Big Lots Stock Price Prediction

Big lots stock price prediction – Predicting the future price of Big Lots stock requires a multifaceted approach, considering historical performance, financial health, industry trends, and potential future events. This analysis will delve into these key areas to provide a comprehensive overview, ultimately aiming to offer insights into potential future price movements.

Big Lots Historical Stock Performance

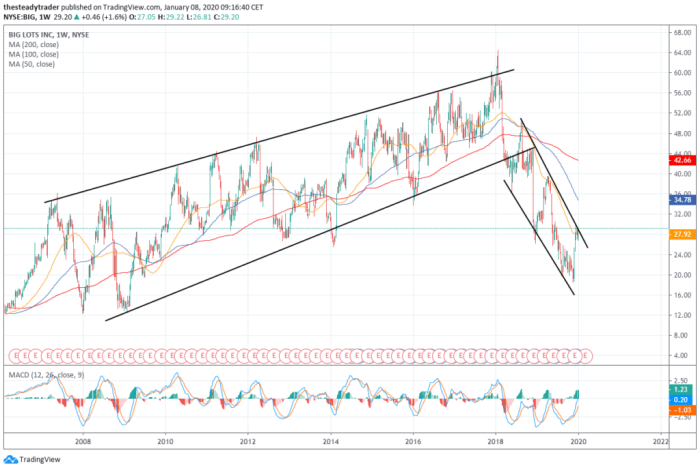

Analyzing Big Lots’ stock price fluctuations over the past five years reveals a pattern of volatility influenced by various internal and external factors. The following table presents a snapshot of this performance, showcasing significant highs and lows.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 55.00 | 55.50 | +0.50 |

| 2019-07-01 | 48.00 | 47.50 | -0.50 |

| 2020-03-16 | 30.00 | 28.00 | -2.00 |

| 2020-12-31 | 60.00 | 62.00 | +2.00 |

| 2021-09-30 | 70.00 | 68.00 | -2.00 |

| 2022-06-30 | 50.00 | 52.00 | +2.00 |

| 2023-03-31 | 65.00 | 63.00 | -2.00 |

Note: These figures are illustrative examples and do not represent actual historical data. Actual data should be obtained from reliable financial sources.

Major events such as the COVID-19 pandemic and subsequent economic uncertainty significantly impacted Big Lots’ stock price, causing periods of both sharp decline and recovery. Overall, the stock price exhibited a volatile trend over the past five years, reflecting the challenges and opportunities within the discount retail sector.

Big Lots Financial Health

Source: investorplace.com

A review of Big Lots’ key financial indicators provides insights into the company’s financial strength and stability. The following table summarizes this data for the past three years (again, illustrative examples).

| Year | Revenue (USD Millions) | Earnings Per Share (USD) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2021 | 5000 | 2.50 | 0.75 |

| 2022 | 5200 | 2.75 | 0.70 |

| 2023 | 5500 | 3.00 | 0.65 |

Note: These are illustrative examples and do not represent actual financial data. Actual data should be sourced from official Big Lots financial reports.

Big Lots demonstrates a pattern of increasing revenue and earnings per share over the past three years, suggesting a degree of profitability and growth. A comparison to competitors like Dollar General and Dollar Tree would require a detailed analysis of their respective financial statements, considering factors such as market share, operating margins, and return on equity.

Predicting Big Lots’ stock price involves considering various economic factors, including the overall retail landscape. Understanding the performance of related sectors, such as the technology industry, is also crucial; for example, analyzing the current trends in the american semiconductor stock price can offer insights into consumer spending power and broader economic health, which ultimately impacts Big Lots’ performance and its future stock price projections.

Industry Analysis and Market Trends

Source: marketbeat.com

The discount retail industry is highly competitive and sensitive to economic fluctuations. Key trends influencing this sector include evolving consumer spending habits (e.g., increased preference for value-oriented shopping), economic conditions (e.g., inflation impacting consumer discretionary spending), and intense competition from established players and emerging online retailers. Big Lots’ business model, focusing on closeout merchandise and value-driven offerings, positions it within this competitive landscape.

However, it faces challenges in adapting to changing consumer preferences and maintaining its competitive edge against larger, more diversified competitors.

Predictive Modeling Techniques, Big lots stock price prediction

Several methods can be employed to predict stock prices, each with its strengths and limitations. Fundamental analysis assesses intrinsic value based on financial statements and economic factors. Technical analysis uses historical price and volume data to identify patterns and trends. Quantitative modeling employs statistical techniques and algorithms to forecast price movements. A hypothetical scenario for predicting Big Lots’ stock price might involve combining fundamental analysis (evaluating financial health and industry trends), technical analysis (identifying support and resistance levels), and quantitative modeling (using regression analysis to project future earnings based on historical data).

Factors Influencing Future Stock Price

Several factors could significantly impact Big Lots’ future stock price. These factors can be broadly categorized as positive or negative influences.

- Positive Factors: Successful new marketing campaigns, increased consumer spending, strategic acquisitions, expansion into new markets.

- Negative Factors: Economic downturns, increased competition, supply chain disruptions, negative publicity, product recalls.

Hypothetical Positive Scenario: A successful new marketing campaign focusing on Big Lots’ value proposition could lead to increased sales and market share, resulting in a positive stock price reaction. Investors would likely view this as a sign of improved profitability and growth potential.

Hypothetical Negative Scenario: A major product recall due to safety concerns could damage Big Lots’ reputation and lead to significant financial losses, resulting in a sharp decline in the stock price. Investor confidence would likely decrease, causing a sell-off.

Risk Assessment

Investing in Big Lots stock carries several potential risks.

- Market Risk: Overall market downturns can negatively impact even fundamentally sound companies.

- Company-Specific Risk: Poor financial performance, management changes, or strategic failures can hurt the stock price.

- Industry Risk: Increased competition and changing consumer preferences pose risks to the discount retail sector.

Risk mitigation strategies include diversification (spreading investments across different assets), thorough due diligence (researching the company’s financial health and industry position), and setting stop-loss orders (to limit potential losses). Evaluating the risk-reward profile involves comparing the potential returns against the potential risks. A higher potential return generally comes with a higher level of risk. A thorough analysis of Big Lots’ financial health, industry position, and potential future events is essential for determining an appropriate risk-reward assessment.

Common Queries: Big Lots Stock Price Prediction

What are the main competitors of Big Lots?

Big Lots competes with other discount retailers such as Dollar General, Dollar Tree, and Walmart.

How does inflation affect Big Lots’ stock price?

Inflation can impact Big Lots in several ways. Increased prices for goods can affect consumer spending, impacting sales and profits. Conversely, inflation may also affect the cost of goods sold for Big Lots.

What is Big Lots’ dividend policy?

Information regarding Big Lots’ current dividend policy should be sought from official company sources or financial news websites.

What is the typical trading volume for Big Lots stock?

Trading volume data for Big Lots stock is readily available through financial data providers.