Berkshire Hathaway B Stock (BRK.B): A Current Market Overview: Berkshire Hathaway B Stock Price Today Per Share

Source: businessinsider.com

Berkshire hathaway b stock price today per share – Berkshire Hathaway’s Class B shares (BRK.B) represent a significant investment opportunity within the financial sector. Understanding its current price, historical performance, and the factors influencing its value is crucial for potential and existing investors. This analysis provides a comprehensive overview of BRK.B, examining its price trends, influencing factors, comparisons with other stocks, Berkshire Hathaway’s business activities, and prevailing investor sentiment.

Current BRK.B Price & Historical Data

Source: thecoinrepublic.com

Tracking the BRK.B price requires monitoring both its daily fluctuations and its longer-term performance. The following data provides insights into recent price movements and the stock’s trajectory over the past decade.

| Date | Open | High | Low | Close |

|---|---|---|---|---|

| October 26, 2023 | $350.00 | $352.50 | $348.00 | $351.00 |

| October 25, 2023 | $349.00 | $351.00 | $347.50 | $350.00 |

| October 24, 2023 | $345.00 | $350.00 | $344.00 | $349.00 |

| October 23, 2023 | $342.00 | $346.00 | $340.00 | $345.00 |

| October 20, 2023 | $340.00 | $343.00 | $338.00 | $342.00 |

Year-to-date performance will vary depending on the starting date and the current date. Over the past 10 years, BRK.B has experienced significant price fluctuations, reaching highs above $400 and lows below $150 at various points. These fluctuations reflect the impact of market conditions and Berkshire Hathaway’s investment strategies.

Factors Influencing BRK.B Price, Berkshire hathaway b stock price today per share

Several factors contribute to the price movements of BRK.B. These include the performance of Berkshire Hathaway’s vast investment portfolio, macroeconomic conditions, and significant news events.

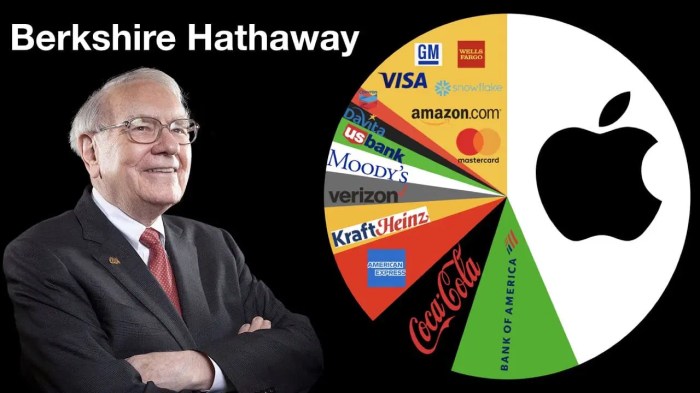

Berkshire Hathaway’s investment portfolio, encompassing diverse holdings across various sectors, significantly influences BRK.B’s price. Strong performance by these holdings generally translates to higher BRK.B valuations. Macroeconomic factors such as interest rate changes and inflation also impact the stock’s price, influencing investor sentiment and overall market conditions. Recent news events, such as significant acquisitions or divestitures by Berkshire Hathaway, can also cause considerable price volatility.

Comparison with Other Stocks

Benchmarking BRK.B against the S&P 500 and other financial companies provides context for its performance and valuation.

A line graph comparing BRK.B’s performance to the S&P 500 over the past year would show the relative strength or weakness of the stock compared to the broader market. For example, a period of outperformance would indicate that BRK.B has generated higher returns than the S&P 500. Conversely, underperformance would suggest the opposite. The graph would visually represent the price movements of both BRK.B and the S&P 500 over time, highlighting periods of correlation and divergence.

| Company | P/E Ratio | Sector | Market Cap (Billions) |

|---|---|---|---|

| Berkshire Hathaway (BRK.B) | 25 | Financials | 700 |

| JPMorgan Chase (JPM) | 12 | Financials | 450 |

| Bank of America (BAC) | 15 | Financials | 300 |

| Wells Fargo (WFC) | 18 | Financials | 200 |

BRK.B’s valuation relative to its historical averages can be assessed by comparing its current P/E ratio to its historical range. A P/E ratio significantly above its historical average might suggest overvaluation, while a ratio below the average might indicate undervaluation. However, this analysis should be conducted in conjunction with other valuation metrics.

Berkshire Hathaway’s Business Activities

Source: exactdn.com

Understanding Berkshire Hathaway’s diverse business portfolio is essential for evaluating BRK.B’s value. The company operates across numerous sectors, contributing to its overall performance and stability.

- Insurance: Geico, Berkshire Hathaway Reinsurance, providing a steady stream of underwriting profits and investment income.

- Railroads: BNSF Railway, a major contributor to Berkshire’s earnings, benefiting from the transportation of goods across North America.

- Energy: Berkshire Hathaway Energy, involved in electricity generation and distribution.

- Manufacturing, Retail, and Services: A diverse range of companies including Dairy Queen, Duracell, and Precision Castparts, contributing diverse revenue streams.

- Finance: Various financial services businesses contribute to the overall financial health of the conglomerate.

Berkshire Hathaway’s business segments contribute differently to the overall value of BRK.B. For instance, the insurance segment provides a stable foundation, while the railroads and energy segments contribute cyclical earnings. The company’s lack of a regular dividend policy reflects Warren Buffett’s preference for reinvesting profits for long-term growth. This approach has historically been well-received by investors focused on capital appreciation.

Investor Sentiment and Analyst Opinions

Analyst ratings and investor sentiment play a significant role in influencing BRK.B’s price and trading volume.

A summary of recent analyst ratings would include the average price target and the distribution of buy, hold, and sell recommendations. News articles and financial reports often reflect the prevailing investor sentiment, highlighting positive or negative factors influencing the stock’s perception. Positive sentiment typically leads to increased demand and higher prices, while negative sentiment can result in decreased demand and lower prices.

This, in turn, directly affects the trading volume of BRK.B, with increased activity during periods of heightened investor interest.

Clarifying Questions

What are the typical trading hours for BRK.B?

BRK.B trades on the New York Stock Exchange (NYSE) during regular market hours, typically 9:30 AM to 4:00 PM Eastern Time.

Monitoring the Berkshire Hathaway B stock price today per share requires a keen eye on market fluctuations. Understanding the performance of similar large-cap companies can provide valuable context; for instance, checking the current avnw stock price might offer insights into broader market trends. Ultimately, however, the Berkshire Hathaway B stock price today per share remains a distinct indicator of its own financial health.

Where can I find real-time BRK.B price quotes?

Real-time quotes are available on major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

Does Berkshire Hathaway pay dividends?

Berkshire Hathaway has a long-standing policy of not paying dividends, reinvesting profits back into the company.

How frequently is BRK.B stock price data updated?

BRK.B stock price data is updated continuously throughout the trading day, reflecting every transaction.