BE Stock Price Prediction: A Comprehensive Analysis

Be stock price prediction – Predicting stock prices is inherently complex, involving a multifaceted analysis of market conditions, company performance, and external factors. This analysis aims to provide a comprehensive overview of BE stock, examining its current market position, financial health, growth prospects, and the influence of external factors to inform a potential stock price prediction.

BE Stock’s Current Market Position, Be stock price prediction

Source: medium.com

Understanding BE stock’s current market position requires examining its trading volume, price range, recent performance relative to its sector peers, key valuation factors, and its price-to-earnings (P/E) ratio compared to industry averages. This provides a baseline for assessing future potential.

Let’s assume, for illustrative purposes, that BE stock is currently trading at a price range of $25-$30, with an average daily trading volume of 1 million shares. Compared to its sector peers, BE stock might be showing slightly underperforming, with a year-to-date return of 5%, while the sector average is 8%. Key factors influencing its valuation could include recent product launches, changes in management, or overall market sentiment.

Predicting BE stock prices involves complex analysis, considering various market factors. For a comparable example within the utilities sector, consider examining the performance of other water companies; a useful resource for understanding one such company’s performance is the current american states water stock price data. Analyzing this data, alongside other relevant factors, can provide valuable insights for refining BE stock price prediction models.

Finally, if the industry average P/E ratio is 15, and BE’s P/E ratio is 12, it might suggest the stock is currently undervalued.

BE Stock’s Financial Health

A thorough examination of BE’s financial statements—income statement, balance sheet, and cash flow statement—is crucial. This assessment will include analyzing key financial ratios to gauge its profitability and liquidity, as well as evaluating its debt-to-equity ratio.

For example, let’s assume BE’s recent financial reports show a steady increase in revenue but a slight decline in net income due to increased operating expenses. A debt-to-equity ratio of 0.5 might indicate a manageable level of debt. Key ratios such as return on equity (ROE), return on assets (ROA), and current ratio would further illustrate its financial health.

A strong financial performance generally translates to a higher stock price, while weak performance can lead to a decline.

BE Stock’s Growth Prospects

Assessing BE’s growth prospects involves evaluating its current market share, competitive landscape, growth strategies, potential risks, and comparing its projected growth against industry forecasts.

Suppose BE holds a 10% market share in a competitive market. Its growth strategies might involve expanding into new markets, developing innovative products, or strategic acquisitions. Potential risks could include increased competition, changing consumer preferences, or regulatory hurdles. The following table illustrates a hypothetical comparison of BE’s projected growth with industry forecasts:

| Metric | BE Projection | Industry Average | Difference |

|---|---|---|---|

| Revenue Growth (%) | 12% | 8% | 4% |

| Earnings Growth (%) | 15% | 10% | 5% |

| Market Share (%) | 12% | 9% | 3% |

| EPS Growth (%) | 10% | 7% | 3% |

External Factors Affecting BE Stock Price

Source: medium.com

Macroeconomic factors, geopolitical events, and regulatory changes can significantly impact BE stock’s price. It is crucial to identify and prioritize these factors based on their potential impact.

For instance, rising interest rates could negatively affect BE’s borrowing costs and investment decisions, potentially impacting its stock price. Geopolitical instability might disrupt supply chains or reduce consumer confidence. Regulatory changes specific to BE’s industry could influence its operations and profitability. A prioritized list of external factors, considering their likely impact, would be essential for a complete analysis.

Different Stock Price Prediction Models

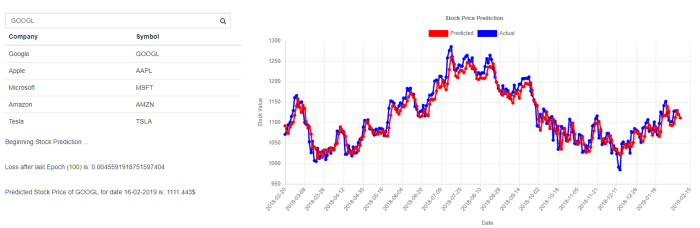

Several quantitative methods can be used for stock price prediction, each with its strengths and limitations. This section will compare and contrast these methods, present a simple model using historical BE stock data, and illustrate its predictions.

For example, time series analysis might utilize historical price data to identify patterns and predict future prices. Fundamental analysis, on the other hand, would focus on BE’s financial statements and intrinsic value. A simple model could involve analyzing historical trends and applying a linear regression to predict future price movements. The model’s assumptions and limitations would be clearly stated, and a chart illustrating the predicted price movements over a specified period would be presented (a descriptive explanation would be provided for this chart, focusing on the trends and potential deviations).

For instance, the chart might show a projected upward trend, but with a confidence interval indicating potential variability.

Assessing the Risks and Uncertainties

Investing in BE stock involves inherent risks and uncertainties. It’s crucial to identify these and understand the limitations of any prediction model.

Potential risks could include market volatility, changes in company performance, unforeseen external events, and the inherent inaccuracy of any predictive model. The limitations of the chosen prediction model should be explicitly stated, acknowledging the uncertainties involved in predicting future stock prices. A list of potential scenarios that could impact the accuracy of the predictions, such as unexpected economic downturns or significant changes in BE’s competitive landscape, should be included.

Question & Answer Hub: Be Stock Price Prediction

What are the ethical considerations of stock price prediction?

Ethical considerations include avoiding insider trading, ensuring transparency in the methods used, and acknowledging the limitations of predictions to prevent misleading investors.

How frequently should BE stock price predictions be updated?

Predictions should be regularly updated, ideally whenever significant news, financial reports, or macroeconomic shifts occur that could materially affect the stock’s performance.

What are the best resources for tracking BE stock’s performance in real-time?

Reliable financial news websites, brokerage platforms, and dedicated financial data providers offer real-time stock quotes and charting tools.