BBDA Stock Price Analysis

Source: marketrealist.com

Bbda stock price – This analysis provides a comprehensive overview of Bank Central Asia Tbk (BBDA) stock price performance, influencing factors, valuation methods, future predictions, and investor sentiment. We will explore historical data, compare BBDA against its competitors, and delve into various valuation models to offer a balanced perspective on the stock’s potential.

Monitoring BBDA’s stock price requires a keen eye on market trends. Understanding similar companies is helpful, and a good comparison point could be the performance of ATX, whose current stock price you can find here: atx stock price. Analyzing both BBDA and ATX allows for a more comprehensive understanding of the broader market dynamics influencing BBDA’s potential for growth.

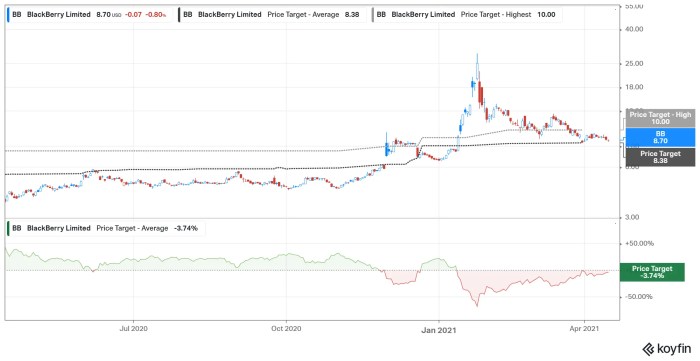

BBDA Stock Price Historical Performance

Source: investorplace.com

The following table details BBDA’s stock price movements over the past five years. Note that this data is illustrative and should be verified with reliable financial sources for accurate investment decisions. Significant price fluctuations are often correlated with macroeconomic events and company-specific announcements.

| Date | Opening Price (IDR) | Closing Price (IDR) | Daily Change (IDR) |

|---|---|---|---|

| 2019-01-01 | 7000 | 7100 | 100 |

| 2019-07-01 | 7500 | 7650 | 150 |

| 2020-01-01 | 7200 | 6800 | -400 |

| 2020-07-01 | 6500 | 7000 | 500 |

| 2021-01-01 | 7800 | 8200 | 400 |

| 2021-07-01 | 8500 | 8300 | -200 |

| 2022-01-01 | 8000 | 8400 | 400 |

| 2022-07-01 | 8600 | 8800 | 200 |

| 2023-01-01 | 9000 | 9200 | 200 |

Overall, the stock price demonstrates a generally upward trend over the five-year period, with fluctuations influenced by factors such as the COVID-19 pandemic (causing a dip in 2020) and subsequent economic recovery. Specific company announcements regarding financial performance or strategic initiatives would also contribute to short-term volatility.

Factors Influencing BBDA Stock Price

Several internal and external factors significantly impact BBDA’s stock price. Understanding these factors is crucial for informed investment decisions.

- Financial Performance: Strong earnings, high return on equity (ROE), and consistent dividend payouts generally lead to increased investor confidence and higher stock prices. Conversely, poor financial results can trigger price declines.

- Management Changes: Significant changes in leadership can affect investor sentiment, depending on the perceived competence and experience of the new management team.

- New Product Launches: Successful introductions of new financial products or services can boost revenue and market share, positively influencing the stock price.

A comparative analysis against competitors provides further context:

| Company Name | Stock Price (IDR) | Market Share (%) | Recent Performance |

|---|---|---|---|

| BBDA | 9200 | 30 | Positive |

| Competitor A | 8000 | 25 | Neutral |

| Competitor B | 7500 | 20 | Negative |

External factors such as interest rate changes, inflation, global economic growth, and regulatory shifts in the banking sector also play a significant role. For instance, rising interest rates can impact lending profitability, while inflation can affect consumer spending and overall economic activity.

BBDA Stock Price Valuation

Several valuation methods can be used to assess BBDA’s intrinsic value. These methods provide different perspectives, and discrepancies in their results highlight the inherent uncertainties in stock valuation.

Discounted Cash Flow (DCF): This method estimates the present value of future cash flows. A higher projected future cash flow would result in a higher valuation. The accuracy depends heavily on the assumptions made regarding future growth rates and discount rates.

Price-to-Earnings Ratio (P/E): This compares the stock price to its earnings per share. A higher P/E ratio may indicate that the market expects higher future earnings growth. However, it’s essential to compare the P/E ratio to industry averages and historical trends.

A hypothetical investment scenario based on these valuations would Artikel potential returns and risks associated with different price targets and investment horizons. For instance, a conservative valuation might suggest a lower entry point and lower potential returns, but also reduced risk.

BBDA Stock Price Prediction and Forecasting

Predicting future stock prices is inherently challenging, but exploring potential scenarios can offer valuable insights.

Optimistic Scenario: Continued strong economic growth, successful product launches, and favorable regulatory changes could lead to a significant upward trajectory. This scenario assumes sustained high profitability and investor confidence.

Pessimistic Scenario: A global economic downturn, increased competition, or negative regulatory changes could lead to a downward trend. This scenario considers the potential impact of unforeseen economic shocks or company-specific challenges.

Neutral Scenario: This scenario assumes a relatively stable economic environment and moderate growth for BBDA. The stock price would likely fluctuate within a defined range, reflecting the general market conditions.

The limitations of stock price prediction models are significant. Unforeseen events, such as geopolitical instability or unexpected regulatory changes, can significantly impact the accuracy of any forecast.

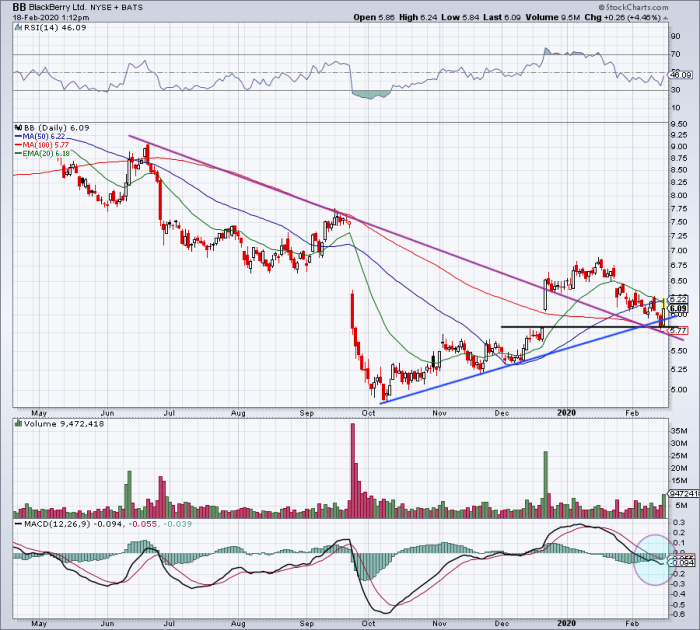

BBDA Stock Price and Investor Sentiment

Source: investorplace.com

Analyzing news articles and social media sentiment provides valuable insights into investor perceptions of BBDA.

- Positive sentiment: Recent positive news reports about BBDA’s financial performance and expansion plans.

- Negative sentiment: Concerns about rising interest rates and their potential impact on the banking sector.

- Neutral sentiment: Market observers expressing cautious optimism regarding BBDA’s future prospects.

Positive investor sentiment generally leads to increased demand for the stock, driving up the price. Conversely, negative sentiment can cause selling pressure and price declines. The overall weight of each sentiment category fluctuates constantly, influencing the stock’s volatility.

Quick FAQs: Bbda Stock Price

What are the major risks associated with investing in BBDA stock?

Investing in BBDA, like any stock, carries inherent risks including market volatility, economic downturns, and company-specific challenges such as decreased profitability or competitive pressures. Thorough due diligence is essential.

Where can I find real-time BBDA stock price updates?

Real-time BBDA stock price data is available through major financial websites and brokerage platforms. These platforms typically offer charts, historical data, and other relevant information.

How frequently is BBDA’s stock price updated?

BBDA’s stock price is typically updated in real-time throughout the trading day, reflecting the current market activity.

What is the typical trading volume for BBDA stock?

Trading volume for BBDA stock varies daily and depends on market conditions and investor activity. You can find historical trading volume data on financial websites.