operations will significantly influence its future competitiveness and profitability. The success of its digital solutions segment will be a key driver of its future performance.

Predicting the Baker Hughes stock price forecast requires careful consideration of various market factors. A comparison with other biotech companies, such as observing the current applied dna stock price , can offer insights into broader industry trends. Ultimately, however, the Baker Hughes forecast depends on its own performance and the overall energy sector outlook.

Macroeconomic Factors and Geopolitical Risks

Macroeconomic conditions and geopolitical events significantly influence Baker Hughes’ profitability and stock valuation. This section analyzes the impact of these factors.

Impact of Global Oil Prices

Global oil prices are a major determinant of Baker Hughes’ profitability. Higher oil prices typically lead to increased demand for oilfield services and equipment, boosting the company’s revenue and profits. Conversely, lower oil prices can significantly reduce demand, impacting the company’s financial performance. Historical data correlating oil prices and Baker Hughes’ financial performance can illustrate this relationship.

Influence of Interest Rates and Inflation

Interest rates and inflation influence Baker Hughes’ valuation. Higher interest rates can increase borrowing costs and reduce the present value of future cash flows, impacting the company’s stock valuation. Inflation can affect input costs, impacting profitability. Analysis should consider the impact of macroeconomic indicators on the company’s financial performance and stock valuation.

Potential Geopolitical Risks

Geopolitical risks, such as political instability in oil-producing regions or international sanctions, can disrupt Baker Hughes’ operations and impact its profitability. An analysis should consider potential geopolitical risks and their potential impact on the company’s operations and stock price. Examples could include specific regions or events that historically impacted the energy sector.

Impact of Environmental Regulations and Climate Change Policies, Baker hughes stock price forecast

Environmental regulations and climate change policies are increasingly influencing the oil and gas industry. These policies can lead to increased compliance costs and potentially reduce demand for fossil fuels. Baker Hughes’ ability to adapt to these changes and invest in sustainable technologies will be crucial for its long-term success.

Stock Valuation and Price Prediction Models

This section presents different stock valuation methods and a financial model to forecast Baker Hughes’ future performance. Technical indicators will also be considered to analyze stock price trends.

Stock Valuation Methods

| Valuation Method | Description | Advantages | Disadvantages |

|---|---|---|---|

| Discounted Cash Flow (DCF) | Projects future cash flows and discounts them back to their present value. | Intrinsic value-based; considers long-term growth. | Sensitive to assumptions about future cash flows and discount rate. |

| Price-to-Earnings Ratio (P/E) | Compares a company’s stock price to its earnings per share. | Easy to calculate and widely used. | Can be misleading if earnings are volatile or manipulated. |

| Price-to-Book Ratio (P/B) | Compares a company’s stock price to its book value per share. | Useful for valuing asset-heavy companies. | Doesn’t reflect future growth potential. |

| Dividend Discount Model (DDM) | Values a stock based on its expected future dividend payments. | Suitable for companies with a stable dividend payout. | Not applicable to companies that don’t pay dividends. |

Financial Model for Forecasting Future Earnings and Cash Flows

A detailed financial model, while not fully reproducible here, would project Baker Hughes’ future revenue, expenses, and cash flows based on various assumptions about oil prices, industry growth, and operational efficiency. The model would utilize historical data and industry forecasts to estimate key financial variables and incorporate sensitivity analysis to assess the impact of different scenarios. The output would be projected financial statements (income statement, balance sheet, and cash flow statement) over a specified period (e.g., 5-10 years).

Application of Technical Indicators

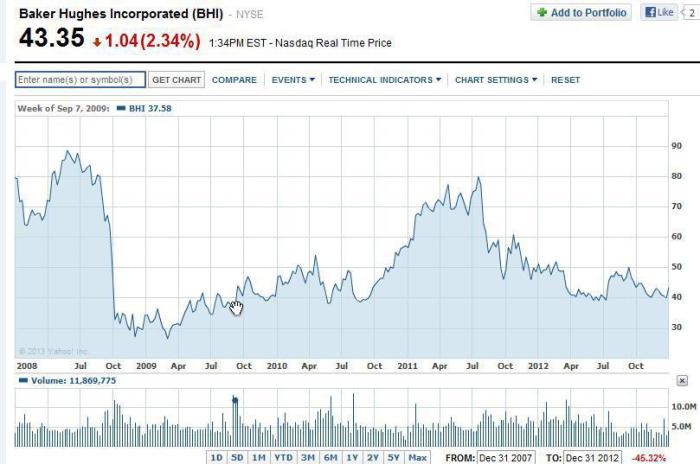

Technical indicators, such as moving averages, relative strength index (RSI), and MACD, can be used to analyze Baker Hughes’ stock price trends. These indicators provide insights into the momentum, overbought/oversold conditions, and potential support/resistance levels. Analyzing these indicators in conjunction with fundamental analysis can provide a more comprehensive view of the stock’s price trajectory.

Potential Price Targets and Scenarios

Based on the valuation models and technical analysis, potential price targets and scenarios can be developed. For example, a bullish scenario might project a higher price target based on strong industry growth and high oil prices, while a bearish scenario might predict a lower price target based on weaker industry conditions and lower oil prices. These scenarios should be clearly defined and justified by the underlying assumptions and analysis.

Risk Assessment and Investment Considerations: Baker Hughes Stock Price Forecast

Investing in Baker Hughes stock involves various risks. This section identifies these risks and assesses the investment’s risk-reward profile.

Key Risks Associated with Investing in Baker Hughes Stock

Key risks include cyclical nature of the oil and gas industry, volatility of oil prices, competition from other energy service companies, regulatory changes, and geopolitical risks. Each risk should be described and its potential impact on the stock price should be assessed. For example, a significant decline in oil prices could negatively impact Baker Hughes’ revenue and profitability, leading to a decline in its stock price.

Risk-Reward Profile Comparison

The risk-reward profile of Baker Hughes should be compared with other investments in the energy sector. This comparison should consider factors such as expected return, volatility, and risk tolerance. For example, a comparison could be made with other major oilfield service companies or with investments in renewable energy companies.

Potential Upside and Downside Scenarios

Source: globenewswire.com

Potential upside scenarios might involve higher-than-expected oil prices, successful implementation of new technologies, and increased market share. Downside scenarios could include lower-than-expected oil prices, increased competition, and regulatory setbacks. These scenarios should be supported by data and analysis to provide a realistic assessment of the potential outcomes.

Investment Recommendation

Based on the analysis conducted, a recommendation on whether to buy, sell, or hold Baker Hughes stock can be provided. The recommendation should be clearly justified with supporting evidence from the previous sections. This might include a discussion of the valuation metrics, risk assessment, and potential future scenarios.

Illustrative Scenarios and Their Impact

This section explores the impact of different scenarios on Baker Hughes’ financial performance and stock price.

Sustained High Oil Prices

Source: seekingalpha.com

A scenario of sustained high oil prices would likely lead to increased demand for Baker Hughes’ services and equipment, resulting in higher revenue, profitability, and a potential increase in its stock price. The financial performance would show significant growth in key metrics like revenue, operating income, and net income. This positive performance would likely attract investors, further driving up the stock price.

Specific examples of historical periods with sustained high oil prices and their impact on Baker Hughes (or similar companies) could be used to illustrate this scenario.

Significant Decline in Oil Prices

Conversely, a significant decline in oil prices would likely lead to reduced demand for Baker Hughes’ services and equipment, resulting in lower revenue, profitability, and a potential decrease in its stock price. The financial performance would show declines in key metrics. The company might need to implement cost-cutting measures or restructuring to mitigate the impact. Examples of historical periods with significant oil price declines and their impact on Baker Hughes (or similar companies) could illustrate this scenario.

Increased Regulatory Pressure

Increased regulatory pressure, such as stricter environmental regulations or limitations on oil and gas exploration, could negatively impact Baker Hughes’ operations and profitability. This could lead to increased compliance costs, potential delays in projects, and a potential decrease in its stock price. The financial performance would likely show reduced profitability due to increased expenses and potentially lower revenue.

The company’s ability to adapt to these regulations and invest in sustainable technologies would be crucial in mitigating the negative impact.

FAQ Resource

What are the main drivers of Baker Hughes’ stock price?

Global oil prices, industry demand, technological advancements, and geopolitical stability are key drivers. Company-specific factors like financial performance and operational efficiency also play a significant role.

How does Baker Hughes compare to its competitors?

Comparative analysis against Schlumberger and Halliburton considers market share, technological innovation, and profitability. The relative strengths and weaknesses of each company influence their respective stock valuations.

What are the long-term prospects for Baker Hughes?

Long-term prospects depend on sustained energy demand, successful technological adaptation, and effective management of environmental and geopolitical risks. The company’s ability to innovate and adapt to changing market conditions will be crucial.