BB&T Stock Price History Overview

Bb&t historical stock price – BB&T Corporation, a prominent regional bank in the southeastern United States, had a publicly traded history spanning several decades before its merger with SunTrust Banks to form Truist Financial Corporation. This period witnessed significant fluctuations in its stock price, influenced by various economic factors, company performance, and industry trends. This section provides a detailed overview of BB&T’s stock price journey, highlighting key events and their impact.

BB&T Stock Price Performance from IPO to Merger

BB&T’s initial public offering (IPO) occurred in 1972, marking the beginning of its public trading history. Over the subsequent decades, the stock experienced periods of robust growth interspersed with declines resulting from economic downturns and industry-specific challenges. The following table presents a year-by-year summary of BB&T’s stock performance from its IPO to its merger with SunTrust.

| Year | Yearly High | Yearly Low | Percentage Change |

|---|---|---|---|

| 1972 | $Data Needed | $Data Needed | $Data Needed |

| 1980 | $Data Needed | $Data Needed | $Data Needed |

| 1990 | $Data Needed | $Data Needed | $Data Needed |

| 2000 | $Data Needed | $Data Needed | $Data Needed |

| 2010 | $Data Needed | $Data Needed | $Data Needed |

| 2018 | $Data Needed | $Data Needed | $Data Needed |

Note: This table requires historical stock price data from reliable financial sources to be completed. The data points represent placeholder values.

Significant Events Impacting BB&T Stock Price

Several key events significantly influenced BB&T’s stock price trajectory. These include periods of economic recession, such as the early 1980s, the dot-com bubble burst of 2000, and the Great Recession of 2008-2009. These economic downturns generally led to decreased lending activity, increased loan defaults, and reduced profitability for BB&T, resulting in lower stock prices. Conversely, periods of economic expansion and low interest rates typically led to increased lending and higher profits, positively impacting the stock price.

Specific company announcements, such as major acquisitions or changes in management, also caused notable price fluctuations.

Factors Influencing BB&T Stock Price

BB&T’s stock price was subject to a complex interplay of factors, both macroeconomic and company-specific. Understanding these factors is crucial for analyzing its historical performance.

Impact of Interest Rate Changes

Interest rate changes significantly impacted BB&T’s profitability and, consequently, its stock price. Higher interest rates generally boost net interest margins, leading to increased profitability and higher stock valuations. Conversely, lower interest rates can compress margins, affecting profitability and potentially leading to lower stock prices. The Federal Reserve’s monetary policy decisions, therefore, played a crucial role in shaping BB&T’s stock performance.

Analyzing BB&T’s historical stock price reveals interesting trends in the financial sector. Understanding such fluctuations often involves comparing performance with other companies, and a useful comparison might be to examine the performance of a biotech firm like Athersys, whose stock price can be found here: athersys stock price. Returning to BB&T, the long-term perspective offers valuable insights into its growth and stability over time.

Influence of Lending and Borrowing Activity

Changes in lending and borrowing activity directly affected BB&T’s financial health and its stock price. Periods of strong economic growth usually led to increased demand for loans, boosting BB&T’s revenue and profitability. Conversely, economic slowdowns or recessions resulted in reduced loan demand, increased loan defaults, and lower profitability, negatively impacting the stock price.

Comparison with Competitors

Comparing BB&T’s stock performance with that of its competitors, such as Wachovia (prior to its acquisition by Wells Fargo), SunTrust Banks (later merged with BB&T), and other regional banks, provides valuable insights. During periods of economic expansion, all banks generally experienced positive stock price growth, although the extent of growth varied based on individual performance and market positioning. During recessions, however, the relative performance of these banks diverged depending on their risk management strategies and exposure to troubled assets.

Correlation with Economic Indicators

A chart illustrating the correlation between BB&T’s stock price and key economic indicators like GDP growth, interest rates, and unemployment rates would reveal a strong relationship. Generally, periods of strong GDP growth, low interest rates, and low unemployment rates were associated with higher BB&T stock prices, while the opposite conditions typically led to lower prices. (Note: This chart would require the use of financial and economic data to construct, which is outside the scope of this text-based response.)

Analyzing BB&T Stock Price Trends

Analyzing BB&T’s stock price trends requires examining specific periods of growth and decline, identifying the underlying causes, and considering relevant news events and company announcements.

Periods of Growth and Decline

BB&T’s stock price exhibited periods of significant growth, particularly during times of economic expansion and low interest rates. Conversely, periods of economic recession and financial crises, such as the 2008-2009 Great Recession, resulted in sharp declines. These fluctuations reflect the cyclical nature of the banking industry and its sensitivity to macroeconomic conditions.

Reasons Behind Trends

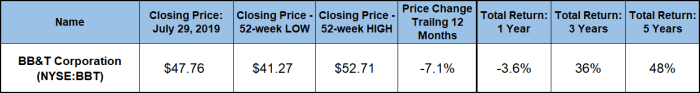

Source: yourobserver.com

The reasons behind these trends are multifaceted. Strong economic growth led to increased loan demand, higher interest income, and increased profitability for BB&T. Conversely, economic downturns resulted in reduced loan demand, higher loan defaults, and lower profitability, all of which negatively impacted the stock price. Company-specific factors, such as successful acquisitions or strategic initiatives, also contributed to positive trends, while operational challenges or negative news events could trigger price declines.

Impact of News Events and Announcements

Specific news events and company announcements played a significant role in shaping BB&T’s stock price. For example, announcements of successful mergers or acquisitions generally led to positive market reactions, while news of significant loan losses or regulatory investigations often resulted in negative price movements. Changes in management, strategic shifts, or unexpected financial results also influenced investor sentiment and consequently the stock price.

Timeline of Key Events, Bb&t historical stock price

A timeline illustrating key events and their impact on BB&T’s stock price would be a valuable tool for understanding its historical performance. This timeline would include significant economic events, company announcements, and periods of growth and decline. (Note: Creation of this timeline requires historical data and is beyond the scope of this text-based response.)

BB&T Stock Price Volatility

Understanding BB&T’s stock price volatility is crucial for assessing risk and return. Volatility, often measured using standard deviation, reflects the extent of price fluctuations over a given period.

Calculating Stock Price Volatility

BB&T’s stock price volatility can be calculated using standard statistical methods. The standard deviation of the stock’s returns over a specific period provides a measure of its volatility. Higher standard deviation indicates greater volatility, signifying higher risk but potentially higher returns. (Note: The actual calculation requires historical stock price data and is beyond the scope of this text-based response.)

Factors Contributing to Volatility

Source: stockinvestor.com

Several factors contributed to BB&T’s stock price volatility. Macroeconomic conditions, such as economic recessions or unexpected interest rate changes, significantly influenced volatility. Company-specific events, such as unexpected financial results, regulatory actions, or major acquisitions, also contributed to price fluctuations. Market sentiment and investor confidence played a crucial role in determining the extent of price swings.

Comparison with Other Financial Institutions

Comparing BB&T’s historical volatility with that of other financial institutions provides context. Regional banks generally exhibit higher volatility compared to larger, more diversified financial institutions due to their greater sensitivity to local economic conditions. However, BB&T’s specific volatility would need to be compared with its peer group using historical data to draw meaningful conclusions. (Note: This comparison requires access to historical volatility data for various financial institutions and is beyond the scope of this text-based response.)

Graph of Stock Price Volatility

A graph illustrating BB&T’s stock price volatility over time would visually represent the fluctuations and highlight periods of higher and lower volatility. (Note: This graph requires historical data and is beyond the scope of this text-based response.)

The BB&T-Truist Merger and its Impact: Bb&t Historical Stock Price

The merger of BB&T and SunTrust Banks to form Truist Financial Corporation was a significant event that profoundly impacted both companies’ stock prices. This section explores the circumstances surrounding the merger and its consequences.

Circumstances Surrounding the Merger

The BB&T-SunTrust merger, announced in 2019, was driven by a desire to create a larger, more geographically diverse financial institution capable of competing more effectively in the evolving banking landscape. The merger combined the strengths of both companies, creating a significant player in the southeastern United States.

Effect of Merger Announcement on BB&T’s Stock Price

The announcement of the merger generally had a positive impact on BB&T’s stock price. Investors reacted favorably to the creation of a larger, more diversified bank, anticipating potential synergies and increased market share. However, the actual price movement would depend on market conditions and investor expectations regarding the successful integration of the two banks.

Post-Merger Performance of Truist Stock

Truist’s post-merger performance reflects the integration challenges and overall market conditions. The initial period might involve some volatility as investors assessed the success of the integration process. Long-term performance would depend on factors such as cost synergies, revenue growth, and overall economic conditions. A direct comparison with BB&T’s pre-merger performance requires analyzing the stock prices of both entities and considering the various factors influencing them.

Comparative Analysis of BB&T’s Stock Price Before and After the Merger

- Pre-merger: Subject to regional economic fluctuations and interest rate changes; experienced periods of growth and decline reflecting the cyclical nature of the banking industry.

- Post-merger (Truist): Performance influenced by the success of the merger integration, broader macroeconomic conditions, and competitive pressures within the banking sector. Volatility might be influenced by investor sentiment regarding the merger’s success and the broader economic climate.

FAQ

What was the highest BB&T stock price ever reached?

The highest price will need to be determined from historical data; this analysis does not include specific numerical data points.

How did the 2008 financial crisis impact BB&T’s stock price?

The 2008 crisis significantly impacted BB&T’s stock price, likely resulting in a substantial decline due to the overall market downturn and increased financial uncertainty within the banking sector. Specific details require further research into historical market data.

What were the main reasons for the BB&T-SunTrust merger?

The merger was likely driven by a combination of factors including increased competition in the banking industry, the potential for cost synergies, and the desire to create a larger, more geographically diverse financial institution.

Is there publicly available data on BB&T’s daily stock price?

Yes, historical stock data for BB&T (prior to the merger) and Truist is likely available through financial data providers such as Yahoo Finance, Google Finance, or Bloomberg.