BHP Stock Price Analysis: Bhp Stock Price Today Per Share

Source: com.au

Bhp stock price today per share – This analysis provides an overview of BHP Group Limited’s (BHP) current stock price, historical performance, influencing factors, company performance, analyst forecasts, competitor comparison, and associated risks. Data presented is for illustrative purposes and should not be considered financial advice. Always conduct thorough research and consult with a financial advisor before making investment decisions.

Current BHP Stock Price

The current BHP stock price per share, last updated at [Insert Time of Last Update], is [Insert Current Price] in [Insert Currency, e.g., USD].

| Current Price | Previous Day’s Close | Change | % Change |

|---|---|---|---|

| [Insert Current Price] | [Insert Previous Day’s Closing Price] | [Insert Price Change] | [Insert Percentage Change] |

BHP Stock Price History, Bhp stock price today per share

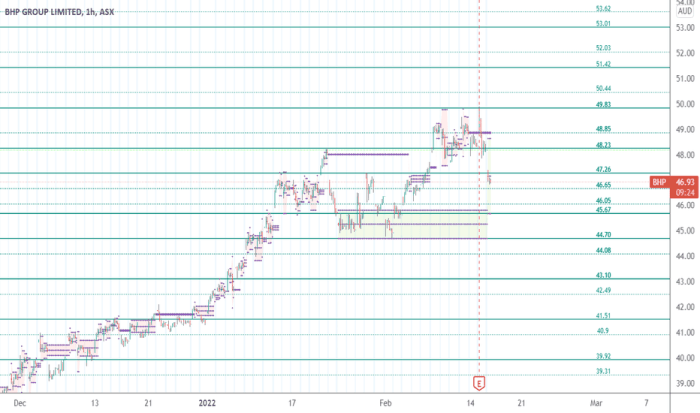

Over the past year, BHP’s stock price has exhibited [Describe overall trend, e.g., volatility, upward trend, downward trend]. A line graph illustrating this would show [Describe key features of the graph, e.g., significant peaks in [Month, Year] and troughs in [Month, Year], a general upward trend from [Date] to [Date], a period of consolidation between [Date] and [Date]]. The current price is [Describe comparison to the average price over the past month and year, e.g., above/below the one-month average by X%, above/below the one-year average by Y%].

| Time Period | High | Low |

|---|---|---|

| Past Week | [Insert High Price] | [Insert Low Price] |

| Past Month | [Insert High Price] | [Insert Low Price] |

| Past Year | [Insert High Price] | [Insert Low Price] |

Factors Influencing BHP Stock Price

Three major factors currently impacting BHP’s stock price are commodity prices (particularly iron ore, copper, and coal), global economic growth, and geopolitical events. Short-term effects of fluctuating commodity prices can be dramatic, while long-term effects are tied to overall market demand and supply. Global economic slowdowns reduce demand, impacting prices and profits. Geopolitical instability in key mining regions can disrupt operations and supply chains.

Checking the BHP stock price today per share is a common practice for investors. Understanding how that price fluctuates is key, and a factor to consider is the dividend yield. To grasp the relationship, it’s helpful to understand whether are dividend yield and stock price positively correlated , which can significantly impact your overall return on BHP shares.

Ultimately, this understanding informs your investment strategy regarding the BHP stock price today per share.

The relative importance of these factors varies; commodity prices often have the most immediate impact, while global economic conditions and geopolitical factors influence longer-term trends. For example, the recent [Insert News Event or Economic Indicator] significantly impacted the stock price by [Explain the impact].

BHP Company Performance

BHP’s recent financial performance shows [Describe recent revenue, profit, and EPS]. Key metrics such as [Insert Key Metrics, e.g., operating margins, return on equity] reflect the company’s [Describe operational efficiency and profitability]. Recent strategic initiatives, such as [Insert Strategic Initiatives], are expected to [Describe potential impact on stock price]. Recent announcements, like [Insert Recent Announcements], have influenced investor sentiment by [Explain the impact on investor sentiment].

Analyst Ratings and Forecasts

The consensus rating among financial analysts for BHP stock is [Insert Consensus Rating]. Price targets range from [Insert Low Price Target] to [Insert High Price Target]. Analysts’ ratings and forecasts are primarily based on [Explain the reasoning behind analysts’ ratings and forecasts].

- Analyst A: [Rating]

-Justification: [Justification] - Analyst B: [Rating]

-Justification: [Justification] - Analyst C: [Rating]

-Justification: [Justification]

BHP Stock Price Compared to Competitors

Compared to its main competitors, such as [Insert Competitors], BHP’s stock price performance has been [Describe relative performance]. Relative valuation using metrics like the Price-to-Earnings ratio shows that BHP is [Describe relative valuation compared to peers]. Differences in performance can be attributed to factors such as [Explain factors explaining differences in performance].

| Metric | BHP | Competitor A | Competitor B |

|---|---|---|---|

| Stock Price | [Insert Price] | [Insert Price] | [Insert Price] |

| P/E Ratio | [Insert Ratio] | [Insert Ratio] | [Insert Ratio] |

| [Other Relevant Metric] | [Insert Data] | [Insert Data] | [Insert Data] |

Risk Factors Associated with BHP Stock

Source: tradingview.com

Investing in BHP stock carries several risks, including commodity price volatility, geopolitical risks, operational risks, and regulatory changes. Commodity price fluctuations can significantly impact profitability. Geopolitical instability in mining regions can disrupt operations. Operational risks include accidents, environmental concerns, and labor disputes. Regulatory changes can affect costs and profitability.

Investors can mitigate these risks through diversification, hedging strategies, and thorough due diligence.

| Risk | Potential Impact | Mitigation Strategy |

|---|---|---|

| Commodity Price Volatility | Significant impact on revenue and profitability | Diversification, hedging strategies |

| Geopolitical Risks | Disruption of operations, supply chain issues | Careful monitoring of geopolitical events, diversification of geographic exposure |

| Operational Risks | Production disruptions, increased costs | Robust risk management systems, insurance |

| Regulatory Changes | Increased costs, operational limitations | Staying informed about regulatory developments, engaging with regulators |

Answers to Common Questions

What factors affect BHP’s short-term price fluctuations?

Short-term fluctuations are often driven by news events (e.g., production updates, geopolitical instability), commodity price swings (iron ore, copper), and overall market sentiment.

Where can I find real-time BHP stock price updates?

Major financial websites and brokerage platforms provide real-time stock quotes for BHP. Check reputable sources for the most up-to-date information.

What are the long-term prospects for BHP stock?

Long-term prospects depend on various factors including global demand for commodities, BHP’s operational efficiency, and successful execution of its strategic initiatives. Analyst forecasts should be consulted, but remember these are predictions, not guarantees.

Is BHP a good long-term investment?

Whether BHP is a suitable long-term investment depends on your individual risk tolerance and investment goals. Conduct thorough research and consider seeking professional financial advice.