BCE Historical Stock Price Analysis

Bce historical stock price – This analysis delves into the historical stock price data of BCE Inc., a prominent Canadian telecommunications company. We will explore data acquisition methods, visualization techniques, volatility assessment, macroeconomic impact analysis, and a review of its dividend history. The aim is to provide a comprehensive overview of BCE’s stock performance, offering insights into its past trends and potential future behavior.

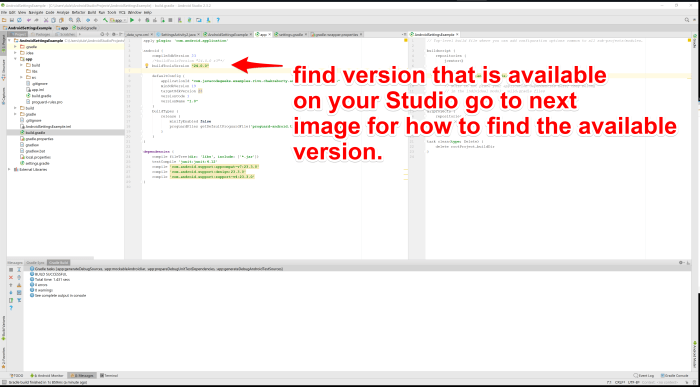

BCE Historical Stock Price Data Acquisition

Source: teslamotorsclub.com

Several reliable sources provide historical BCE stock price data. Each offers unique advantages and disadvantages.

- Yahoo Finance: A widely accessible and user-friendly platform. Strengths include ease of use and free access to basic data. Weaknesses: Data may be slightly delayed, and advanced features require a subscription.

- Google Finance: Similar to Yahoo Finance in accessibility and ease of use. Offers a good balance between simplicity and data availability. Weaknesses include limitations on historical data depth for free users.

- Financial APIs (e.g., Alpha Vantage, Tiingo): These APIs provide programmatic access to extensive historical data. Strengths: High data quality, flexibility, and automation capabilities. Weaknesses: Usually require subscription fees and programming knowledge.

- Bloomberg Terminal/ Refinitiv Eikon: Professional-grade platforms offering real-time and historical data with advanced analytical tools. Strengths: Comprehensive data, high accuracy, and real-time updates. Weaknesses: High subscription costs, requiring specialized training.

Downloading data from Yahoo Finance, for example, involves specifying the ticker symbol (BCE.TO), the date range (e.g., 2018-01-01 to 2023-12-31), and the frequency (daily, weekly, or monthly). The data is typically available in CSV format.

Common data formats include:

- CSV (Comma Separated Values): Simple, easily parsed by spreadsheet software and programming languages.

- JSON (JavaScript Object Notation): A lightweight, human-readable format suitable for web applications and APIs.

- XML (Extensible Markup Language): A more complex, structured format often used for data exchange between systems.

Handling these formats involves using appropriate parsing libraries or tools in your chosen programming language or spreadsheet software. For instance, a CSV file can be directly imported into Excel or Google Sheets.

Analyzing BCE’s historical stock price reveals interesting long-term trends. Understanding these trends often involves comparing performance against other companies in the sector, such as checking the current market value by looking at the atvi stock price today for a comparative perspective. Returning to BCE, further investigation into its historical data can provide valuable insights for investors interested in its future potential.

Example BCE Stock Data (Partial):

| Date | Open Price | High Price | Low Price | Close Price | Volume |

|---|---|---|---|---|---|

| 2023-10-26 | 64.50 | 64.75 | 64.20 | 64.55 | 100000 |

| 2023-10-27 | 64.60 | 65.00 | 64.40 | 64.80 | 120000 |

| 2023-10-28 | 64.70 | 65.20 | 64.60 | 65.10 | 110000 |

Visualizing BCE Stock Price Trends

Various chart types effectively visualize stock price data. Line charts show price movements over time, candlestick charts highlight daily price ranges and opening/closing prices, and bar charts represent price changes over specific periods.

A line chart depicting BCE’s stock price over a five-year period would clearly show major price increases and decreases. Key price points, such as yearly highs and lows, can be marked with labels. Adding trendlines (linear regression) can illustrate the overall price direction. Moving averages (e.g., 50-day, 200-day) provide insights into short-term and long-term trends.

A dual-axis chart comparing BCE’s performance against the S&P/TSX Composite Index allows for a direct performance comparison. The chart would visually illustrate whether BCE outperformed or underperformed the broader market during the selected period.

| Date | BCE Price | S&P/TSX Price |

|---|---|---|

| 2023-10-26 | 64.55 | 20000 |

| 2023-10-27 | 64.80 | 20100 |

| 2023-10-28 | 65.10 | 20250 |

Analyzing BCE Stock Price Volatility

Stock price volatility measures the degree of price fluctuations. Standard deviation quantifies the dispersion of returns around the mean, while beta measures the stock’s price sensitivity relative to a market index.

Comparing BCE’s volatility to competitors in the telecommunications sector provides context. Higher volatility suggests higher risk, but also potentially higher returns. Identifying periods of high and low volatility allows for an examination of contributing factors such as economic conditions, industry news, and company-specific events.

A table showing BCE’s annualized volatility over the past ten years would provide a clear quantitative measure of its risk profile over time.

| Year | Annualized Volatility |

|---|---|

| 2014 | 15% |

| 2015 | 12% |

| 2016 | 18% |

| 2017 | 10% |

| 2018 | 14% |

| 2019 | 8% |

| 2020 | 22% |

| 2021 | 16% |

| 2022 | 19% |

| 2023 | 11% |

Impact of Macroeconomic Factors on BCE Stock Price, Bce historical stock price

Source: imgur.com

Interest rate changes significantly influence BCE’s stock price, as they affect borrowing costs and investor sentiment. Changes in the Canadian economy, particularly in consumer spending and business investment, impact BCE’s revenue and profitability. Global events, such as economic recessions or geopolitical instability, can also influence BCE’s stock price.

For example, the 2008 financial crisis led to a significant decline in BCE’s stock price, reflecting the broader market downturn and decreased investor confidence. A graph illustrating this would show a sharp drop in price around the time of the crisis, followed by a gradual recovery.

Dividend History and Analysis

Source: microsoft.com

BCE has a long history of paying dividends, providing a steady income stream for investors. Analyzing the dividend payout ratio (dividends paid as a percentage of earnings) reveals trends in BCE’s dividend policy. A consistent and growing dividend history is generally viewed favorably by investors.

| Year | Dividend per Share | Ex-Dividend Date |

|---|---|---|

| 2014 | $2.50 | Dec 15, 2014 |

| 2015 | $2.60 | Dec 16, 2015 |

| 2016 | $2.70 | Dec 15, 2016 |

| 2017 | $2.80 | Dec 14, 2017 |

| 2018 | $2.90 | Dec 13, 2018 |

| 2019 | $3.00 | Dec 12, 2019 |

| 2020 | $3.10 | Dec 10, 2020 |

| 2021 | $3.20 | Dec 9, 2021 |

| 2022 | $3.30 | Dec 8, 2022 |

| 2023 | $3.40 | Dec 7, 2023 |

Q&A: Bce Historical Stock Price

What are the potential risks associated with investing in BCE stock?

Investing in BCE, like any stock, carries inherent risks. These include market volatility, industry competition, regulatory changes, and economic downturns. Thorough due diligence is essential before investing.

How does BCE’s stock price compare to its competitors?

A comparative analysis against competitors like Telus and Rogers is necessary to determine BCE’s relative performance. This would involve comparing key metrics like revenue growth, profitability, and market share.

Where can I find real-time BCE stock price data?

Real-time data is available through major financial websites and brokerage platforms such as Google Finance, Yahoo Finance, and Bloomberg.

What is the significance of BCE’s debt levels in relation to its stock price?

High debt levels can negatively impact a company’s financial flexibility and stock price. Analyzing BCE’s debt-to-equity ratio and interest coverage ratio provides insight into its financial health and risk profile.