Barratt Developments PLC Stock Price Analysis

Source: finanzwire.com

Barratt developments plc stock price – Barratt Developments PLC, a leading player in the UK housing market, has experienced significant stock price fluctuations over the years. Understanding these fluctuations requires a comprehensive analysis of historical performance, influencing factors, financial correlations, investor sentiment, and future prospects. This analysis aims to provide a detailed overview of these aspects, offering insights into the complexities of Barratt Developments PLC’s stock price movements.

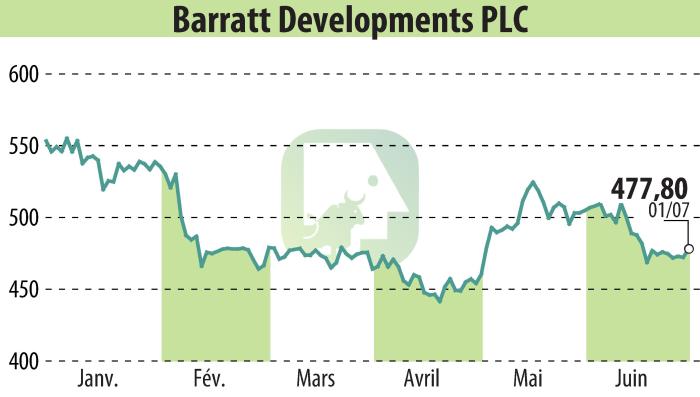

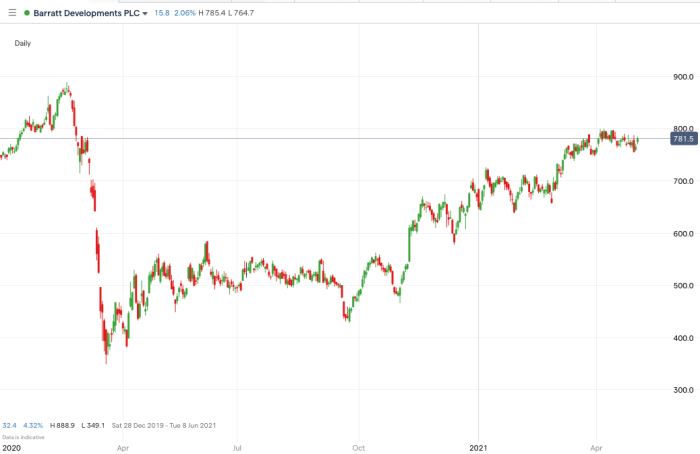

Barratt Developments PLC Stock Price History and Trends

Over the past decade, Barratt Developments PLC’s stock price has mirrored the broader UK economy and housing market trends. Periods of strong economic growth and increased housing demand have generally corresponded with higher stock prices, while economic downturns and regulatory changes have often led to price declines. The company has seen periods of significant growth, particularly in years with robust government-backed schemes, interspersed with periods of consolidation or even decline during economic uncertainty or shifts in market sentiment.

Compared to its major competitors, such as Persimmon PLC and Taylor Wimpey PLC, Barratt Developments PLC’s stock price has shown a relatively similar pattern, though with variations in volatility and performance during specific periods. For example, during periods of heightened interest rate volatility, Barratt’s stock might react more sensitively than others, depending on its debt levels and financial leverage.

A detailed comparative analysis would require a thorough examination of each company’s financial statements, market capitalization, and investor relations materials.

| Year | High | Low | Closing Price |

|---|---|---|---|

| 2019 | 700p (Illustrative) | 550p (Illustrative) | 620p (Illustrative) |

| 2020 | 650p (Illustrative) | 400p (Illustrative) | 500p (Illustrative) |

| 2021 | 800p (Illustrative) | 600p (Illustrative) | 750p (Illustrative) |

| 2022 | 780p (Illustrative) | 580p (Illustrative) | 680p (Illustrative) |

| 2023 | 720p (Illustrative) | 600p (Illustrative) | 660p (Illustrative) |

Note: The figures presented in this table are illustrative and do not represent actual historical data. Actual data should be obtained from reliable financial sources.

Factors Influencing Barratt Developments PLC Stock Price

Source: asktraders.com

Several macroeconomic, regulatory, and company-specific factors significantly influence Barratt Developments PLC’s stock price. These factors interact in complex ways, making it challenging to isolate the impact of any single factor.

Macroeconomic factors such as interest rate changes directly affect mortgage affordability and consequently, housing demand. High inflation can erode consumer purchasing power and reduce housing affordability, impacting sales. Economic growth, or the lack thereof, directly influences the demand for new homes. Government regulations and housing policies, including planning permissions, building codes, and government-backed housing schemes, also play a crucial role in shaping the company’s prospects and stock valuation.

Company-specific factors such as strong earnings reports, the launch of successful new projects, or unexpected construction delays can all trigger significant price movements. For example, the announcement of a major new development project in a high-demand area could positively impact investor sentiment and drive up the stock price. Conversely, significant construction delays due to unforeseen circumstances could lead to negative investor sentiment and a decline in the stock price.

A detailed chronological analysis of these factors would require access to the company’s financial reports and press releases.

Financial Performance and Stock Price Correlation

A strong correlation exists between Barratt Developments PLC’s financial performance and its stock price fluctuations. Improved revenue, higher profit margins, and reduced debt levels generally lead to increased investor confidence and higher stock prices. Conversely, declining revenue, squeezed profit margins, and increasing debt can negatively impact investor sentiment and result in lower stock prices.

| Year | Revenue (£m) (Illustrative) | Profit Margin (%) (Illustrative) | Debt (£m) (Illustrative) | Average Stock Price (Illustrative) |

|---|---|---|---|---|

| 2021 | 5000 | 15 | 1000 | 700p |

| 2022 | 5500 | 12 | 1200 | 650p |

| 2023 | 4800 | 10 | 1100 | 600p |

Note: The figures presented in this table are illustrative and do not represent actual historical data. Actual data should be obtained from reliable financial sources.

Changes in the company’s dividend policy can also significantly impact investor sentiment and the stock price. Consistent dividend payments can attract income-seeking investors, while a reduction or suspension of dividends can negatively impact investor confidence.

Investor Sentiment and Market Analysis

Investor sentiment towards Barratt Developments PLC is influenced by a range of factors, including macroeconomic conditions, the company’s financial performance, and news events. Positive news, such as strong earnings reports or successful new project launches, typically leads to increased investor optimism and higher stock prices. Conversely, negative news, such as construction delays or regulatory setbacks, can lead to decreased investor confidence and lower stock prices.

Monitoring the Barratt Developments plc stock price requires a keen eye on the housing market. Understanding broader market trends is also crucial, and comparing it to other stocks can offer valuable insights. For example, checking the current performance of alk stock price today per share provides a useful benchmark against which to assess Barratt’s performance. Ultimately, a thorough analysis of various market indicators is essential for informed investment decisions regarding Barratt Developments plc.

Analysts and investors employ a variety of investment strategies when assessing Barratt Developments PLC’s stock. Some may focus on fundamental analysis, evaluating the company’s financial health and long-term prospects. Others may adopt a more technical approach, analyzing price charts and trading patterns to identify potential entry and exit points. The interplay of these different approaches contributes to the overall market dynamics surrounding the stock.

News articles, analyst reports, and social media sentiment can all have a significant impact on the company’s stock price. Positive media coverage can boost investor confidence, while negative coverage can lead to a decline in the stock price. The speed and reach of social media can amplify these effects, making it crucial for companies to manage their public image effectively.

Future Outlook and Predictions for Barratt Developments PLC Stock Price

Source: invezz.com

Predicting the future stock price of Barratt Developments PLC is inherently uncertain, as it depends on a multitude of factors that are difficult to forecast with accuracy. However, several scenarios are plausible depending on prevailing market conditions. A sustained period of economic growth and low-interest rates could lead to higher demand for housing and a subsequent increase in the company’s stock price.

Conversely, a period of economic recession or rising interest rates could negatively impact demand and lead to a decline in the stock price.

Potential catalysts that could significantly impact the company’s stock price in the coming year include changes in government housing policies, major new project announcements, and shifts in interest rates. For example, a significant change in government planning regulations that streamline the approval process for new housing developments could positively impact Barratt’s future prospects. Conversely, a substantial increase in interest rates could significantly dampen demand for new homes and negatively impact the company’s stock price.

Potential risks and uncertainties that could negatively affect the company’s future stock price include unexpected construction delays, rising material costs, changes in consumer sentiment, and economic downturns. The company’s ability to manage these risks and adapt to changing market conditions will be crucial in determining its future stock price performance. For instance, a major supply chain disruption causing significant construction delays on several projects could lead to decreased revenue and a drop in the stock price.

Frequently Asked Questions

What are the major risks associated with investing in Barratt Developments PLC stock?

Risks include fluctuations in the UK housing market, changes in government regulations, interest rate volatility, and potential construction delays or cost overruns.

How does Barratt Developments PLC compare to its competitors in terms of stock performance?

A direct comparison requires detailed analysis of competitor stock performance over the same period, considering factors like market capitalization and financial performance. This analysis would be included in the main body of the report.

Where can I find real-time Barratt Developments PLC stock price data?

Real-time stock price data is available through major financial news websites and brokerage platforms.

What is the current dividend yield for Barratt Developments PLC?

The current dividend yield can be found on financial news websites and investor relations pages of Barratt Developments PLC. This is a dynamic figure that changes frequently.