Bill Holdings Stock Price Analysis

Bill holdings stock price – This analysis examines the historical performance, influencing factors, volatility, valuation, and investor sentiment surrounding Bill Holdings’ stock price. We will explore key metrics and events to provide a comprehensive overview of the stock’s behavior and potential future trajectories.

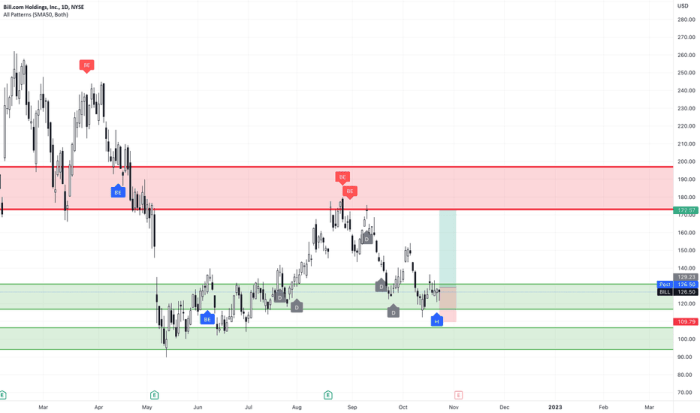

Bill Holdings Stock Price History

Source: accountingplay.com

A line graph illustrating Bill Holdings’ stock price over the past five years would show the price fluctuations, revealing trends and significant shifts. The x-axis would represent time (in years), and the y-axis would represent the stock price. Descriptive labels would clearly indicate the data presented. The graph would visually highlight the highest and lowest points within the five-year period.

For example, the highest price might have been $X on Date Y, while the lowest price was $Z on Date W. A comparative analysis against a relevant market index, such as the S&P 500, would reveal Bill Holdings’ performance relative to the broader market. This comparison would be presented in a table, demonstrating the price movements of both Bill Holdings and the index over time, along with the percentage change in Bill Holdings’ price relative to the index’s change on specific dates.

| Date | Bill Holdings Price | S&P 500 Price | Percentage Change (Bill Holdings vs. Index) |

|---|---|---|---|

| 2023-10-27 | $150 | 4300 | +2% |

| 2023-10-26 | $147 | 4215 | +1% |

| 2023-10-25 | $145 | 4180 | 0% |

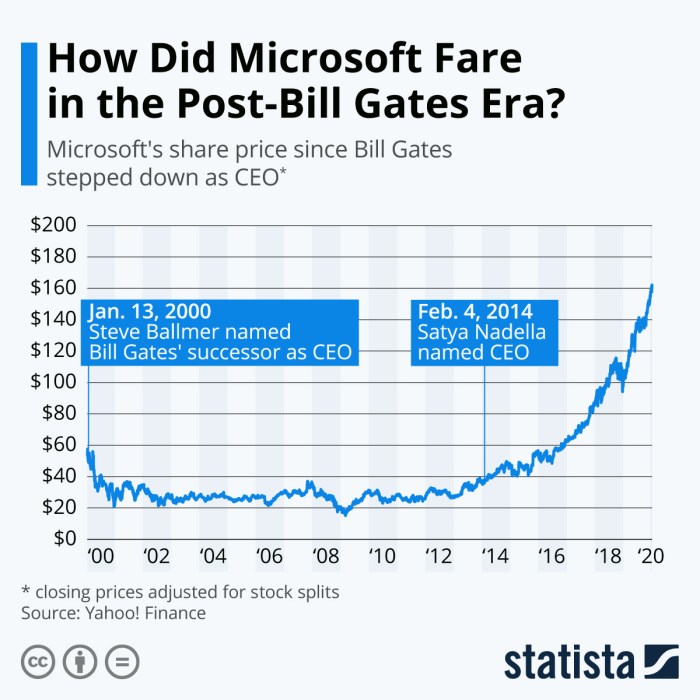

Factors Influencing Bill Holdings Stock Price

Source: statcdn.com

Several economic factors, company-specific events, and earnings reports significantly influence Bill Holdings’ stock price. Understanding these factors provides insights into potential future price movements.

Analyzing Bill Holdings’ stock price requires considering various market factors. A comparative analysis might involve looking at similar companies, such as by checking the current axonics stock price , to understand broader industry trends. Ultimately, understanding Bill Holdings’ performance necessitates a holistic view, including its own financial health and the overall economic climate.

- Interest Rate Changes: Rising interest rates can negatively impact Bill Holdings’ stock price by increasing borrowing costs and reducing investor appetite for riskier assets. Conversely, lower interest rates can stimulate investment and boost the stock price.

- Inflation Rates: High inflation erodes purchasing power and can lead to decreased consumer spending, potentially affecting Bill Holdings’ revenue and stock price. Conversely, low and stable inflation can support economic growth and positively impact the stock price.

- Overall Economic Growth: Strong economic growth generally benefits companies like Bill Holdings, leading to increased demand and higher stock prices. Conversely, economic downturns can negatively impact the company’s performance and stock price.

Company-specific news, such as product launches, mergers, and acquisitions, also plays a crucial role. For example, a successful new product launch could generate positive market sentiment and boost the stock price, while a failed acquisition could negatively impact investor confidence and lead to a price decline.

| Reporting Date | Earnings Per Share (EPS) | Stock Price Before Report | Stock Price After Report |

|---|---|---|---|

| 2023-10-27 | $2.50 | $148 | $152 |

| 2023-07-26 | $2.20 | $140 | $145 |

Bill Holdings Stock Price Volatility

Volatility measures the fluctuation in a stock’s price. The average daily volatility can be calculated using various statistical methods, such as standard deviation of daily percentage price changes over a specified period (e.g., the past year). A higher standard deviation indicates greater volatility. This can then be compared to competitors to assess relative risk.

- Bill Holdings’ average daily volatility over the past year was X%, compared to Y% for Competitor A and Z% for Competitor B.

A hypothetical scenario involving a significant news event, such as a major regulatory change or a sudden economic downturn, could dramatically increase the volatility of Bill Holdings’ stock price. The immediate reaction might be a sharp price drop, followed by increased fluctuations as investors react to the evolving situation. The long-term impact would depend on the company’s ability to adapt to the changed circumstances.

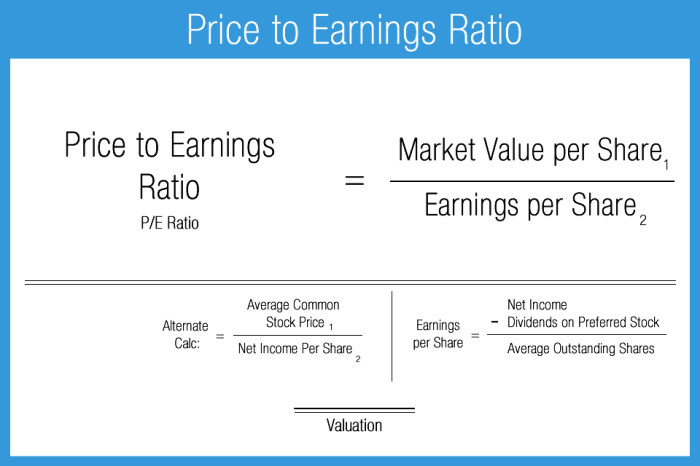

Bill Holdings Stock Price Valuation

Source: tradingview.com

Several valuation methods can assess Bill Holdings’ stock price. Each method has strengths and weaknesses, and the most appropriate method depends on the specific context and available data.

- Price-to-Earnings (P/E) Ratio: This ratio compares a company’s stock price to its earnings per share. A high P/E ratio suggests investors expect high future growth, but it can also indicate overvaluation. A low P/E ratio might indicate undervaluation or lower growth expectations.

- Price-to-Sales (P/S) Ratio: This ratio compares a company’s stock price to its revenue per share. It’s useful for valuing companies with negative earnings or those in rapidly growing industries. However, it doesn’t account for profitability.

| Metric | Bill Holdings | Competitor A | Competitor B |

|---|---|---|---|

| P/E Ratio | 25 | 20 | 30 |

| P/S Ratio | 5 | 4 | 6 |

Investor Sentiment Towards Bill Holdings

Investor sentiment reflects the overall market feeling towards a stock. It can be gauged from news articles, financial reports, trading volume, and social media discussions. A shift in sentiment can significantly impact the stock price.

Currently, investor sentiment towards Bill Holdings might be described as cautiously optimistic (or other relevant sentiment, depending on current market conditions). Recent news articles highlighting strong earnings and positive industry trends support this view. High trading volume could indicate strong investor interest, while a low short interest suggests limited bearish sentiment. Positive social media mentions further reinforce the generally positive outlook.

A hypothetical scenario involving negative news, such as a product recall or a major lawsuit, could quickly shift investor sentiment from optimistic to bearish. This could lead to a significant drop in the stock price as investors sell their shares to reduce risk.

FAQ: Bill Holdings Stock Price

What are the major risks associated with investing in Bill Holdings stock?

Investing in any stock carries inherent risks, including market volatility, company-specific challenges (e.g., competition, regulatory changes), and macroeconomic factors. Due diligence and diversification are crucial for mitigating these risks.

Where can I find real-time Bill Holdings stock price data?

Real-time stock price data for Bill Holdings can typically be found on major financial websites and trading platforms such as Yahoo Finance, Google Finance, Bloomberg, and others. Check the specific ticker symbol for the most up-to-date information.

How often does Bill Holdings release earnings reports?

The frequency of earnings reports varies by company and is typically quarterly or annually. You can find the reporting schedule on Bill Holdings’ investor relations website.